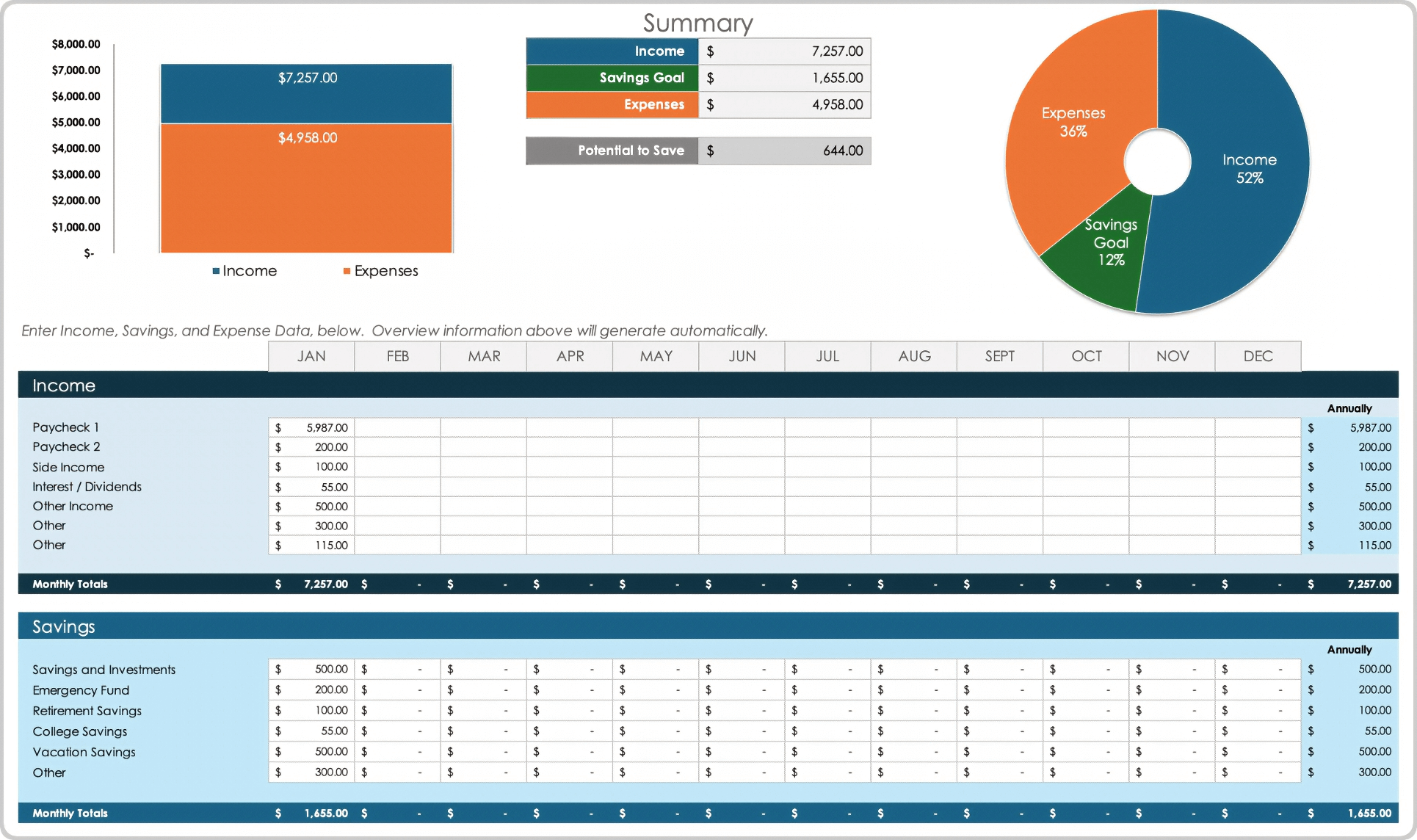

Personal Budget Template

Download the Personal Budget Template for Excel

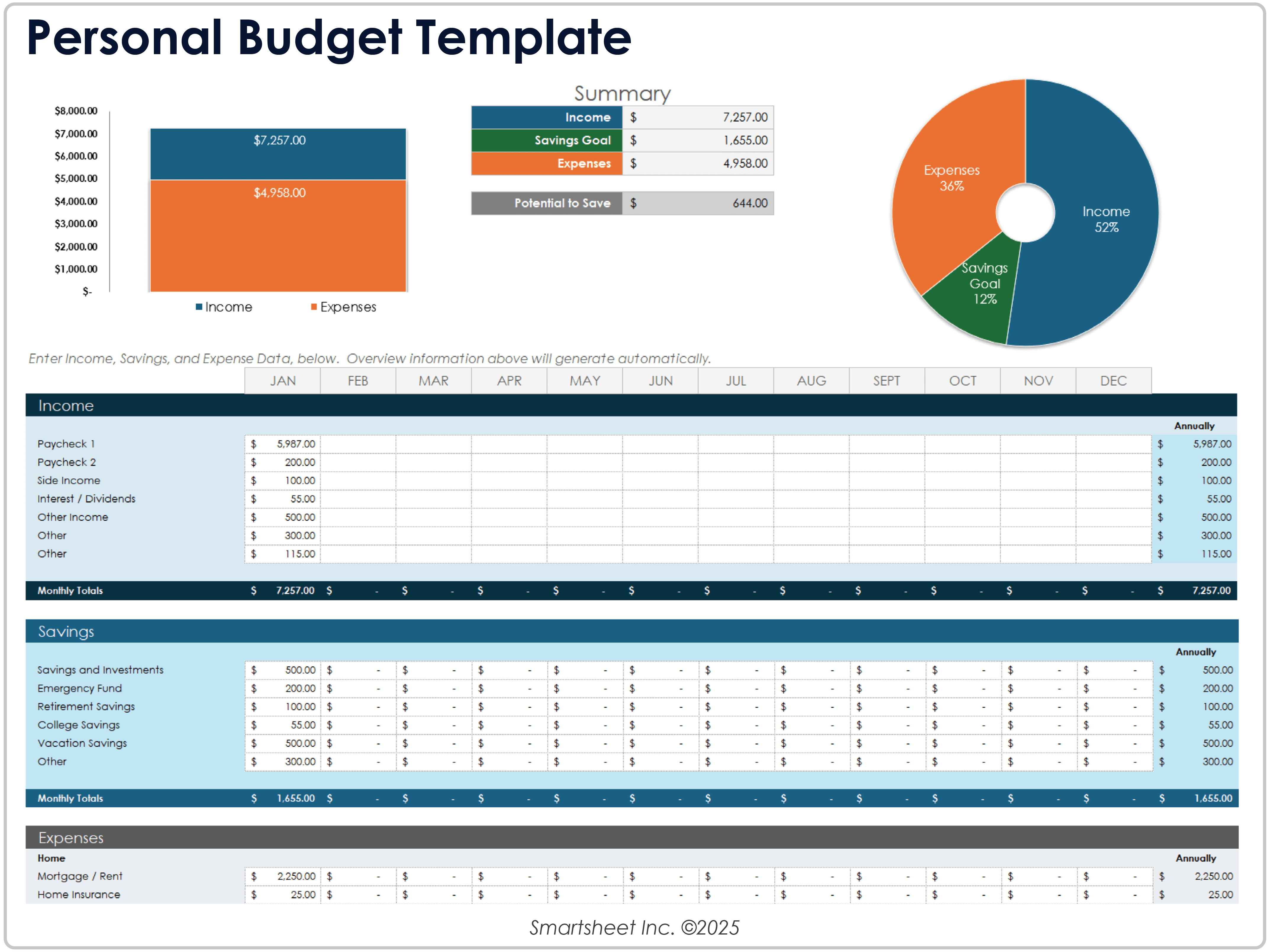

When to Use This Template: You can use this budget template to plan and track personal finances on a monthly and annual basis. This great tool helps you visualize how your income sources, spending habits, and savings evolve over an entire year.

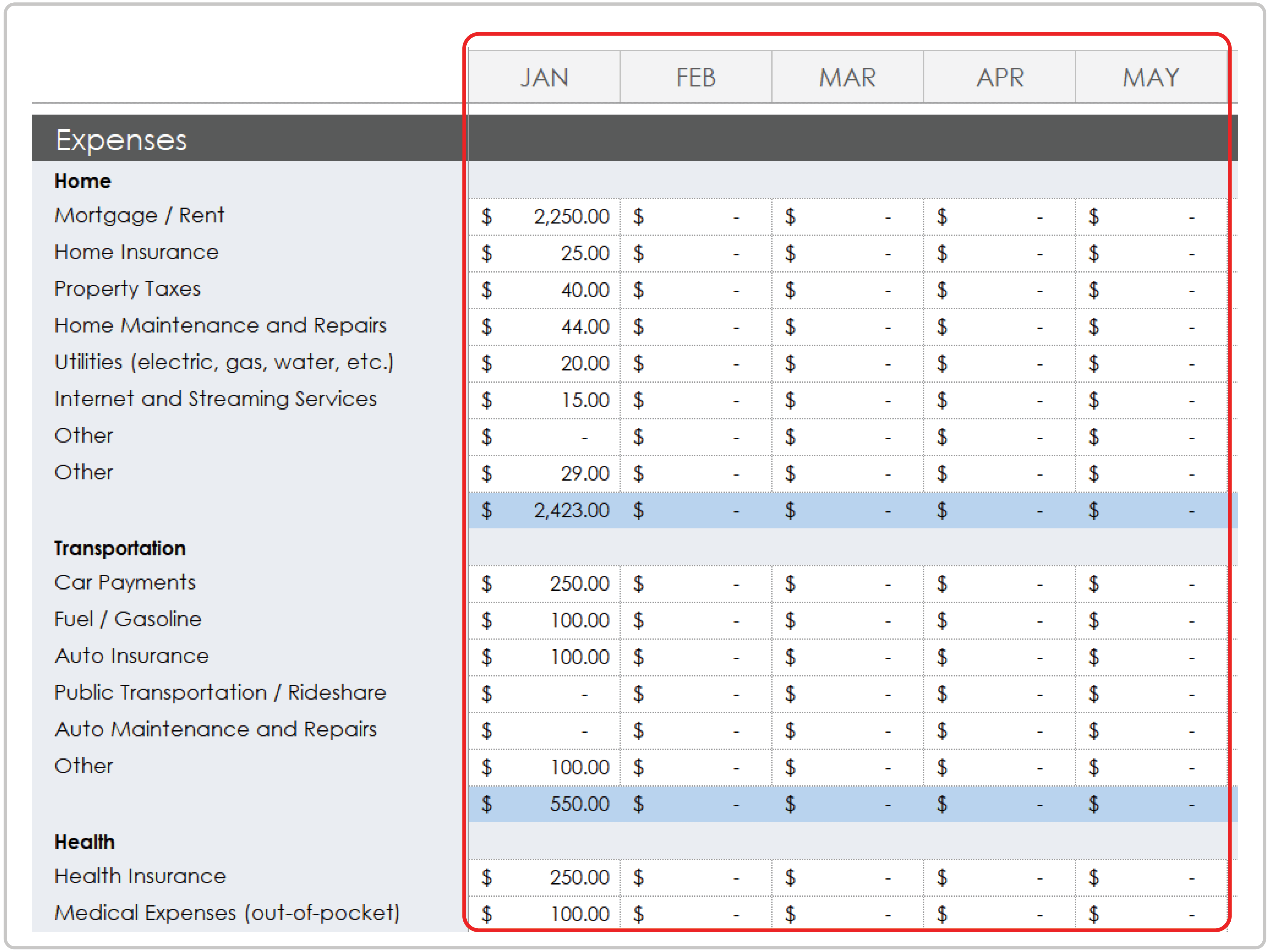

Notable Template Features: On this template, you’ll find sections for income, savings, and expenses. For a detailed breakdown of costs, you can make use of such expense categories as home, transportation, daily living, health, and entertainment. The template also includes charts that visually summarize total income, savings goals, and expenses to help you track progress and identify budget gaps.

Simple Budget Template

Download the Simple Budget Template for Excel

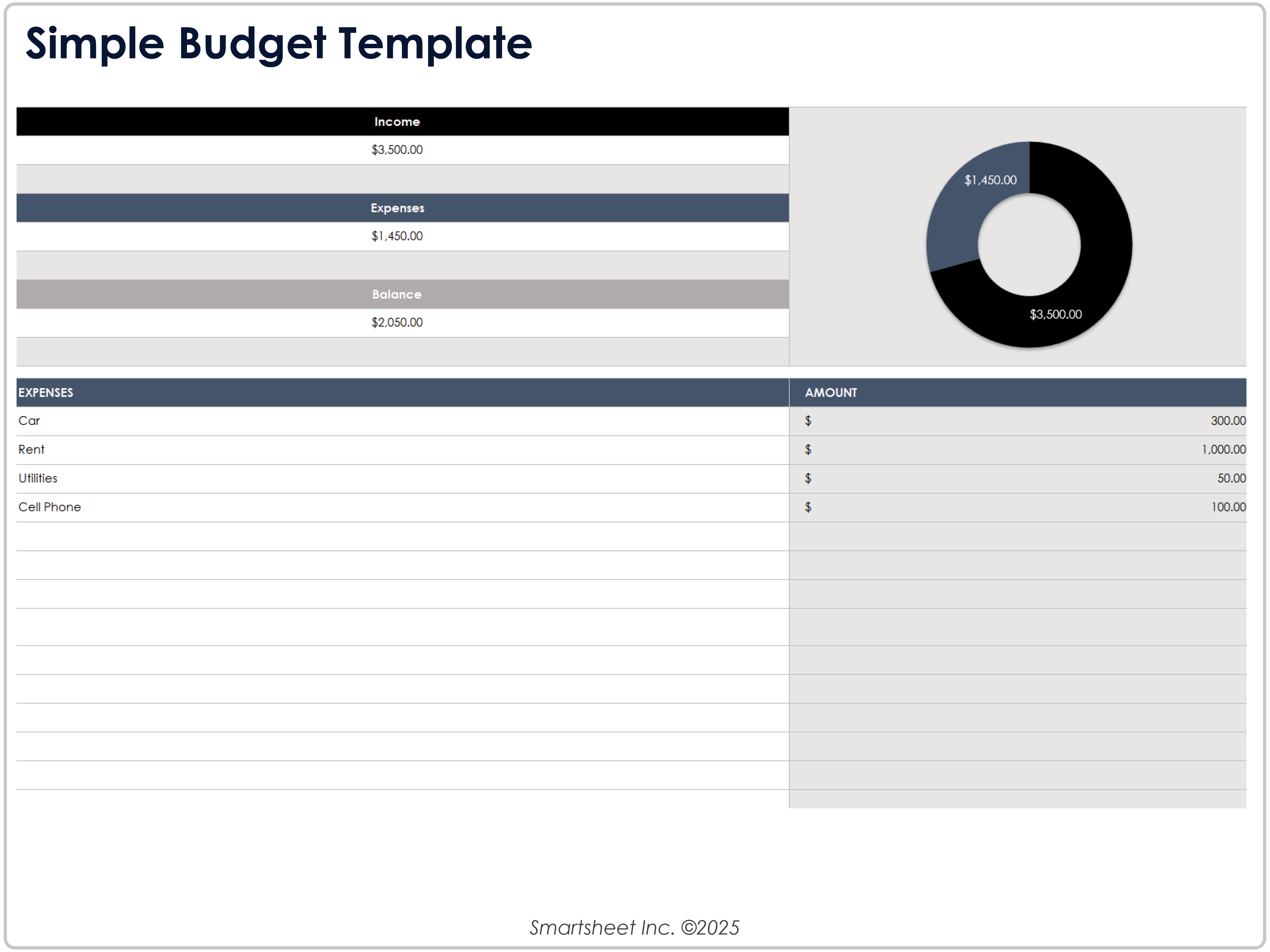

When to Use This Template: This simple budget template enables you to plan monthly income and expenses without the need for complex formulas or categories. If you’re a first-time budgeter or you need to make short-term financial decisions, this template works well.

Notable Template Features: This template features a minimalist layout that summarizes total income, expenses, and remaining balance at a glance. You’ll also notice a donut chart for a visual snapshot of spending versus income. Due to the template's simple structure, it’s easy to start budgeting and to identify funds that could go toward savings, debt payments, or other financial goals.

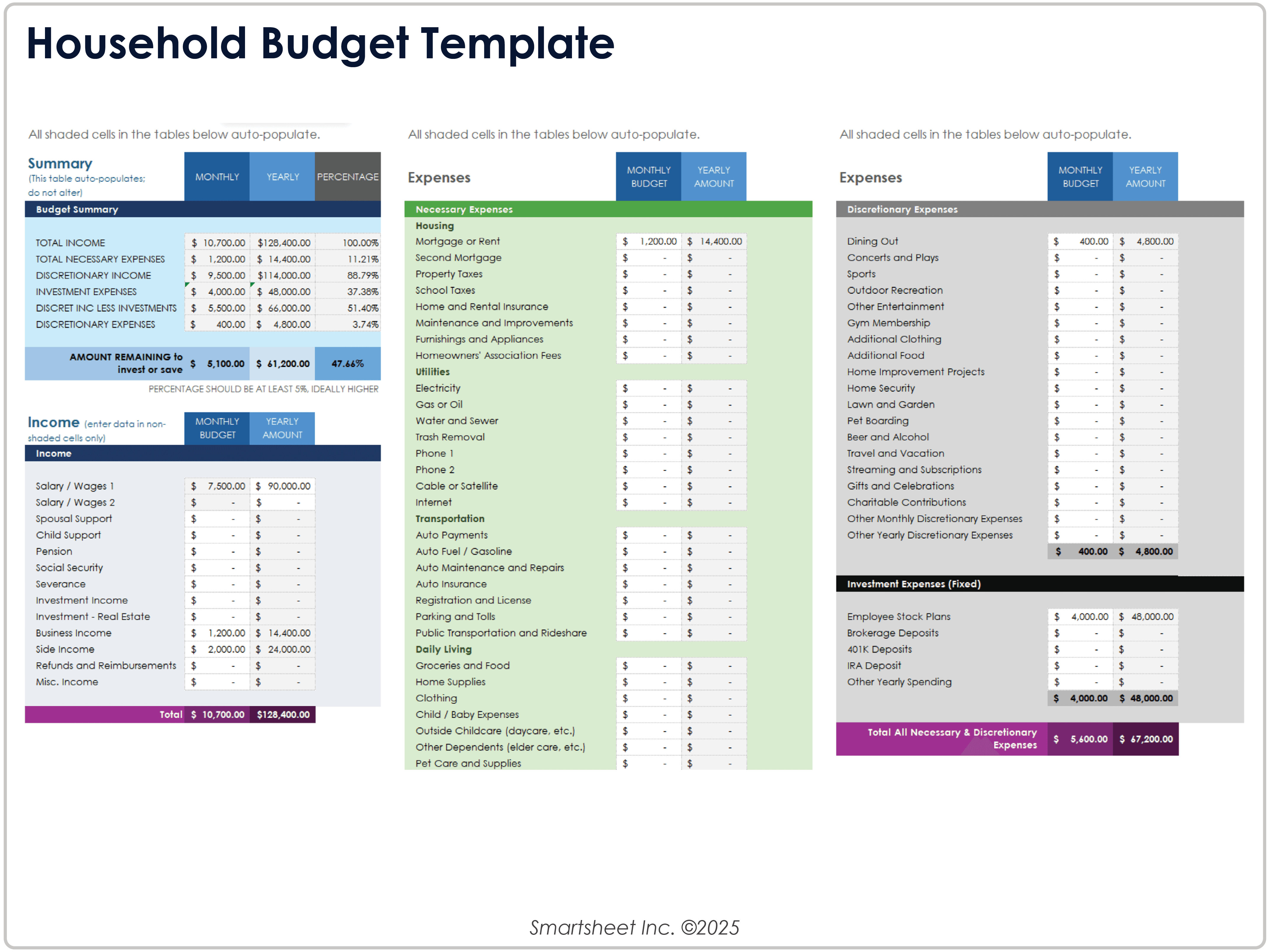

Household Budget Template

Download the Household Budget Template for Excel

When to Use This Template: This budget template can help you manage an entire household's finances, including income, fixed obligations, discretionary spending, and investments. Families with multiple income sources and expense categories can create a detailed budget for financial planning and decision-making.

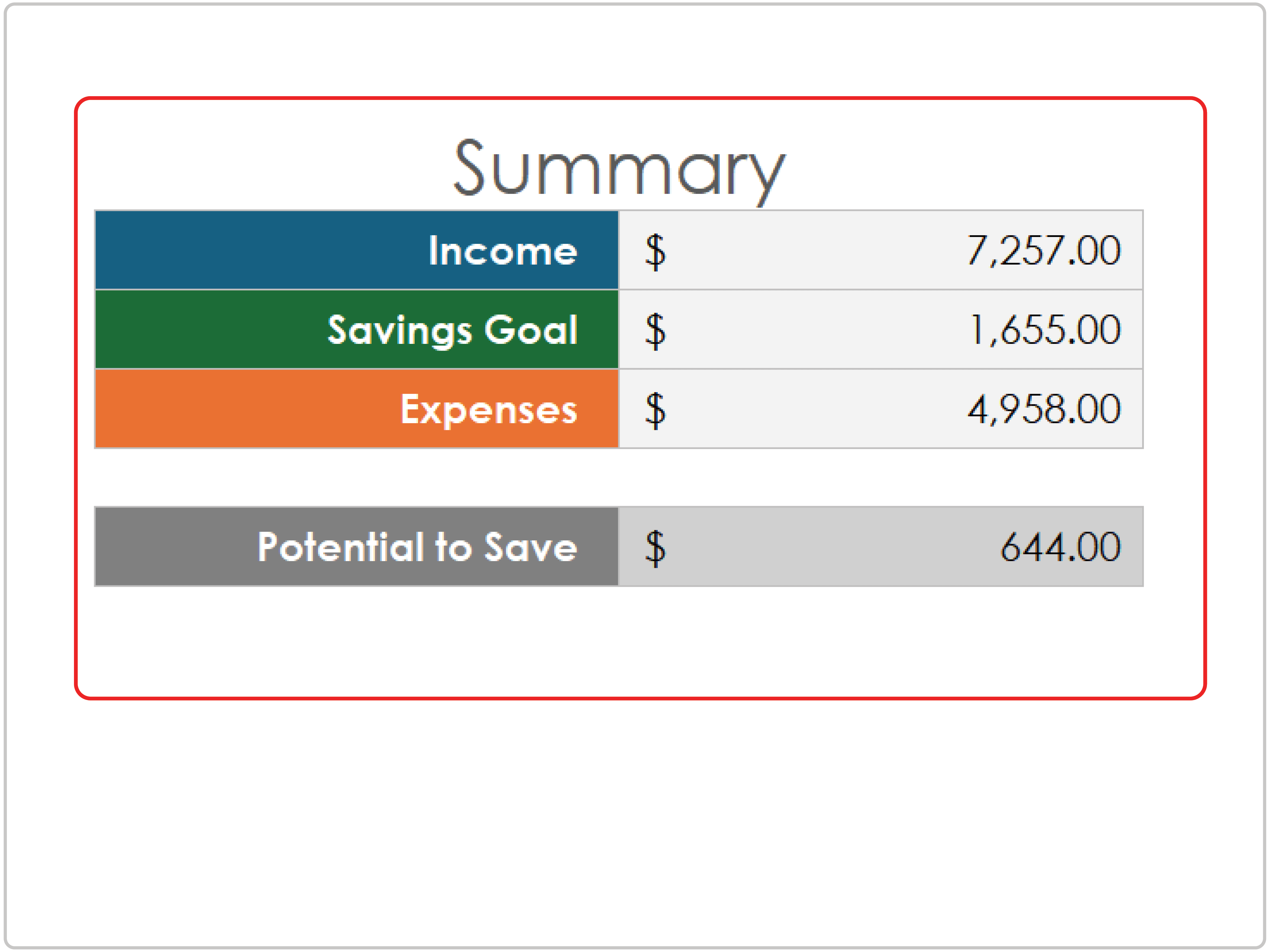

Notable Template Features: With this template, you can organize finances into monthly and yearly budget columns, and it includes an automated summary panel that shows income breakdowns and savings potential. Color-coded input fields and built-in calculations simplify complex budgeting. Use the example expense categories and line items, or edit the template to create a customized household budget.

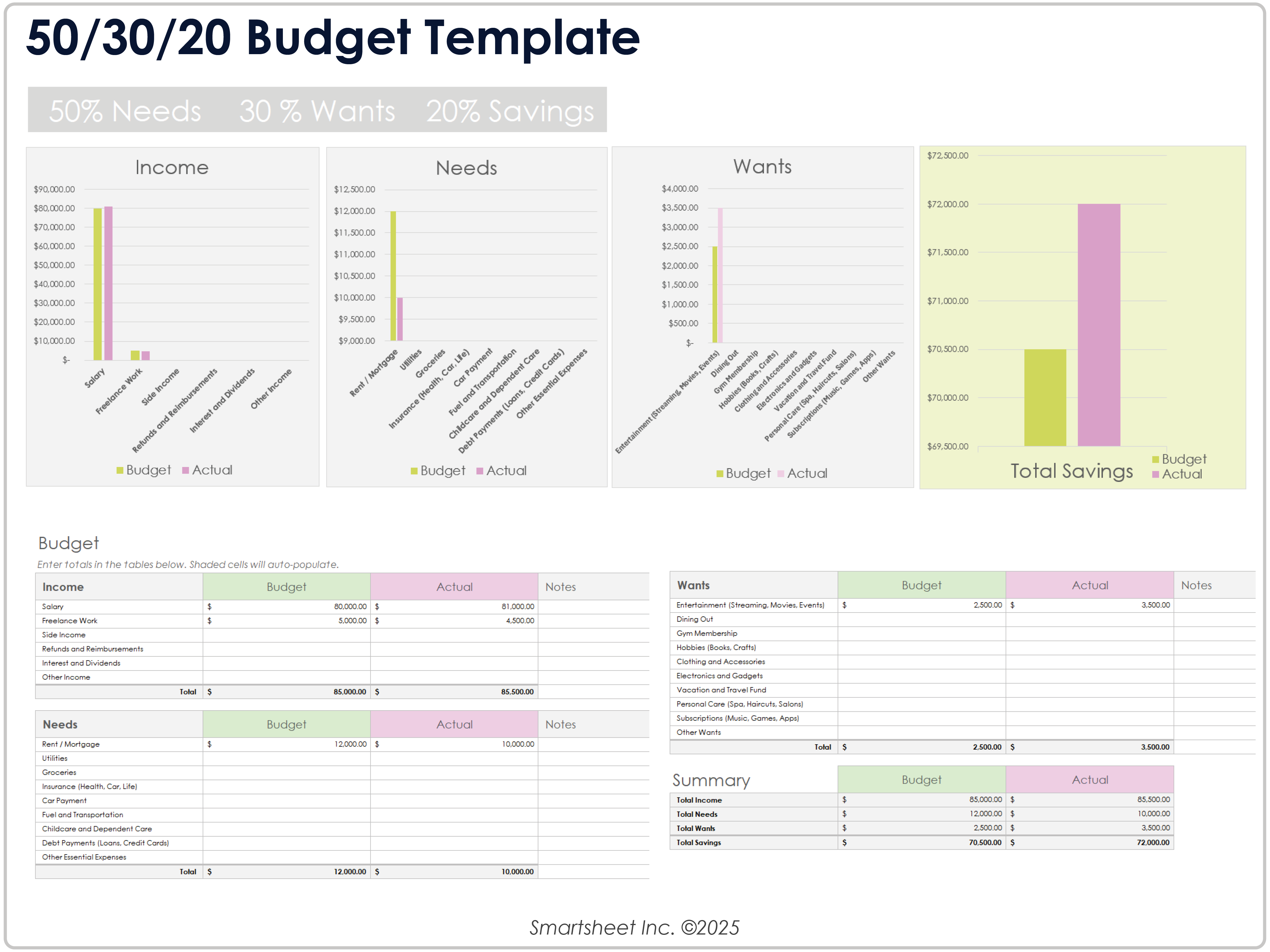

50/30/20 Budget Template

Download the 50/30/20 Budget Template for Excel

When to Use This Template: This template follows the 50/30/20 budgeting rule, with 50 percent of income going toward needs, 30 percent toward wants, and 20 percent toward savings. Monitor how your financial priorities compare to your actual spending with this template.

Notable Template Features: This template is divided into 50/30/20 sections with itemized and total amounts for each portion of your budget. A visual chart shows planned versus actual totals for quick insight into overspending or savings performance. The clean layout on the template is easy to use for budget planning and tracking.

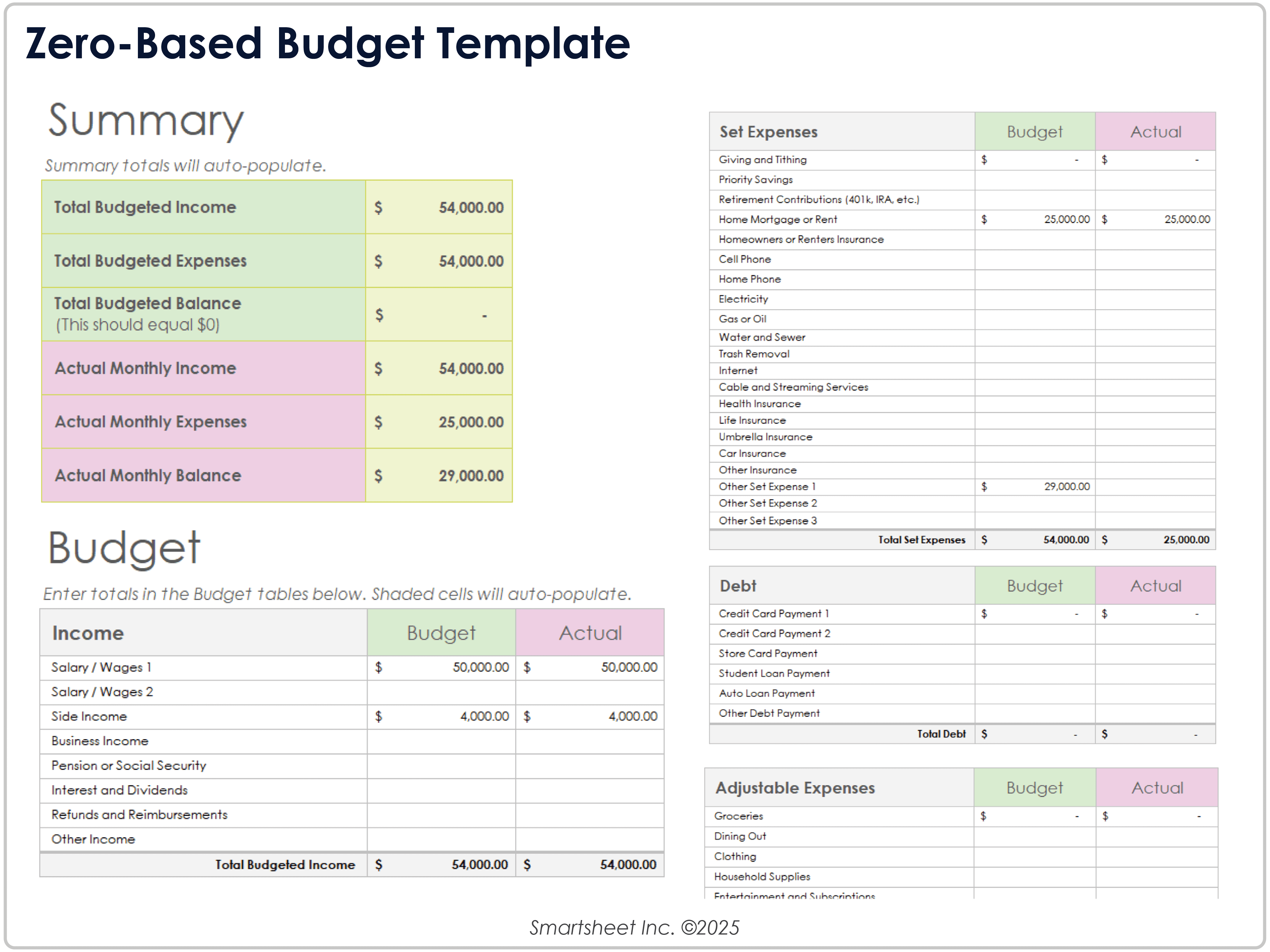

Zero-Based Budget Template

Download the Zero-Based Budget Template for Excel

When to Use This Template: Assign every dollar of income to a purpose and ensure that your monthly budget balances down to zero with this zero-based budget template. Track where your money is going, eliminate waste, and build intentional habits around savings or debt-reduction goals.

Notable Template Features: This template includes budgeted versus actual columns for both income and expenses to support precise tracking and accountability. Use this template to organize costs into set and adjustable expenses, plus debt, to help identify fixed obligations and flexible spending. A built-in zero-sum calculation at the bottom ensures that every dollar is planned and accounted for.

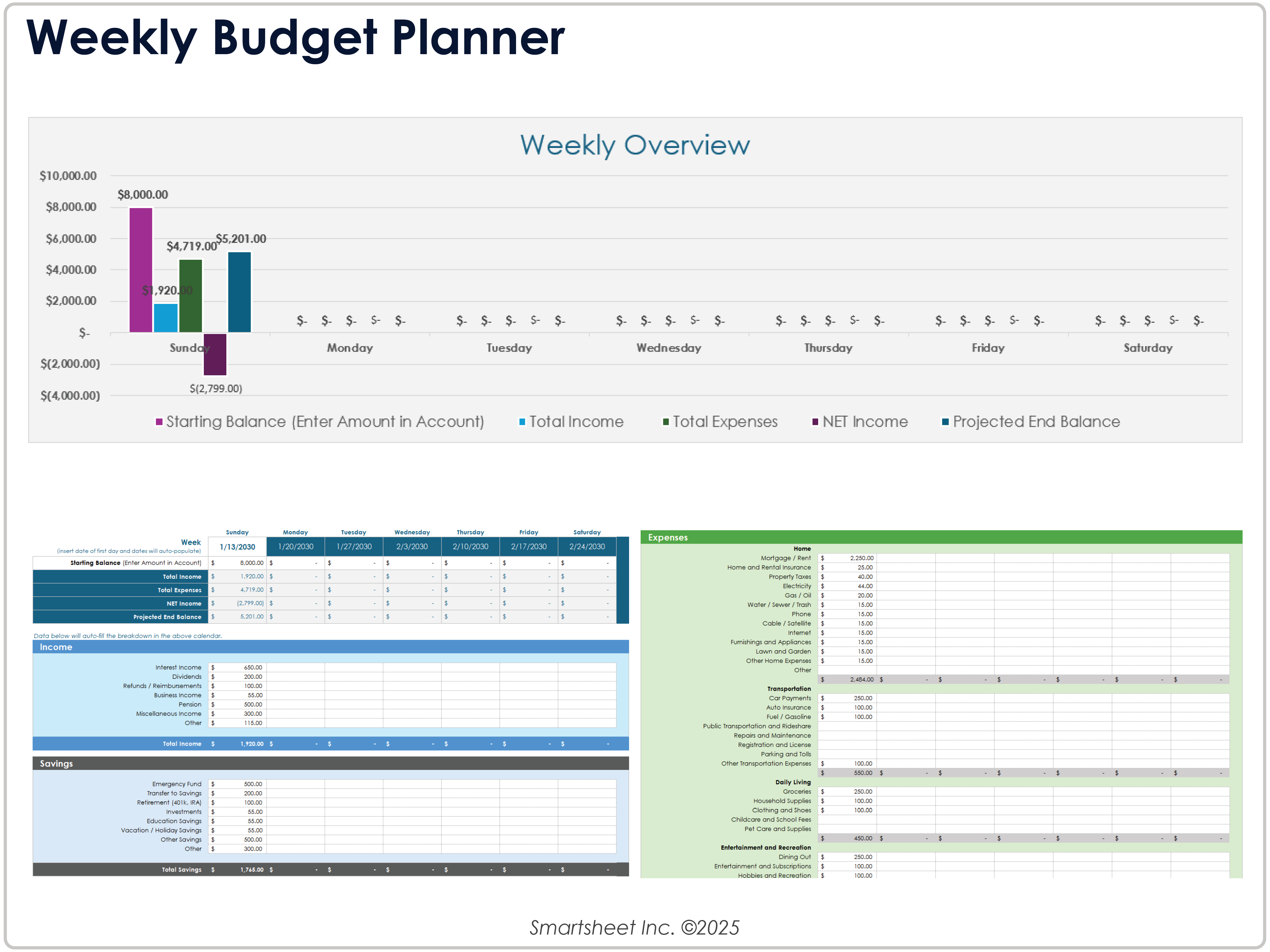

Weekly Budget Planner

Download the Weekly Budget Planner for Excel

When to Use This Template: Use this weekly budget planner template to manage your personal finances and stay on track with week-by-week checkpoints. If you are paid weekly, manage variable income, or want to control short-term spending habits, this template is a prime option.

Notable Template Features: This planner breaks down income, savings, and expenses into weekly columns, which allows for detailed tracking and comparison across the month. The template automatically calculates net income and projected account balance so you can track available funds. It also includes a chart to provide a visual summary of budget changes over time.

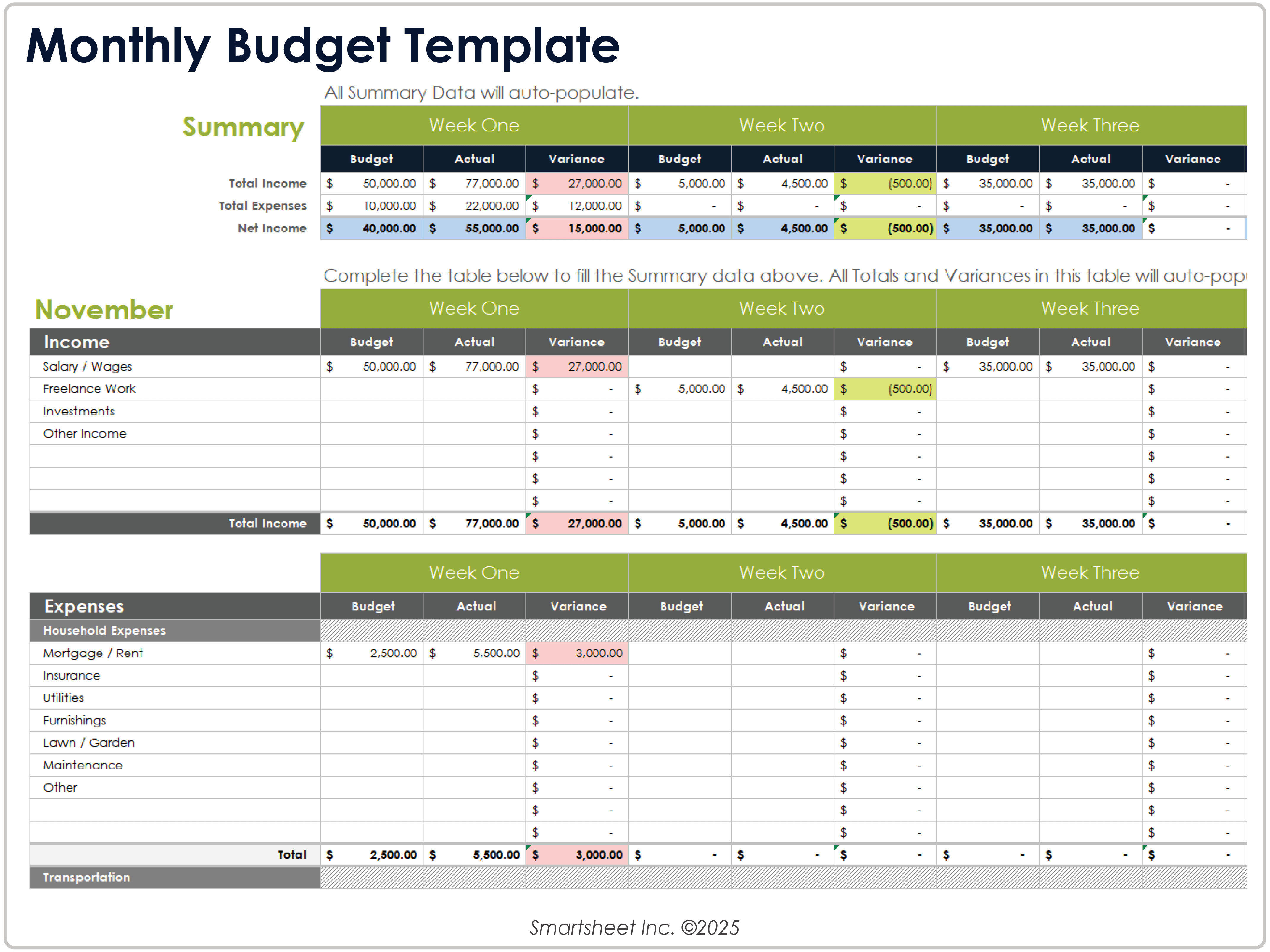

Monthly Budget Template

Download the Monthly Budget Template for Excel

When to Use This Template: You can use this one-month budget template to track income and expenses in detail, compare projected versus actual spending, and spot problem areas before small issues become bigger ones.

Notable Template Features: With this template, you can calculate the difference between your projected and actual costs, allowing you to see where spending diverges from your plan. The template features pre-built categories that cover everything from housing and transportation to personal care and travel for a comprehensive financial overview, as well as a summary section that highlights total amounts for a quick budget overview.

For related resources, see our collection of monthly Google Sheets budget templates.

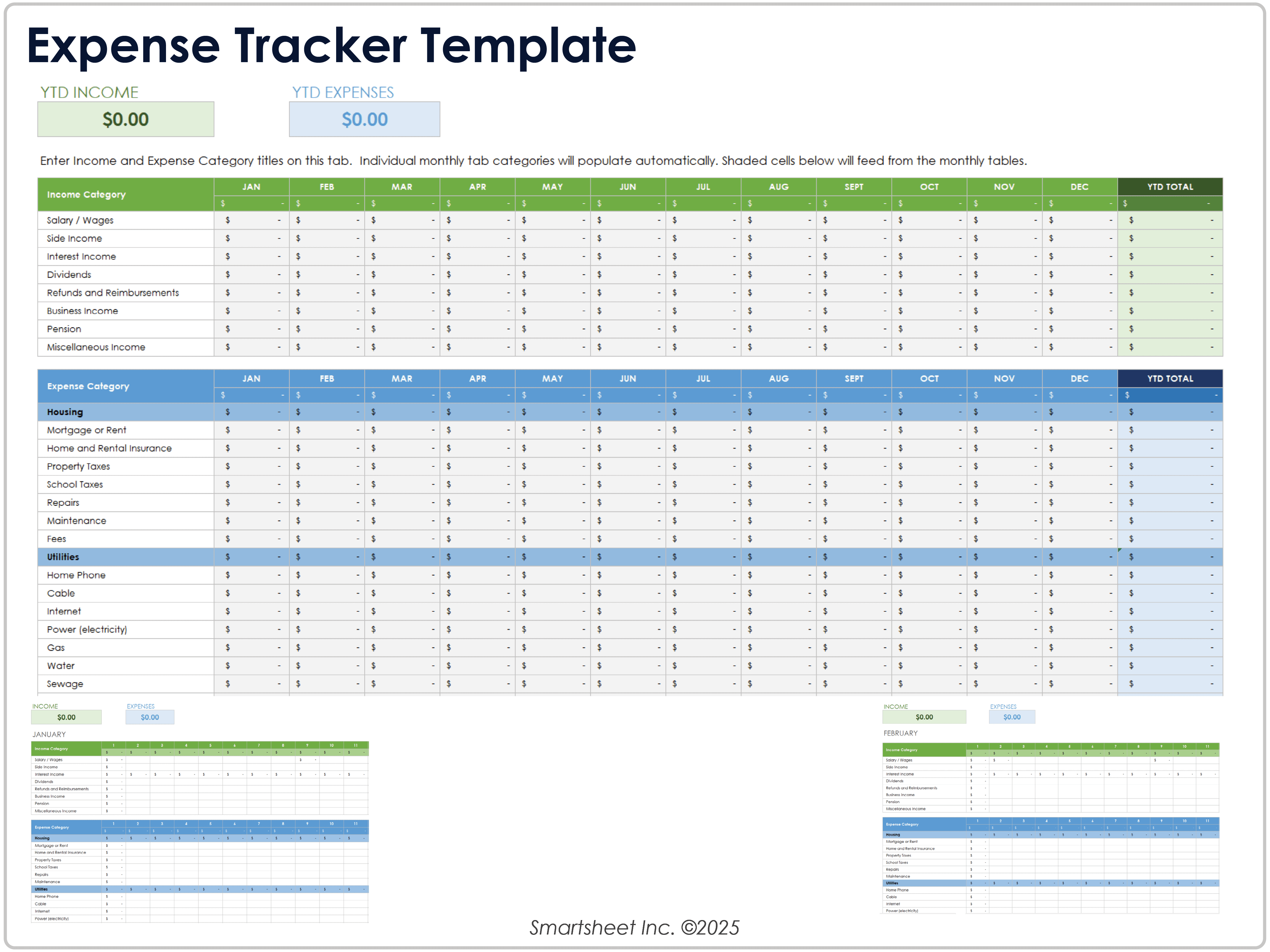

Expense Tracker Template

Download the Expense Tracker Template for Excel

When to Use This Template: Use this template to track expenses across multiple months and ensure that your spending stays within budgeted limits. This helps you plan for future goals or prepare for taxes and audits.

Notable Template Features: On this tracker template, you’ll find separate sheets for each monthly breakdown of income and expenses, along with a year-to-date (YTD) summary. Also take note of customizable categories and a structured way to log transactions and identify financial patterns. The YTD totals at the top of the summary sheet make it easy to track how much you've earned and spent over time.

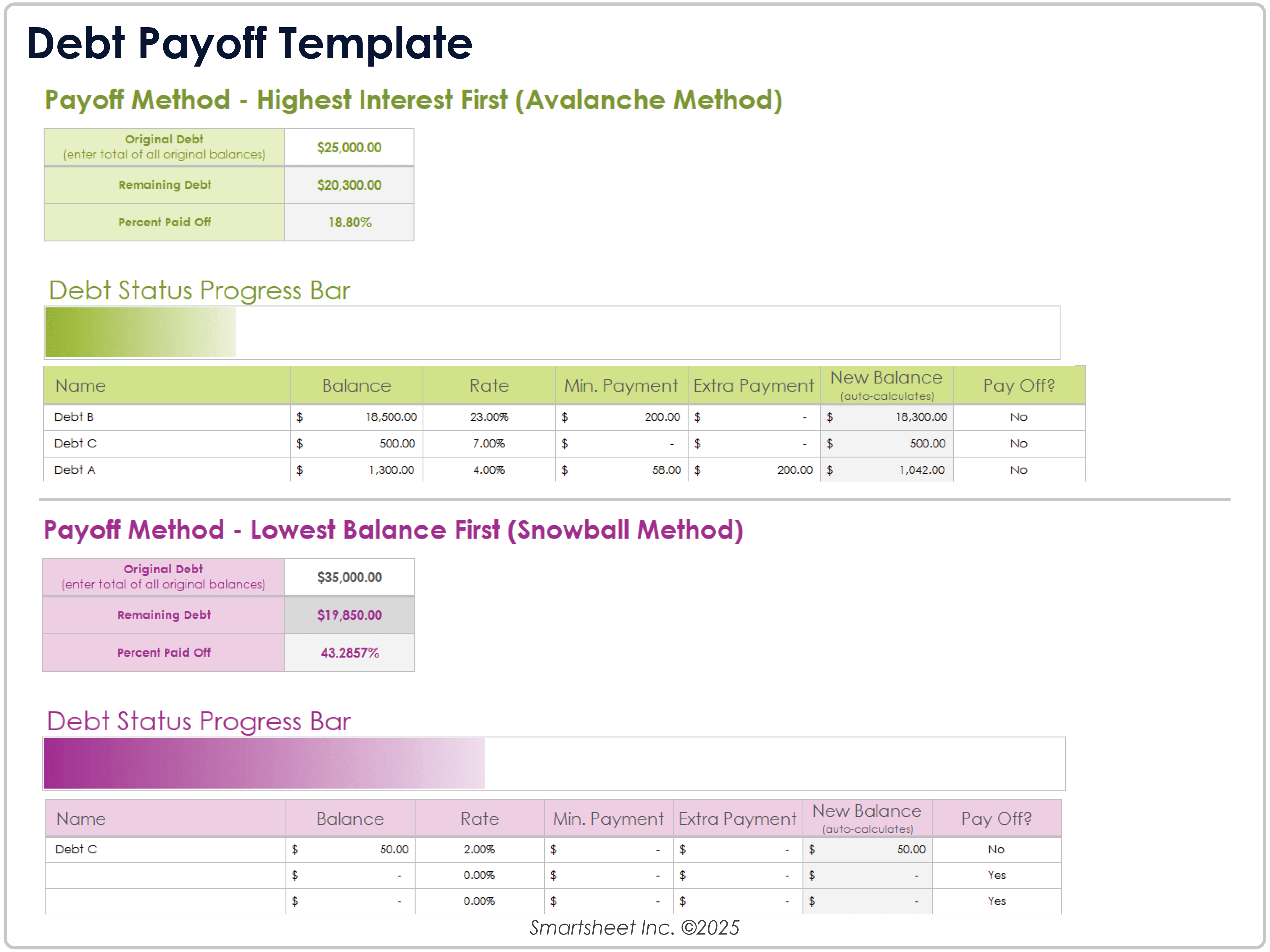

Debt Payoff Template

Download the Debt Payoff Template for Excel

When to Use This Template: This debt payoff template enables you to create a clear debt repayment plan and stay organized as you make monthly payments. This template is ideal for those juggling multiple debts who want to minimize interest paid and track progress.

Notable Template Features: A debt payoff calculator and a payment tracking sheet are the top features of this template. You can input balance, rate, and minimum payment for each debt, and then compare payoff strategies to show total interest, time to pay off, and payment order. Choose the Snowball method to pay off debts with the lowest balance rate first or the Avalanche method to prioritize debts with higher interest rates. The added payment tracking sheet logs monthly amounts and includes a visual progress bar to help you stay on schedule and motivated.

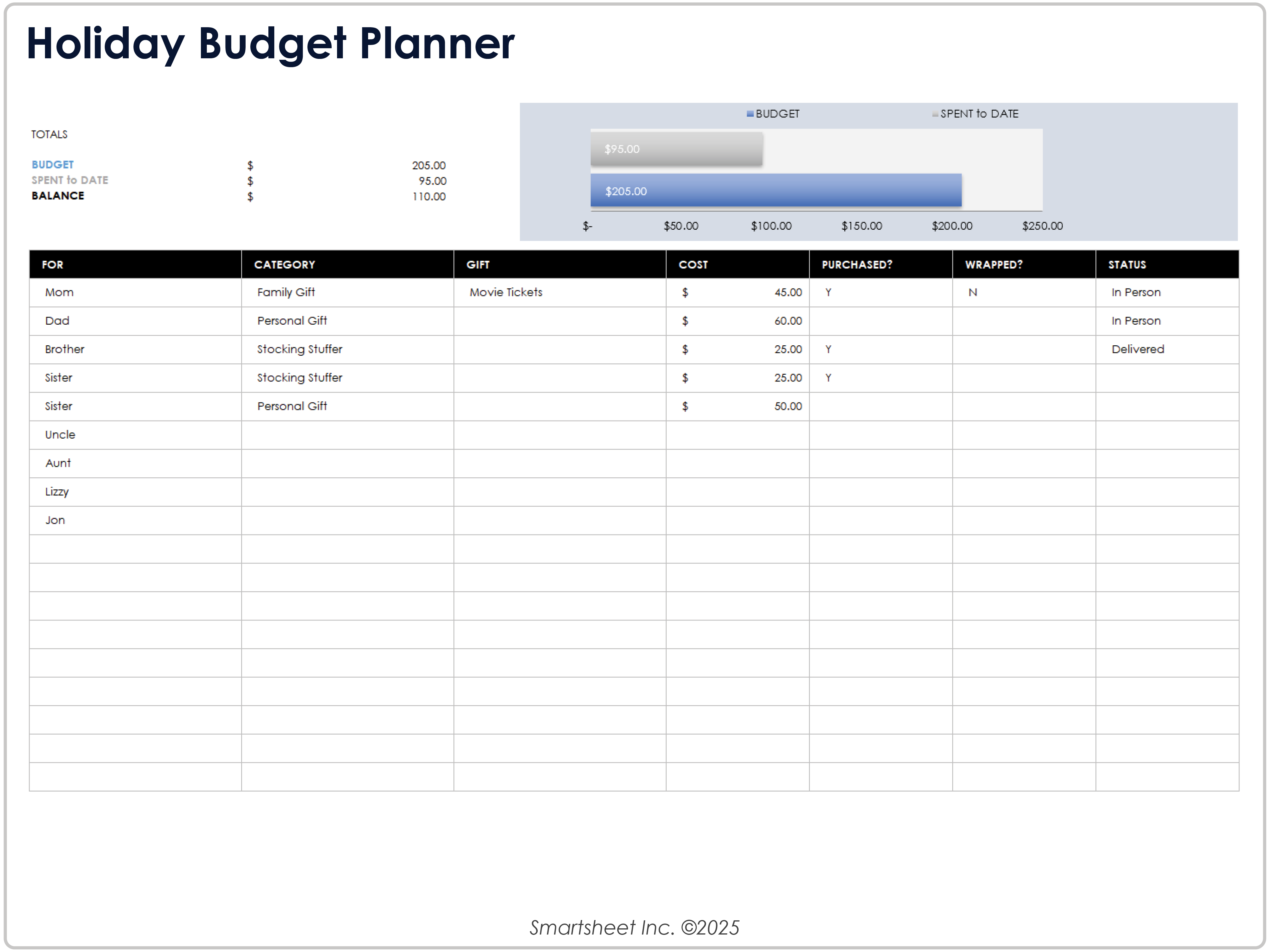

Holiday Budget Planner

Download the Holiday Budget Planner for Excel

When to Use This Template: This template helps you stay organized and on budget during holiday gift shopping, especially if you're buying gifts for multiple recipients or managing a fixed budget.

Notable Template Features: On this template, you can access fields for recipient names, gift categories, item details, and cost, plus columns for tracking purchase status and delivery method. Use the progress bar and balance summary at the top to visualize your remaining budget and total spending.

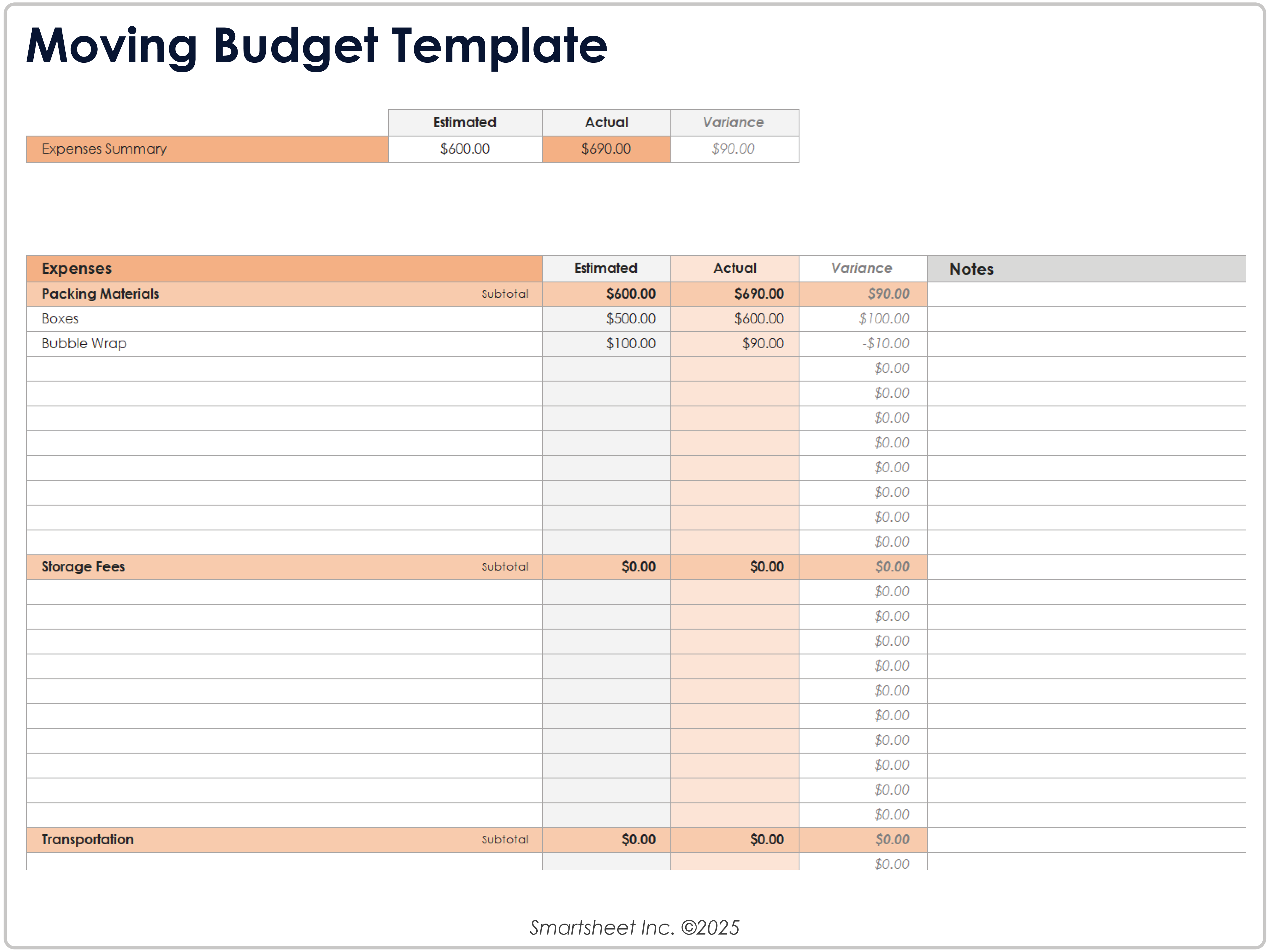

Moving Budget Template

Download the Moving Budget Template for Excel

When to Use This Template: Plan a local or long-distance move and account for every cost with this template. You can create a realistic view of moving expenses, from pre-move preparation to new home costs.

Notable Template Features: This template breaks down moving expenses into key categories, including moving services, transportation and travel, utilities and services, pet care, and more. Each category features editable line items to help you track actual versus estimated expenses, and the template automatically calculates the total cost. Plus, the template includes an emergency fund estimate to manage any surprise costs.

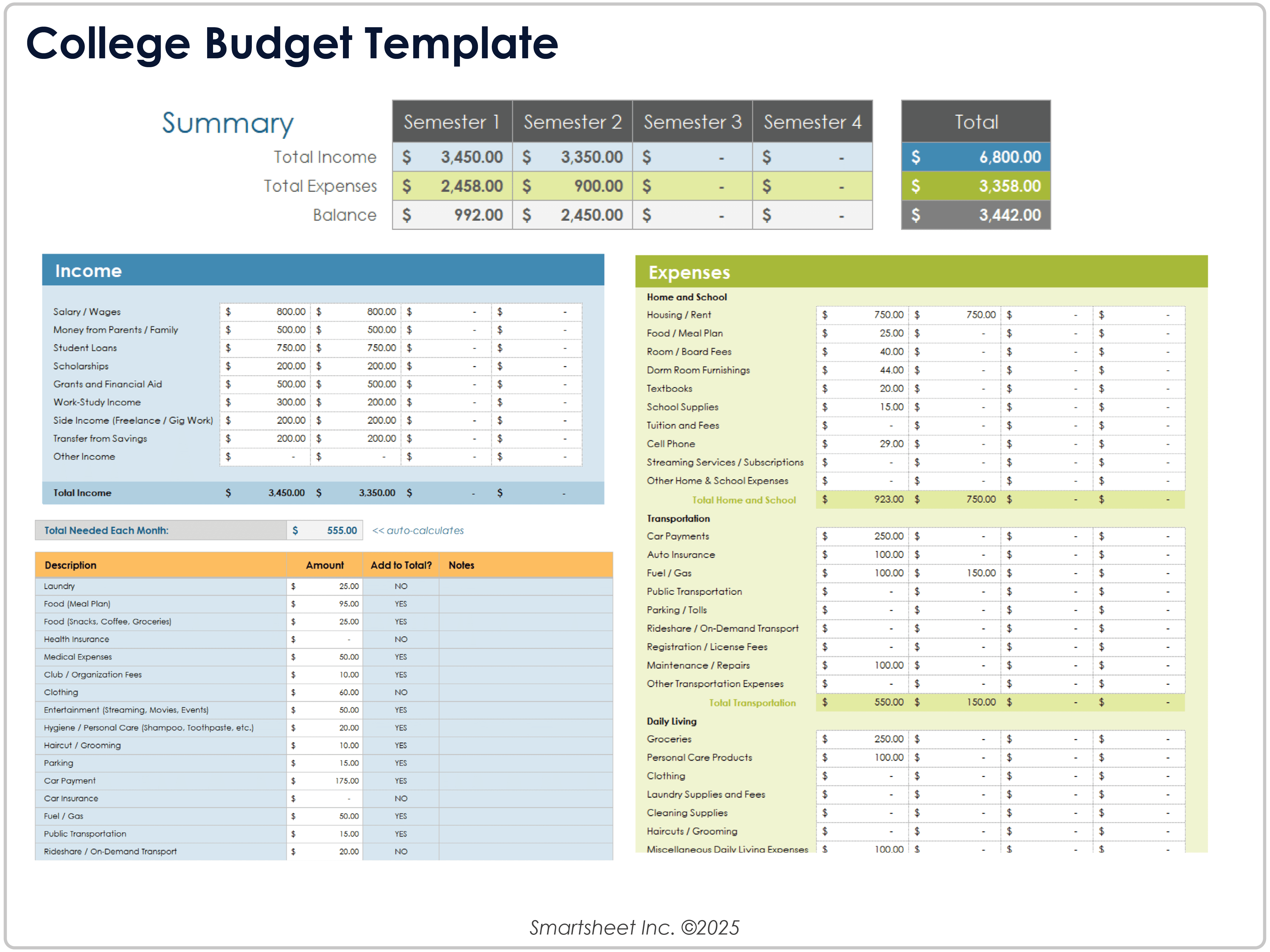

College Budget Template

Download the College Budget Template for Excel

When to Use This Template: College students can use this template to manage finances over multiple semesters and to stay on top of educational and personal expenses while balancing a limited student budget.

Notable Template Features: This budget template is organized by semester and includes detailed tracking for income, expenses, and balance. Sections cover core areas such as home and school, transportation, daily living, entertainment, and health to help you plan for both essential and optional costs. A separate expense estimator worksheet allows you to list expected monthly costs, flag items to include in the budget, and note which expenses are covered by others (such as parents). This helps ensure students budget realistically and avoid overspending.

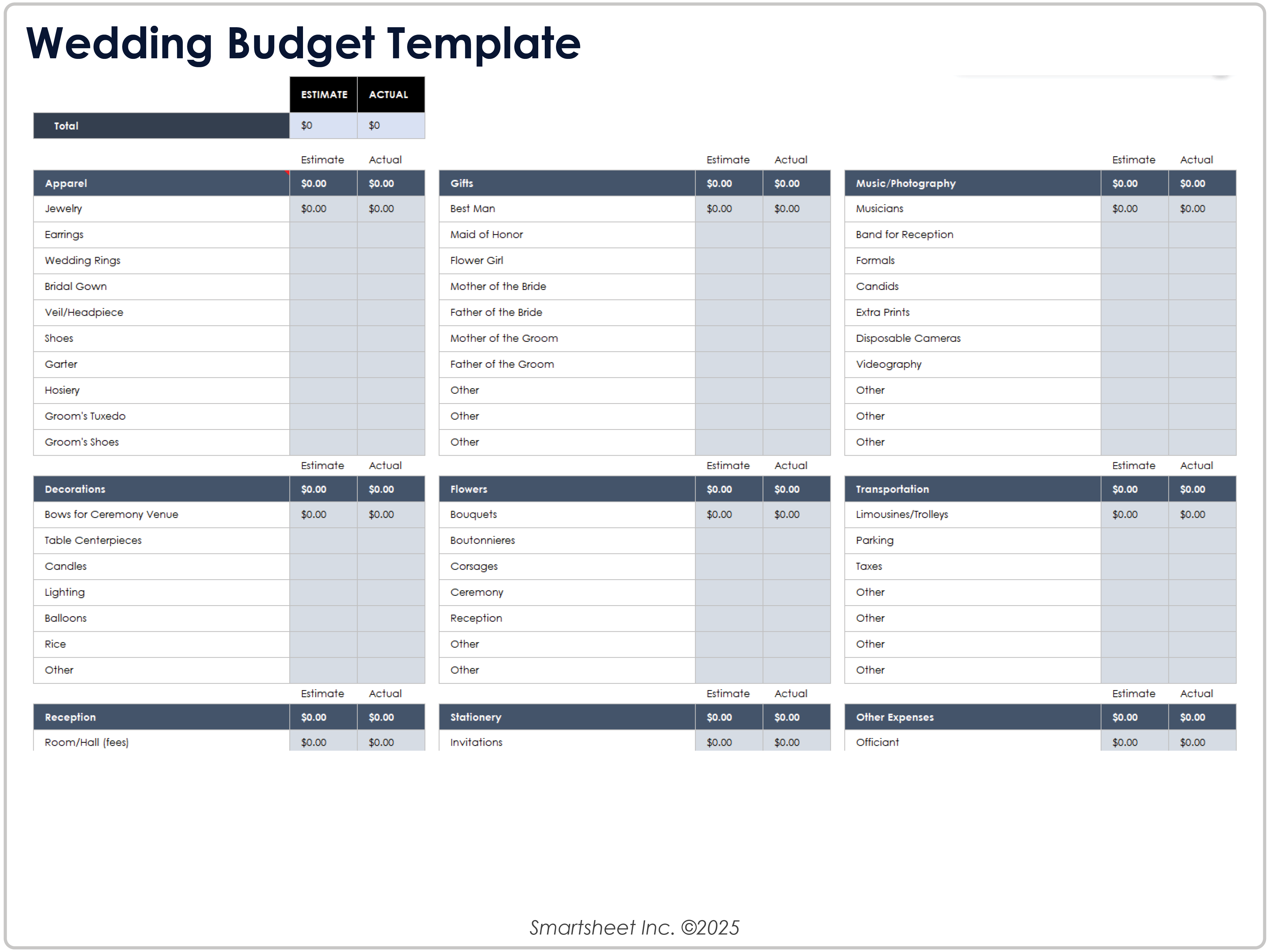

Wedding Budget Template

Download the Wedding Budget Template for Excel

When to Use This Template: You can use this wedding budget template to estimate and track costs for every aspect of the event. This template enables you to create a detailed budget for managing multiple vendors and types of expenses, from attire and decorations to transportation and photography.

Notable Template Features: This budget planner is organized by essential wedding categories, such as apparel, flowers and decor, reception costs, and other expenses. Each category includes columns to track estimated and actual costs with the goal of helping you spot discrepancies and stay within budget. At the top of the template, you can find total amounts for a quick view of your current financial status.

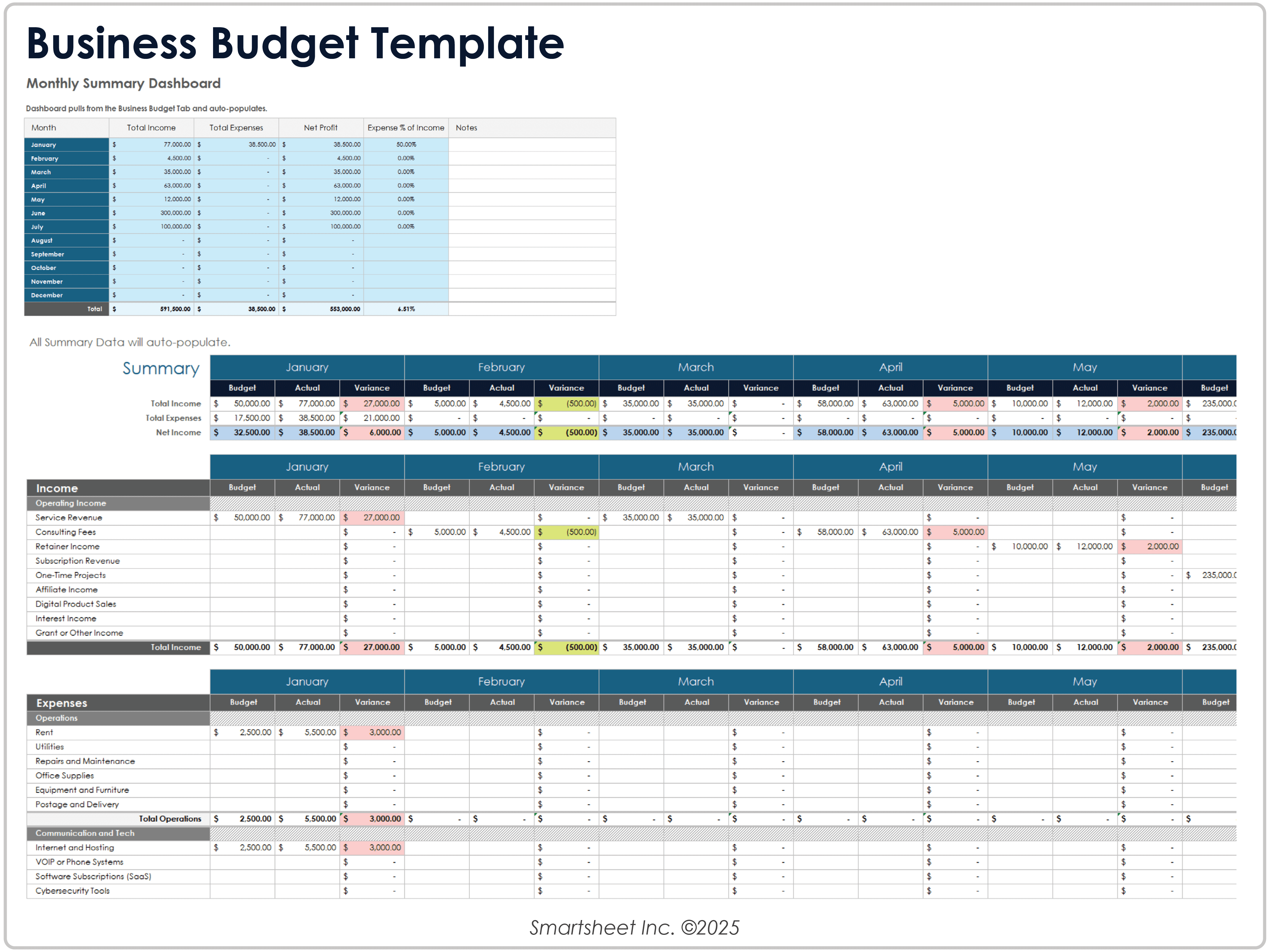

Business Budget Template

Download the Business Budget Template for Excel

When to Use This Template: Track, forecast, and analyze monthly and annual expenses for a small or medium-sized company with this template. Business owners, CFOs, and accountants can use this template to compare projected and actual costs across multiple departments and identify performance trends throughout the fiscal year.

Notable Template Features: This template organizes budgeted and actual expenses by department and month, so you can view cash flow patterns across all 12 months. You’ll also find separate sheets for budget, actual, variance, and analysis sections, which allow for detailed planning and performance data. The template automatically calculates monthly and yearly variance, and visual charts provide quick insights into spending categories and projected versus actual expenses.

Smartsheet vs. spreadsheets for managing business budgets

If your business budget is becoming harder to manage in Excel, consider moving to a more scalable solution. Smartsheet is business budget management software that offers a familiar spreadsheet-like interface along with real-time updates, automated alerts, dashboards, and secure collaboration. Teams can work from one accurate version of the budget and make faster, more confident financial decisions.

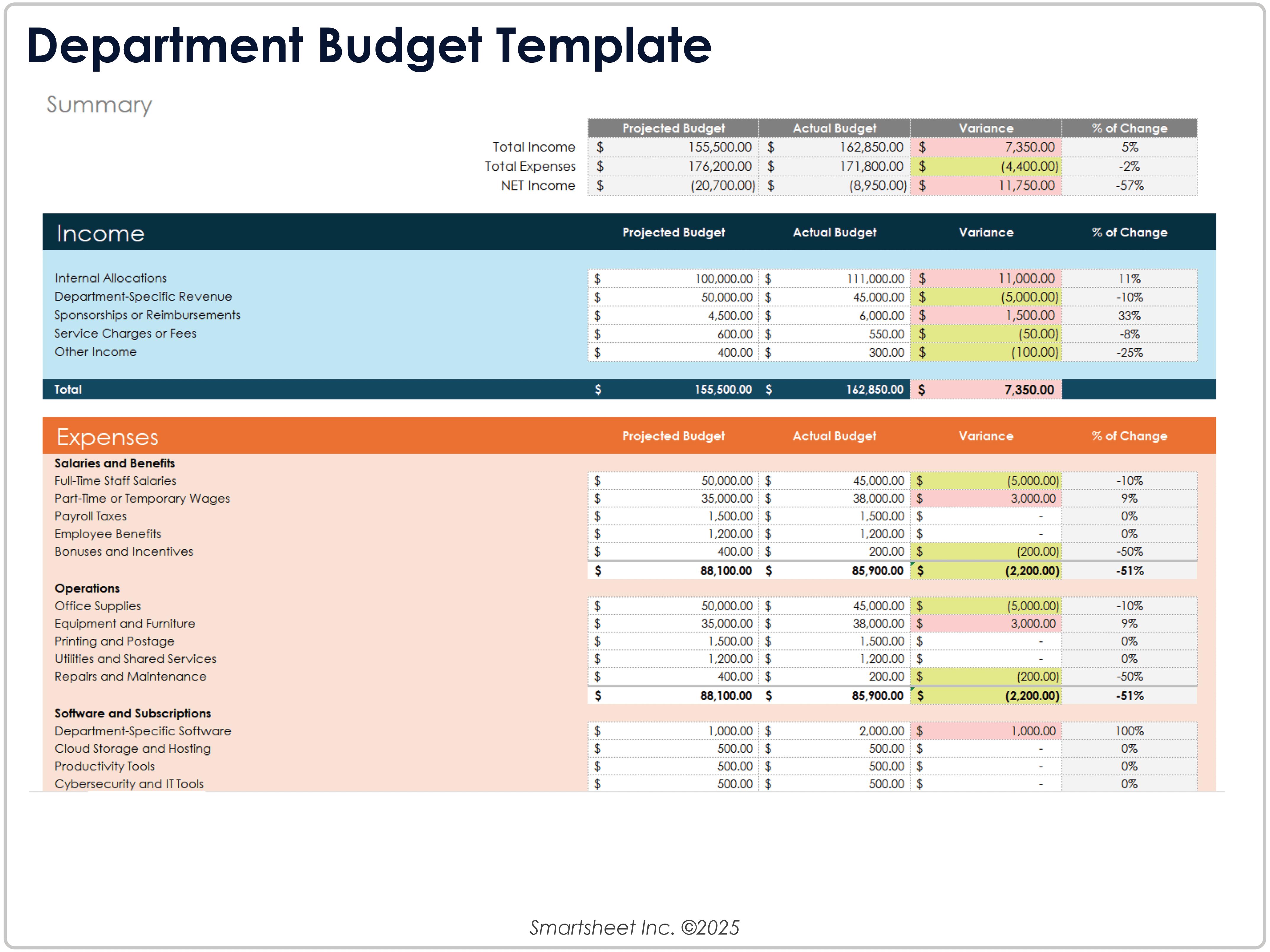

Department Budget Template

Download the Department Budget Template for Excel

When to Use This Template: Department managers can use this budget template during annual planning cycles to compare income and expenses across multiple budget years. Assess year-over-year performance and estimate your department expenses for the upcoming fiscal year with this template.

Notable Template Features: This template offers columns for side-by-side yearly comparison with automatic percentage change calculations. It includes example categories, such as general admin, marketing, research and development, and software, which you can customize for the needs of your department or team. The simple structure helps streamline budget planning and reporting.

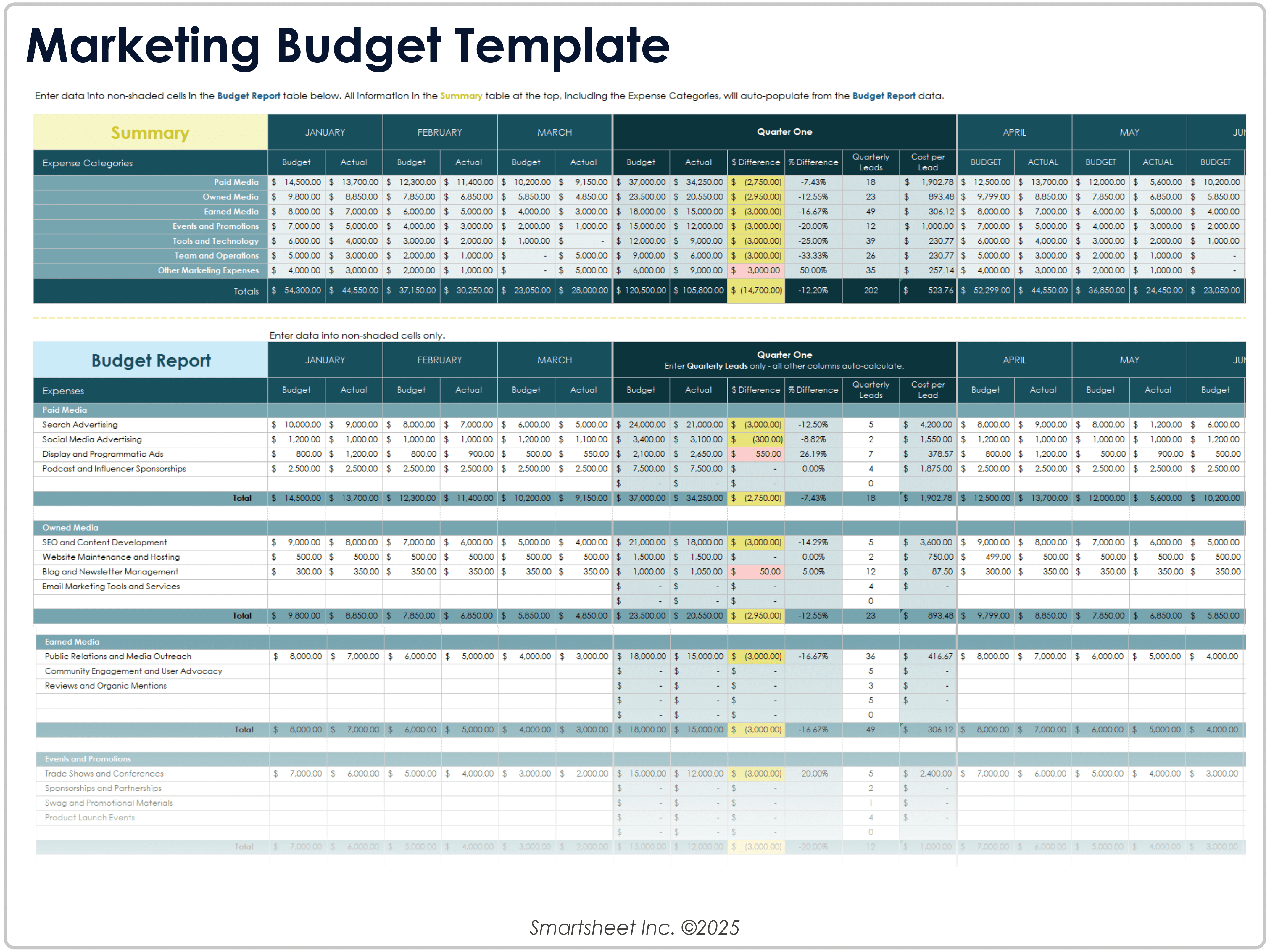

Marketing Budget Template

Download the Marketing Budget Template for Excel

When to Use This Template: Use this marketing budget template to manage a variety of marketing activities across channels. You can track budgeted and actual costs, compare campaign effectiveness, and identify overspending early.

Notable Template Features: This template provides a monthly and quarterly breakdown of projected and actual costs across core marketing functions. It also includes automatic variance tracking and visual summaries to quickly assess performance. Use the totals at the top of the template to view a real-time snapshot of fiscal year projections, actuals, and differences to help you monitor spending and make timely adjustments.

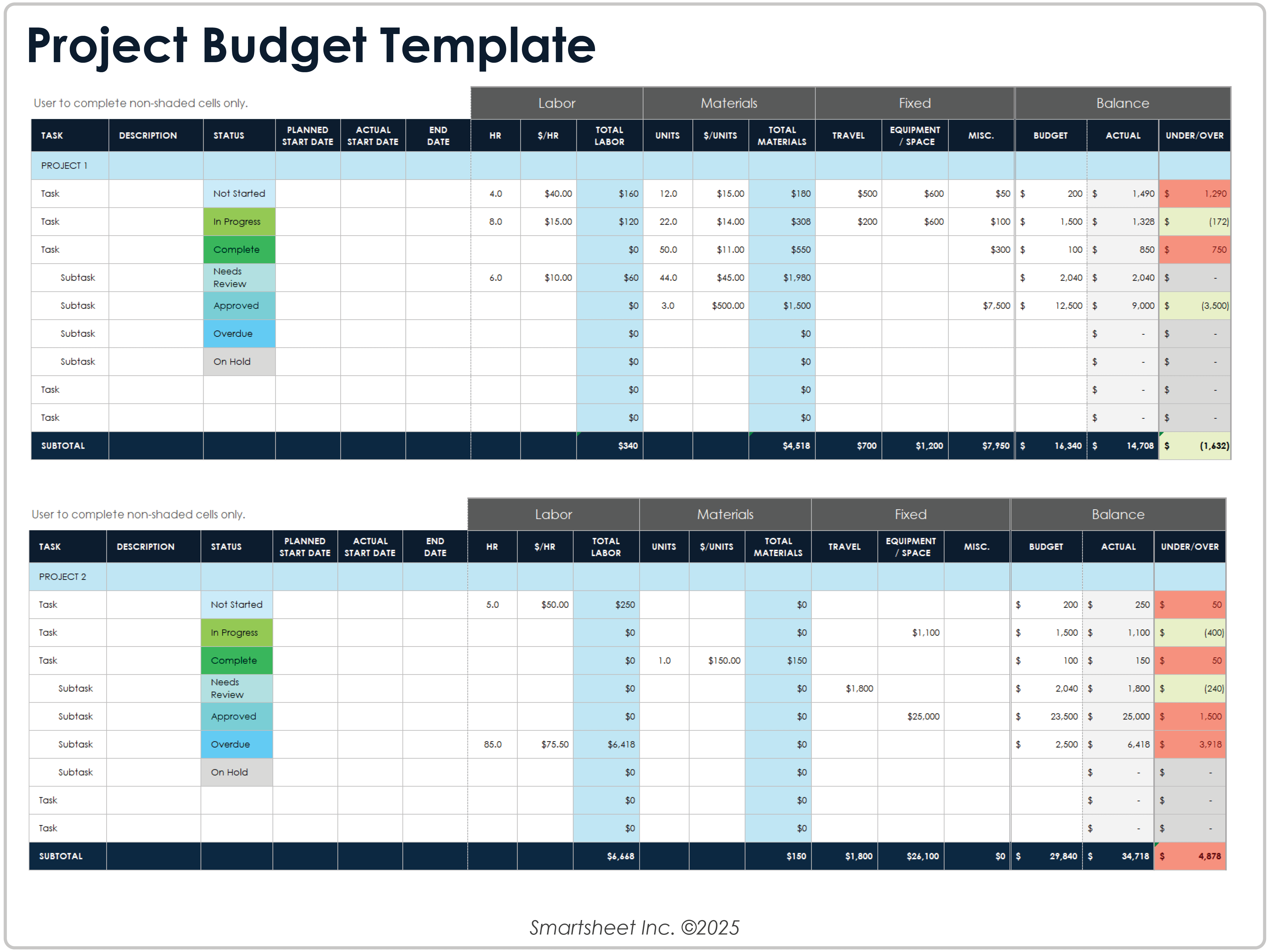

Project Budget Template

Download the Project Budget Template for Excel

When to Use This Template: Manage task-level budgeting for multiple projects with this project budget template. Project managers or teams juggling complex timelines can use this template to stay on schedule and within budget.

Notable Template Features: This template breaks down each project into individual tasks and subtasks, with columns for planned and actual labor hours, material usage, fixed expenses, and overall balance tracking. Color-coded status tags and under/over calculations highlight workflow stages and cost variances. At the bottom of each project section, you’ll find a display of total amounts to make it easy to quickly assess budget health.

Find more budget options in our collection of project budget templates.

The Importance of a Personal Budget

Creating a personal budget is important for your financial well-being and peace of mind, as well as your short- and long-term goals. By taking control of your finances with a personal budget template, you can make headway on these goals.

To get started, consider the following steps to help you establish your personal budget:

- Set Your Goals: Make a list of your short- and long-term goals. Determine why each goal is a priority, how you plan to achieve it, and the time frame in which you would like to accomplish each one. Short-term goals should only take a year to accomplish and include tasks such as paying off a credit card. Long-term goals could take many years to accomplish, such as saving for your child’s education or your own retirement.

- Track Your Spending: To make accurate estimates of how much you should allocate to each expense within your personal budget, you will need a sense of how much you are currently spending in each area. Review your bank statements for the last three to four months to get an idea of your spending. Of course, you may decide to change the amount you budget for each item, but this will at least provide a baseline you can use.

- Personalize Your Budget: Using a personal budget template is helpful to get your budget started, though you can always customize your budget to match your specific needs. Additionally, just because you create a budget one month doesn’t mean your expenses and goals will be the same for the next. Be sure to have monthly check-ins on your budget and don’t hesitate to update it as your circumstances change.

Getting Started Creating a Monthly Budget Tracker

To create a monthly budget tracker, use a template to input all sources of income, your planned savings contributions, and monthly expenses. The template automatically totals your income, savings, and expenses. This provides clarity on potential leftover funds, so you can evaluate your progress toward financial goals.

Here’s a step-by-step guide to creating a monthly budget tracker:

1. Download the personal budget template .

2. Open the downloaded template file.

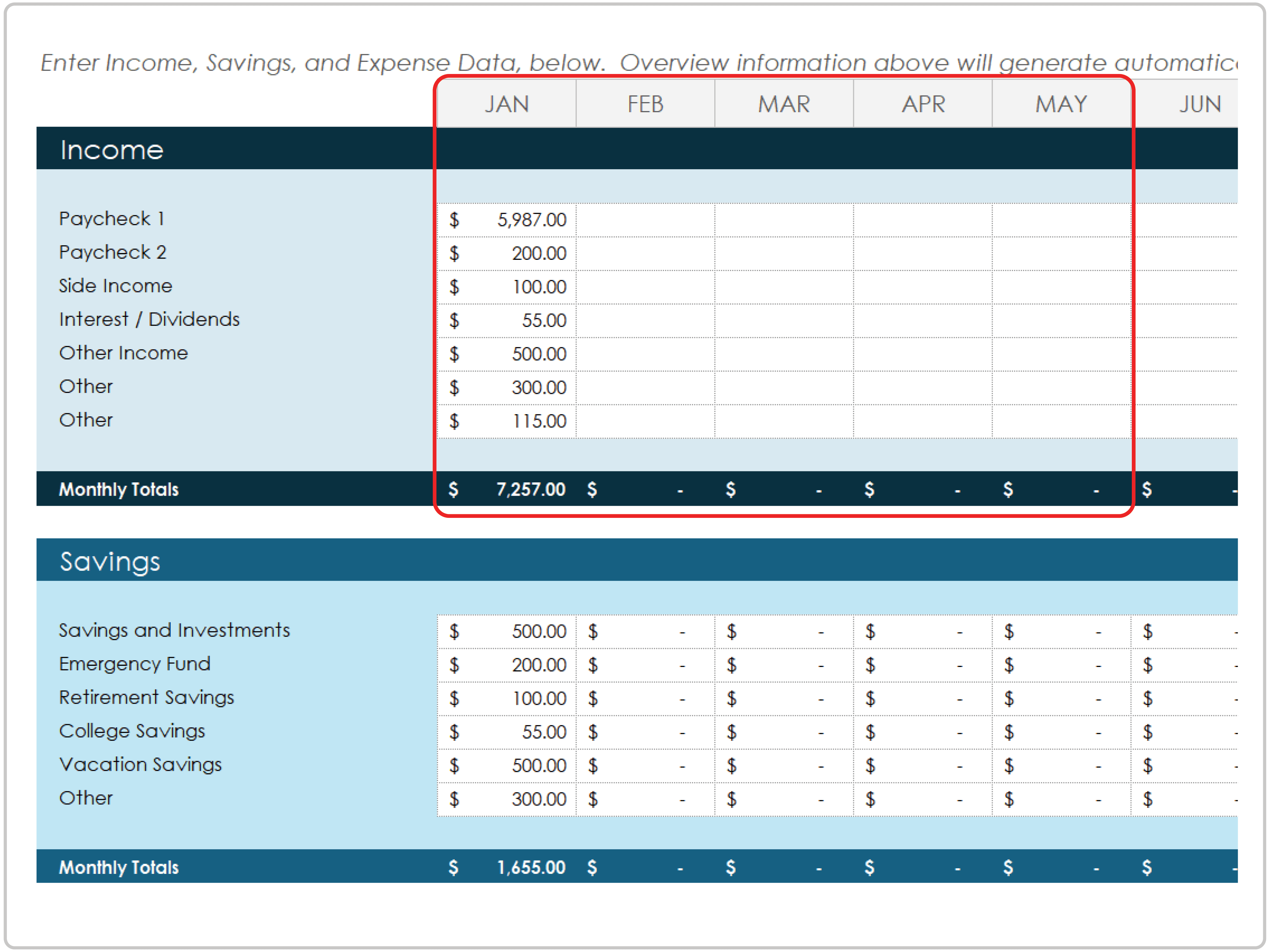

3. Enter your income. The template provides multiple rows in case you have more than one source of income.

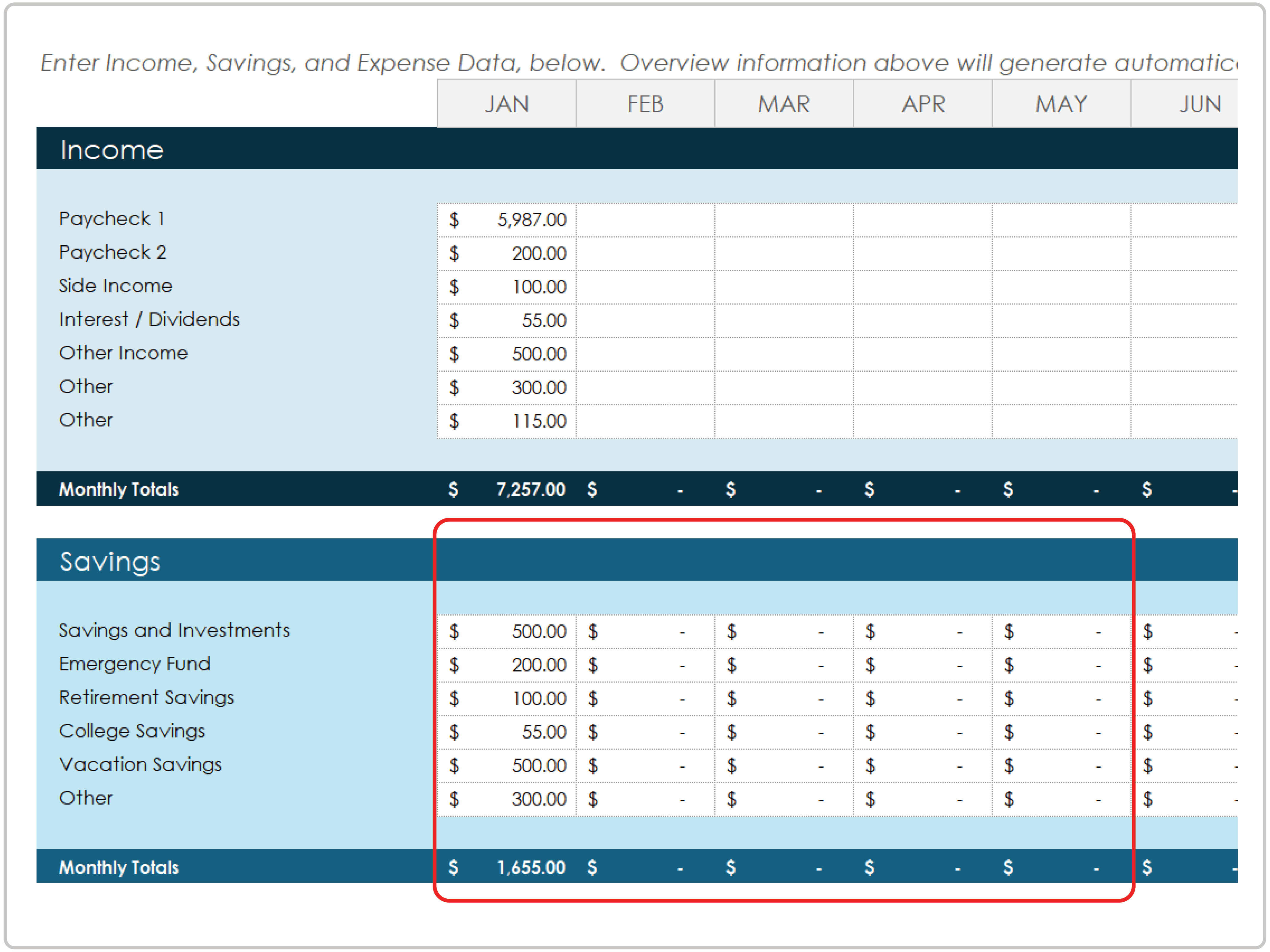

4. Enter your savings goals, which might include short- and long-term goals.

5. Enter your expenses in each cost category.

6. Review the summary at the top of the template. This summary calculates your potential savings by subtracting the Total Savings and Total Expense amounts from Total Income.

7. Review the dashboard charts, which automatically update as you make changes to your personal budget sheet.

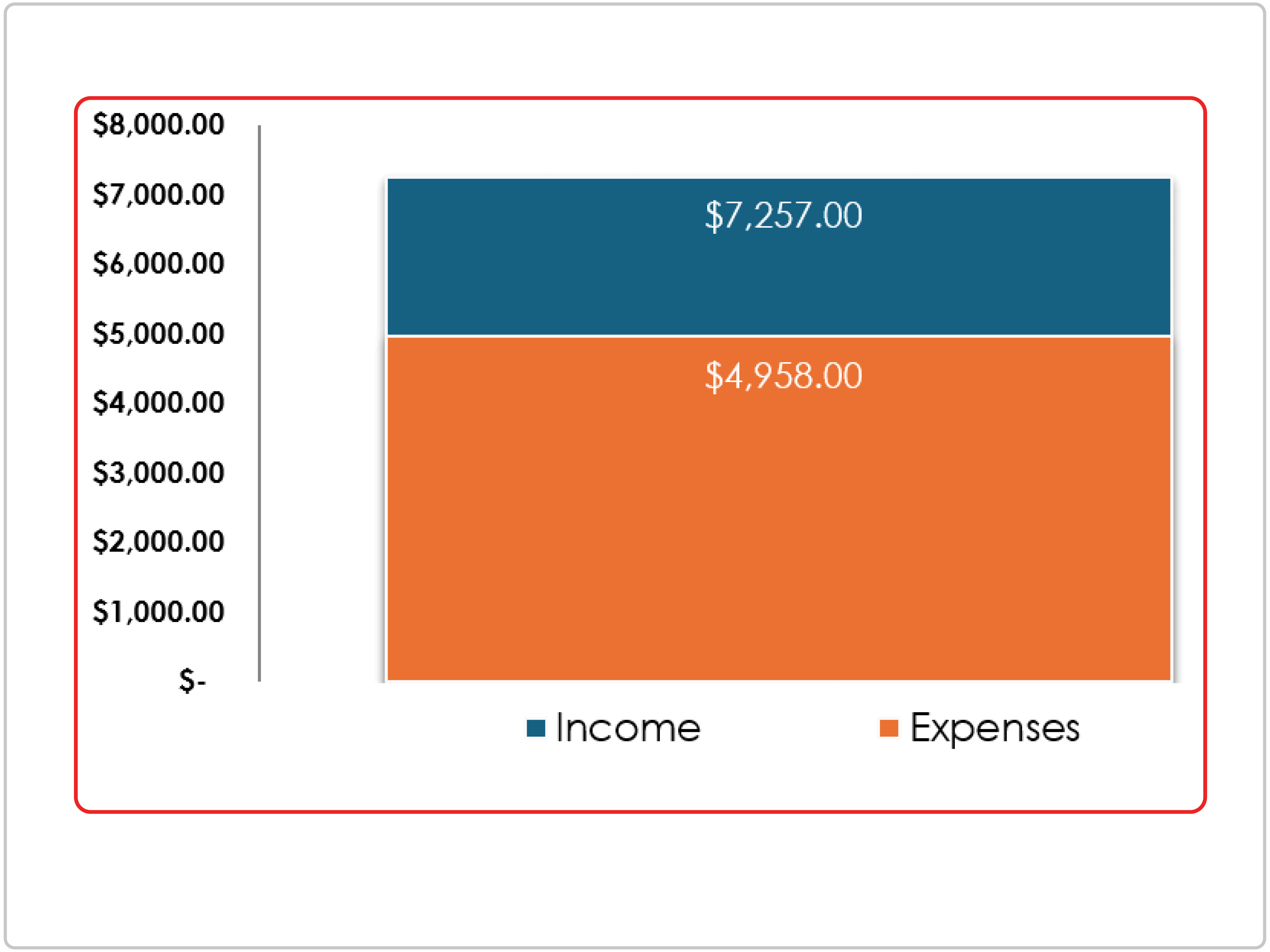

The bar chart provides a quick look at the difference between your total income and expenses.

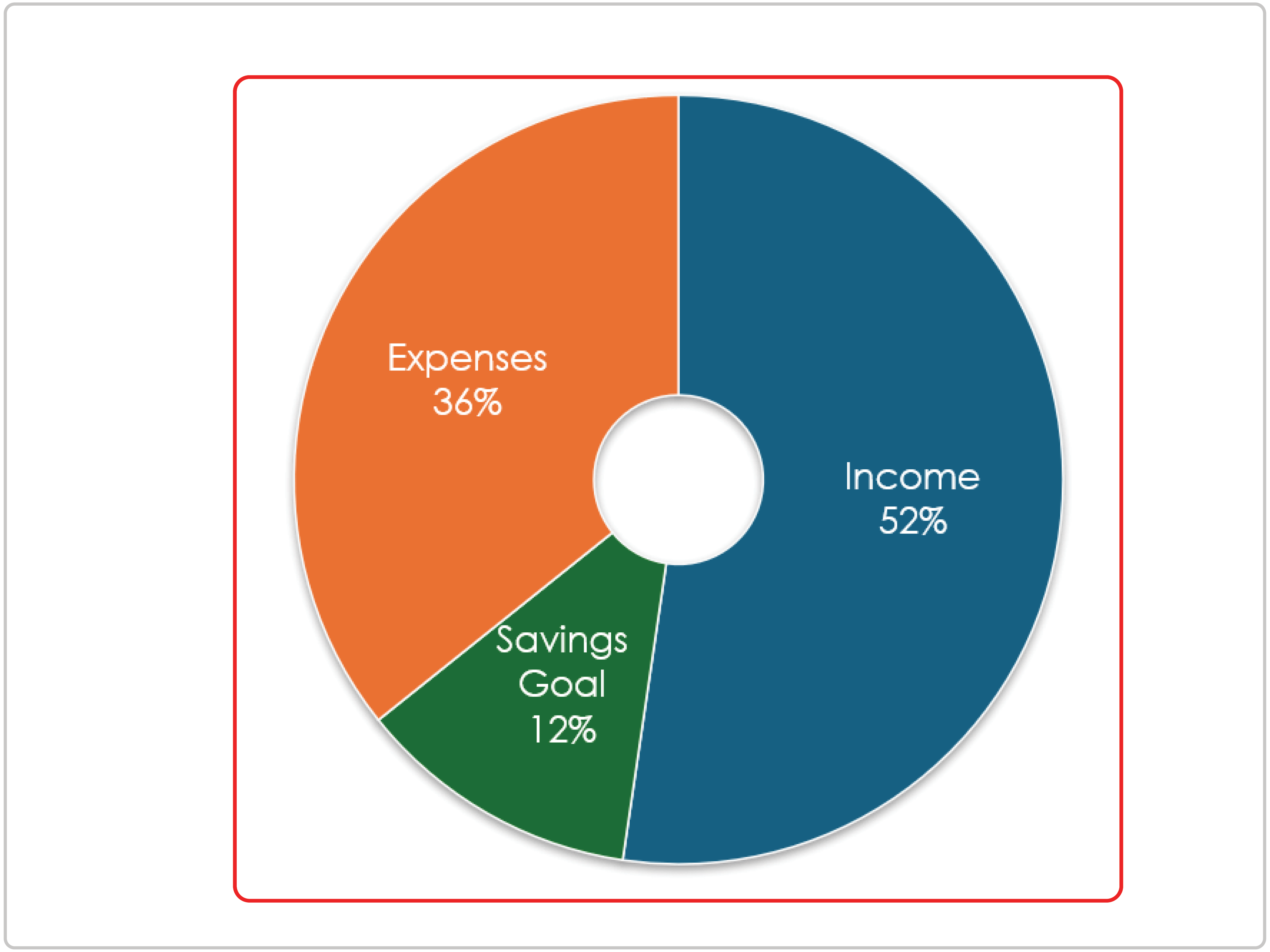

The pie chart provides a visual breakdown of your budget. It shows the percentage that goes to income, savings, and expenses.

What to Include in a Budget Planner

You should include details about income, expenses, savings, and financial goals in a budget planner. Whether you're on a monthly or weekly schedule, a good planner provides clarity on where your money is going and how to manage it effectively.

Here is a closer look at what to include in a budget planner:

- Total Income: List all sources of income, including salary, freelance work, government benefits, etc., to establish how much money you have to work with.

- Fixed Expenses: Include recurring costs that stay the same each month, such as rent or mortgage, car payments, insurance premiums, and subscriptions.

- Variable Expenses: Track spending that fluctuates, such as groceries, utilities, transportation, and entertainment.

- Savings Goals: Designate specific amounts for short- or long-term savings, such as emergency funds, retirement accounts, vacations, or large purchases.

- Debt Payments: Record your monthly debt obligations — including credit cards, student loans, or personal loans — to monitor progress and avoid missed payments.

- Spending Categories: Organize your expenses into clear groups (e.g., housing, transportation, food, personal care) to make the budget easier to manage and analyze.

- Planned vs. Actual Amounts: Track what you expect to spend versus what you actually spend to spot trends, identify problem areas, and adjust future budgets.

- Balance or Leftover Funds: Calculate what’s left after subtracting expenses and savings from your income to help you plan for extra savings, investments, or discretionary spending.

What Is the Best Way to Visualize Income and Expenses?

The best way to visualize income and expenses depends on what insights you’re seeking. A pie chart breaks down your expenses by category, a bar chart compares monthly income and spending side-by-side, and a line graph tracks changes in income or expenses over time to identify trends or fluctuations.

Here are a few examples:

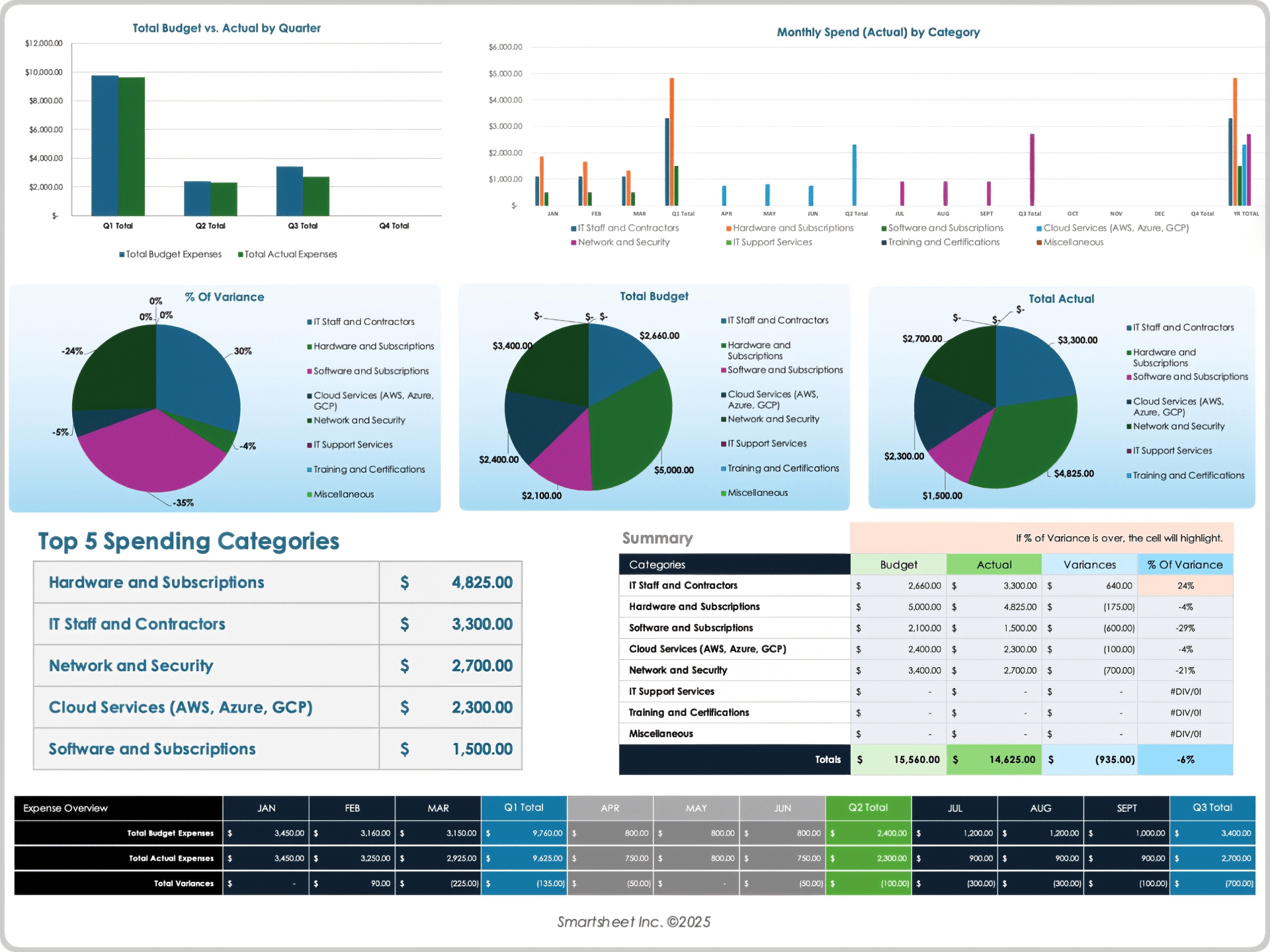

Our IT expense tracking template uses various charts to show monthly and quarterly spending, and budgeted versus actual expenses by category.

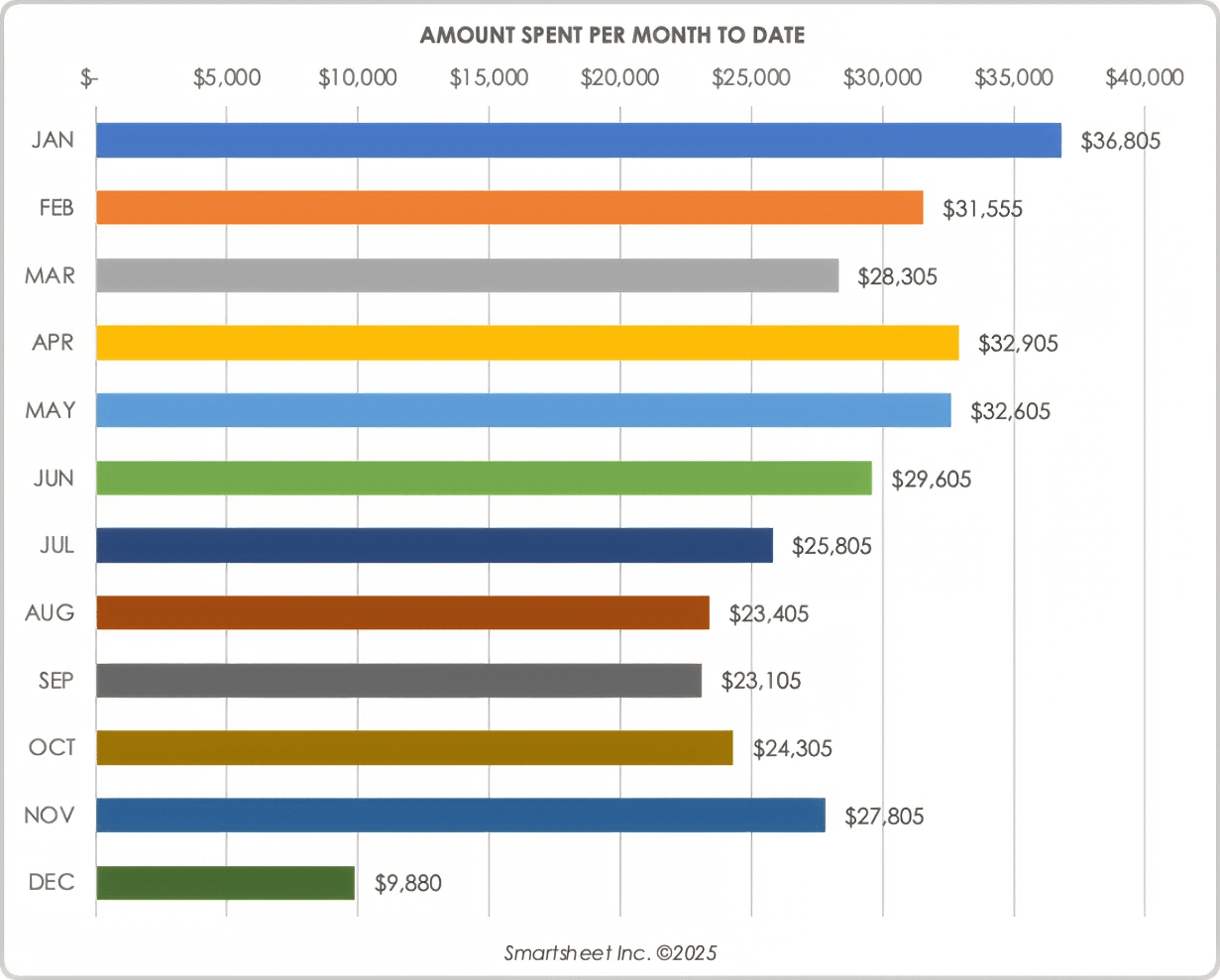

The social media marketing budget template includes a chart for total spending per month.

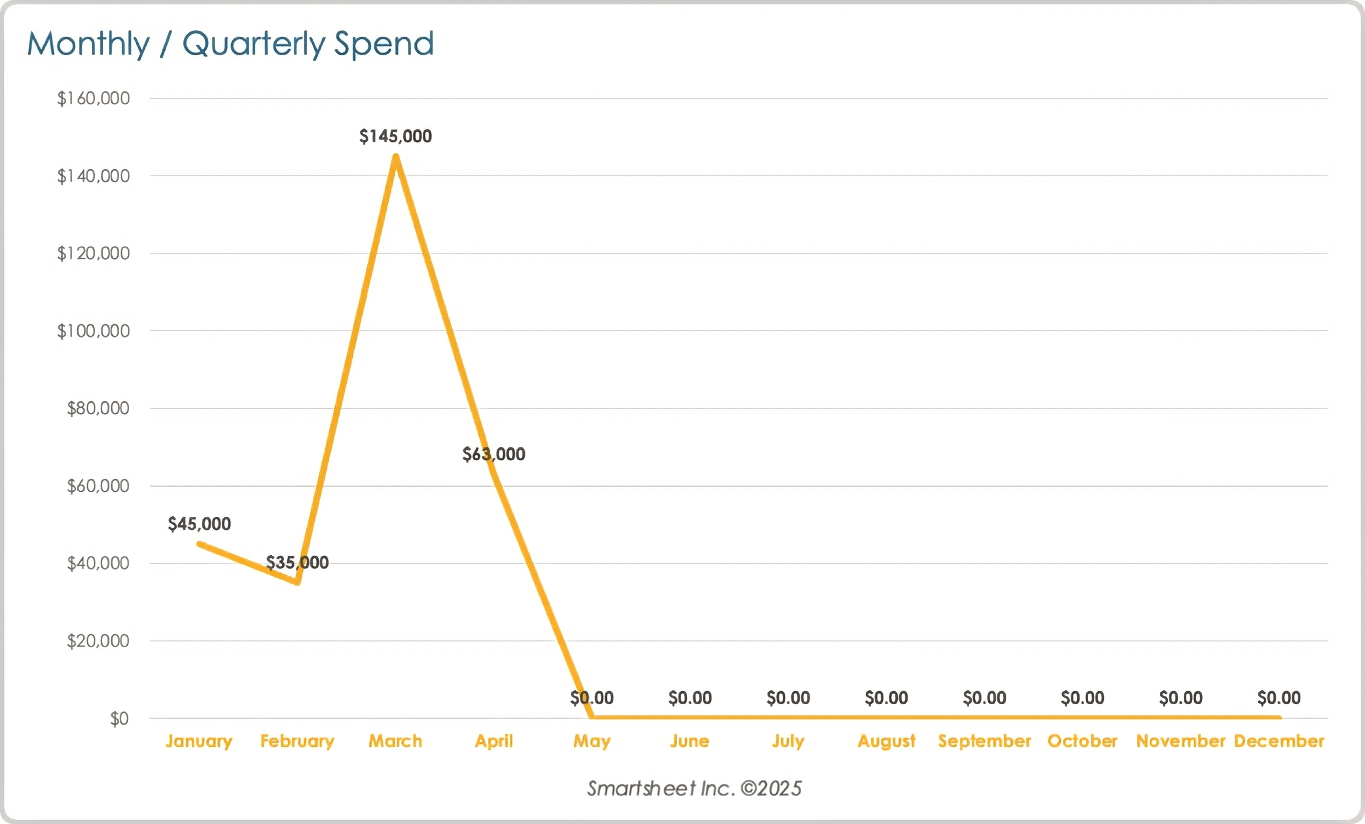

A financial line graph works well for tracking changes or showing future projections.

Upgrade Budget Tracking With Automation and Real-Time Visibility in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.