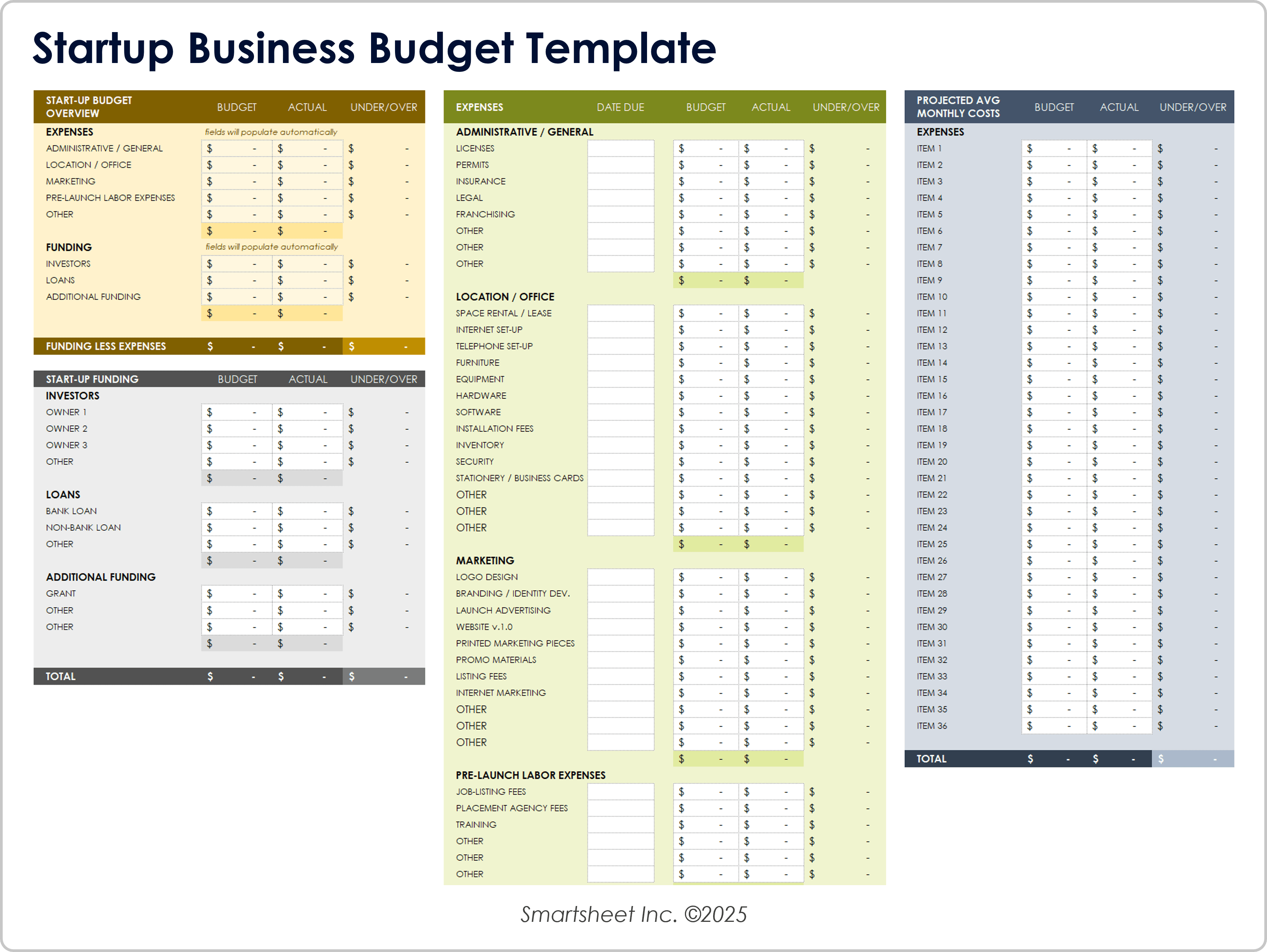

Startup Business Budget Template

Download a Startup Business Budget Template for

Excel | PDF | Google Sheet

When to Use This Template: Use this startup business budget template to estimate funding needs, track early-stage expenses, and monitor actuals against budgeted figures. It’s a great tool for entrepreneurs who want a comprehensive view of startup capital, overhead costs, and monthly burn rate.

Notable Template Features: The template includes pre-built sections where you can organize investor contributions, loans, and additional funding alongside detailed line items for administrative, marketing, labor, and office costs. It also features separate tabs for budget versus actuals and a column for under/over variances, which makes it easy to track discrepancies and stay on top of your runway.

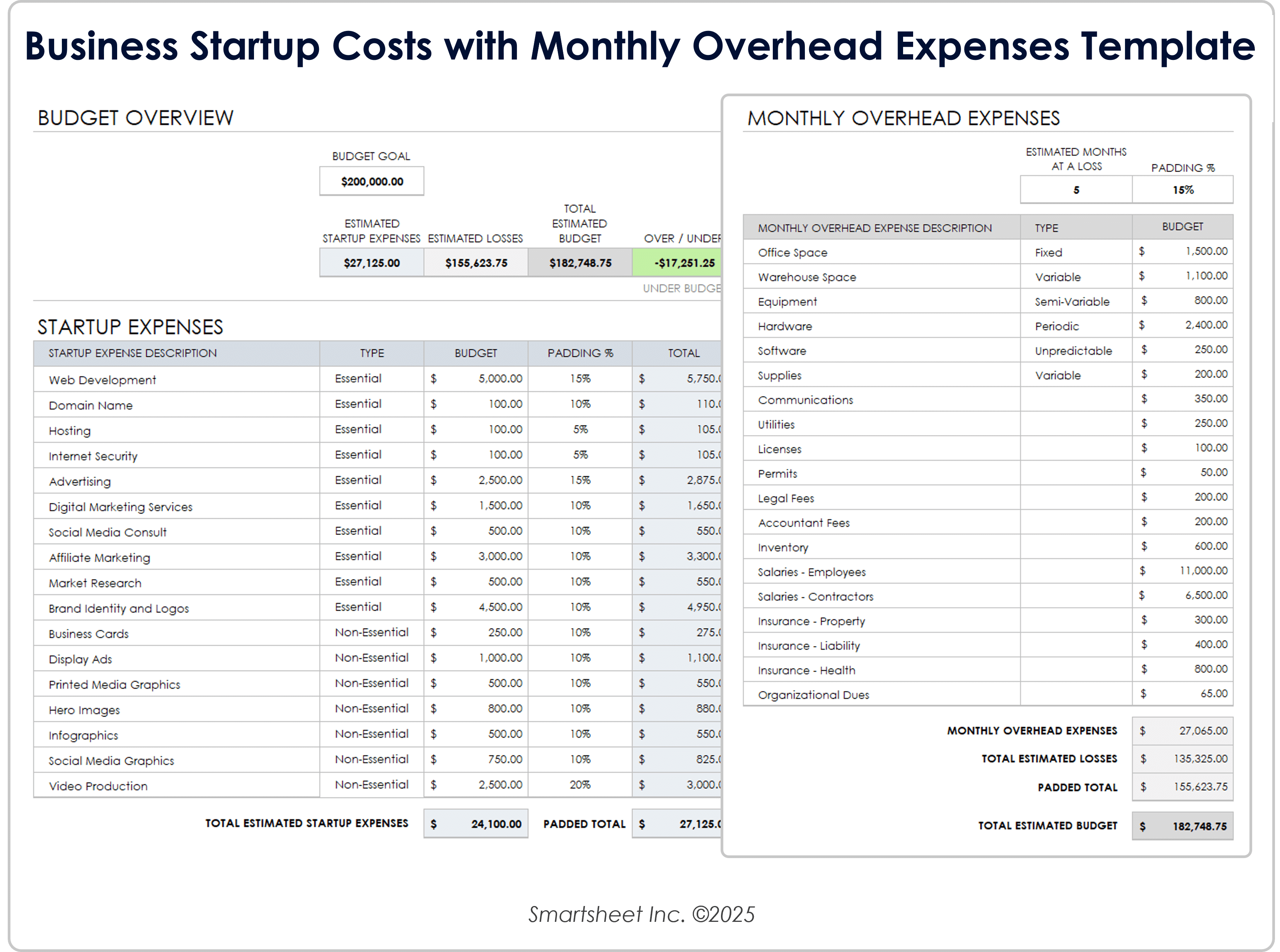

Business Startup Costs with Monthly Overhead Expenses Template

Download a Business Startup Costs With Monthly Overhead Expenses Template for

When to Use This Template: Use this startup budgeting template to estimate launch expenses and project monthly overhead in one centralized view. It’s especially useful for founders who want to identify fixed, variable, and padded costs to evaluate total budget needs against funding goals.

Notable Template Features: The template features side-by-side sections for you to itemize essential and non-essential startup costs with custom padding percentages. It also includes monthly overhead categories, such as office space, payroll, insurance, and utilities. Built-in summary calculations show total budget versus goal and highlight whether you're under or over budget.

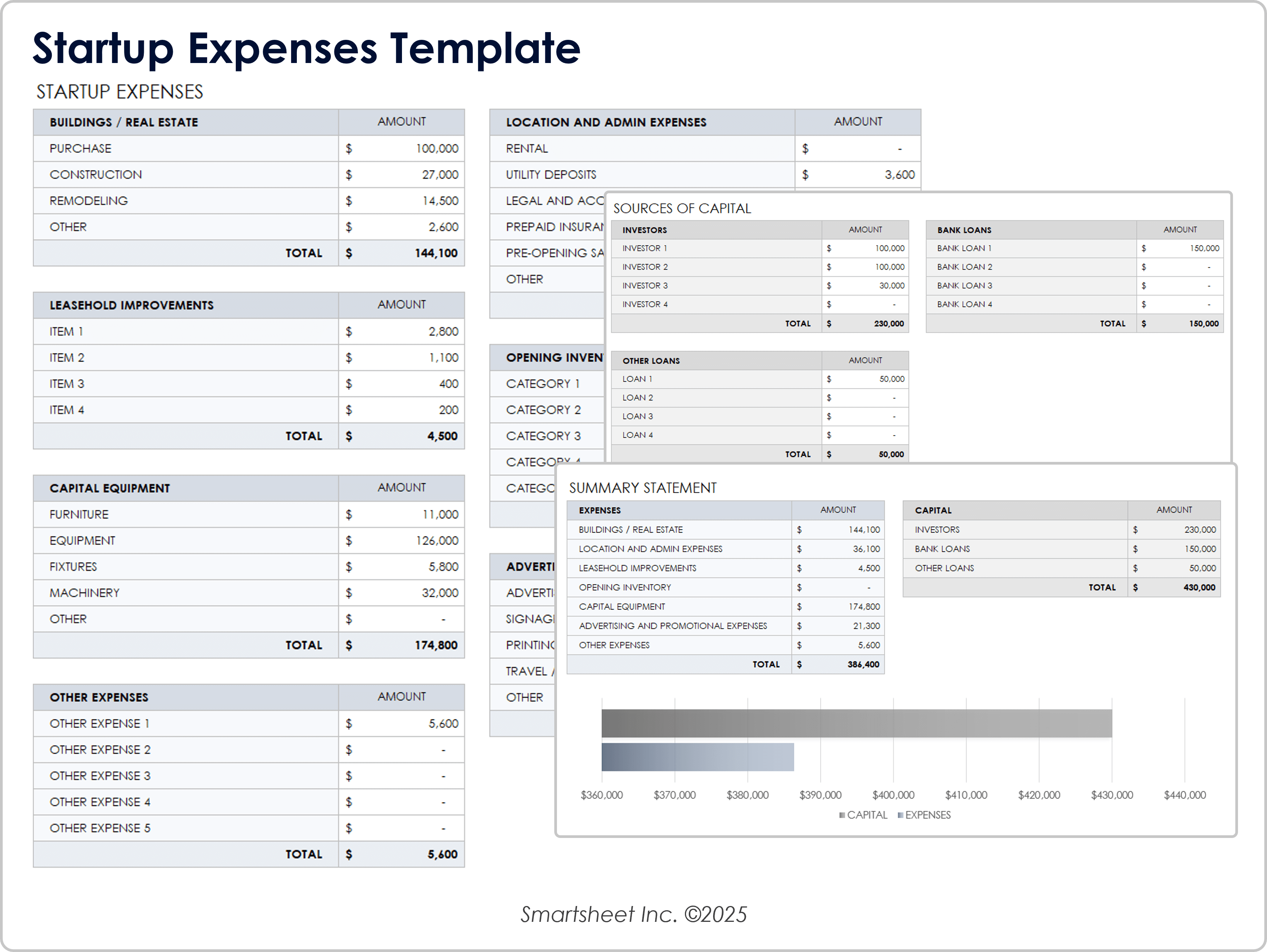

Startup Expenses Template

Download a Startup Expenses Template for

When to Use This Template: This startup expenses template estimates capital needs, itemizes initial costs, and prepares for investor or lender discussions. It’s especially helpful for new businesses that need to calculate total startup funding and project fixed asset investments.

Notable Template Features: The template includes dedicated sections for real estate, leasehold improvements, equipment, inventory, and marketing expenses for a full breakdown of startup costs. Additionally, the built-in summary dashboard shows total capital versus expenses, and the loan collateral section supports bank loan proposals, with space to list secured assets and guarantors.

View this collection of free startup financial templates for even more accounting tools.

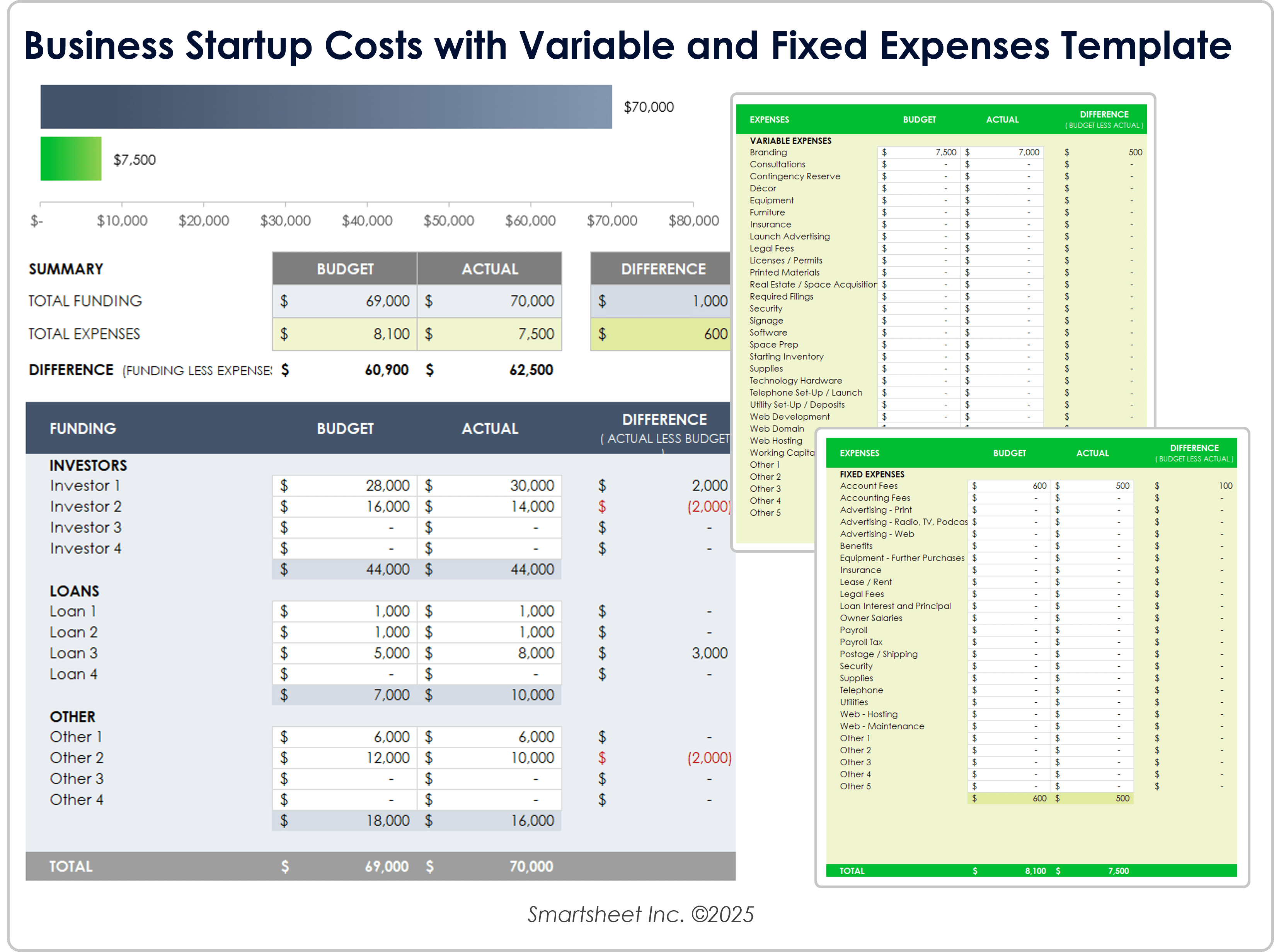

Business Startup Costs with Variable and Fixed Expenses Template

Download a Business Startup Costs With Variable and Fixed Expenses Template for

When to Use This Template: Use this startup cost template to track both fixed and variable expenses alongside multiple funding sources. It’s ideal for new businesses that want to monitor actuals against budget and maintain a clear view of available funds.

Notable Template Features: Use the side-by-side Budget versus Actual fields to view differences in funding and spending across investors, loans, and expense categories. The template also includes a built-in summary section that highlights your total funding, actual expenses, and remaining cash, while the categorized variable expenses area supports granular planning and variance tracking.

This collection of operating budget templates will help you set future expenses.

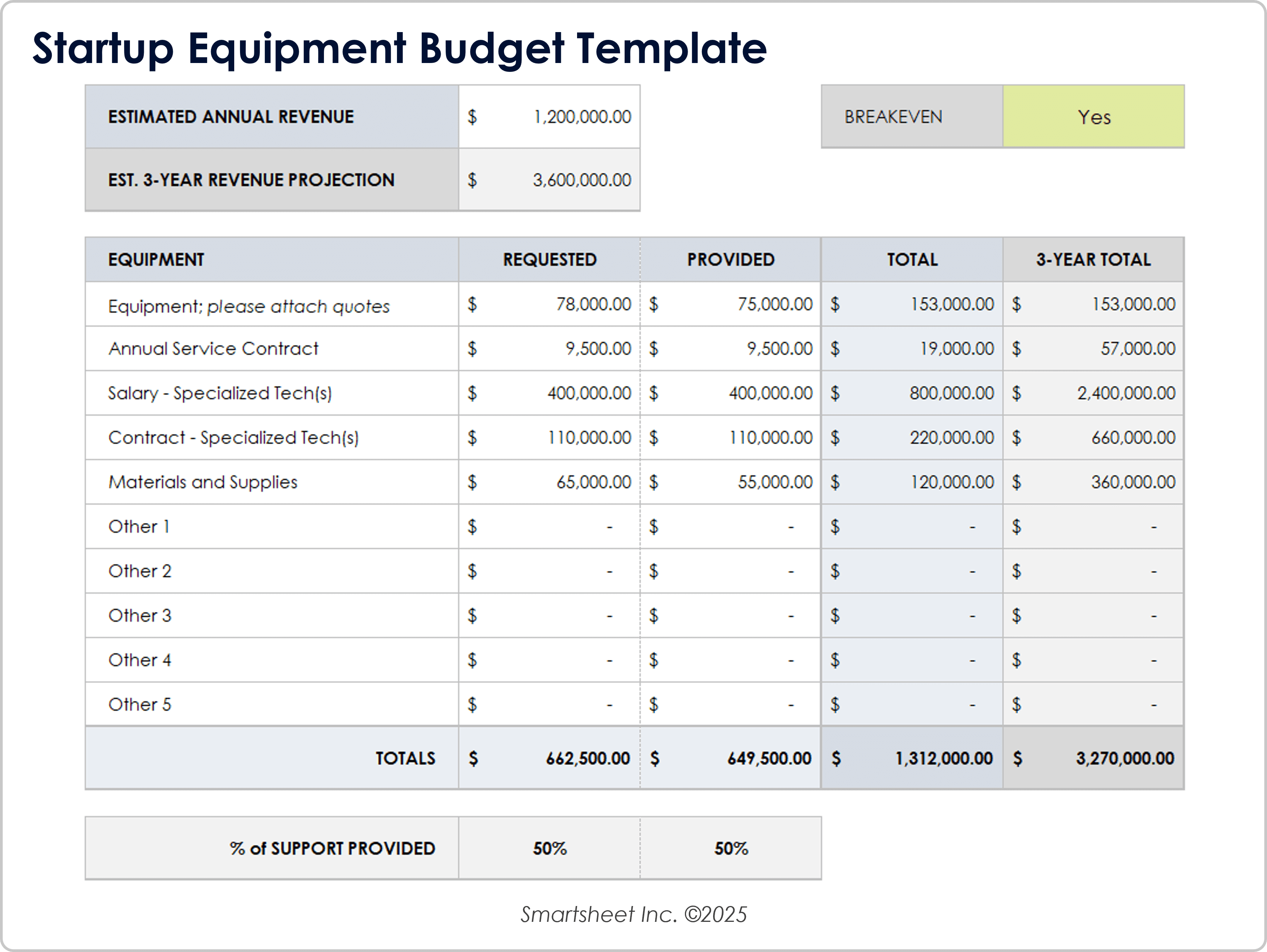

Startup Equipment Budget Template

Download a Startup Equipment Budget Template for

When to Use This Template: Startups that need to document hardware, staffing, and service contracts to reach breakeven can use this equipment budget template to forecast major capital expenses and align them with projected revenue.

Notable Template Features: The template includes pre-built columns for you to compare requested versus provided funding, total costs, and three-year projections across equipment, contracts, salaries, and supplies. Built-in breakeven logic and percent-of-support tracking help teams justify funding requests and evaluate long-term sustainability.

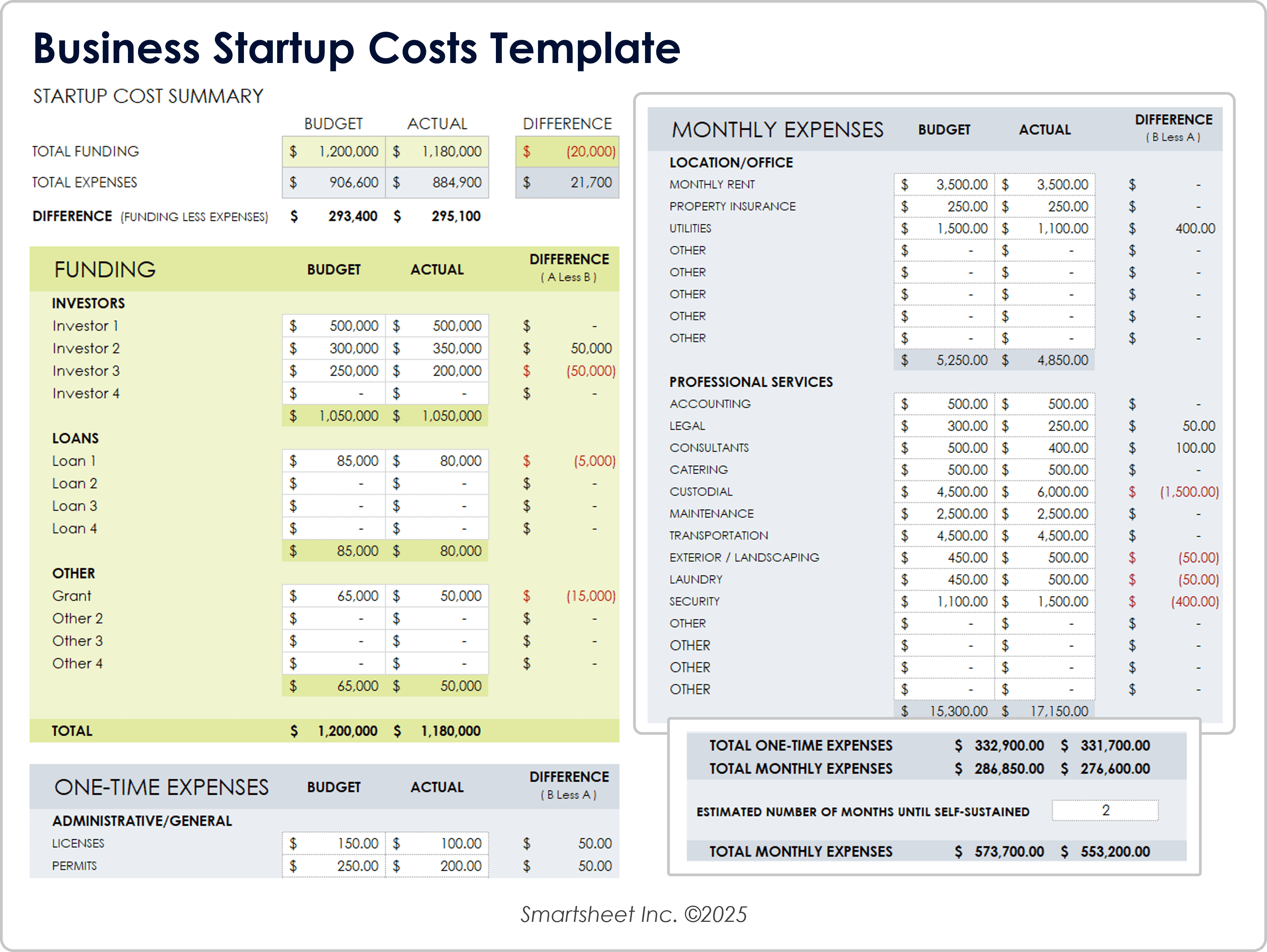

Business Startup Costs Template

Download a Business Startup Costs Template for

When to Use This Template: Estimate and track both one-time startup costs and recurring monthly business expenses with this startup costs template. It’s ideal for entrepreneurs who need to prepare investor-ready budgets or identify funding gaps before launch.

Notable Template Features: This template features separate sections that break down funding sources (investors, loans, grants), fixed administrative and setup costs, and ongoing monthly expenses, such as payroll, rent, and professional services. Built-in variance columns highlight budget versus actual differences across all cost categories for better financial visibility.

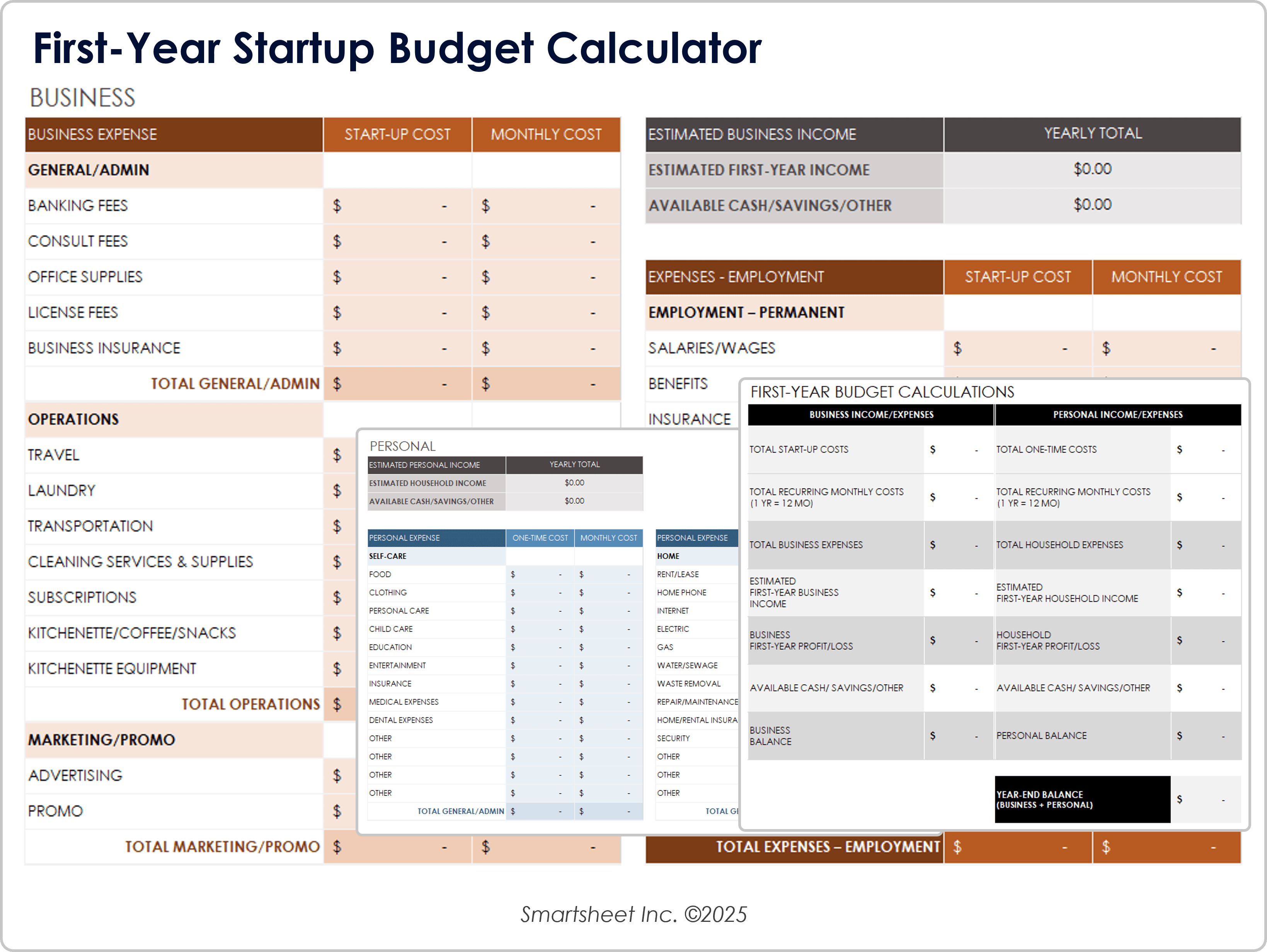

First-Year Startup Budget Calculator

Download a First-Year Startup Budget Calculator for

When to Use This Template: Plan and track both business and personal income and expenses with this template. It’s useful for founders who want to understand the full financial picture of their startup’s launch year, including personal impact.

Notable Template Features: The template includes side-by-side business and personal budget sections, with fields for startup costs, recurring monthly expenses, and income projections. Built-in calculations track profit/loss, available savings, and year-end balances, helping you evaluate startup viability and financial runway.

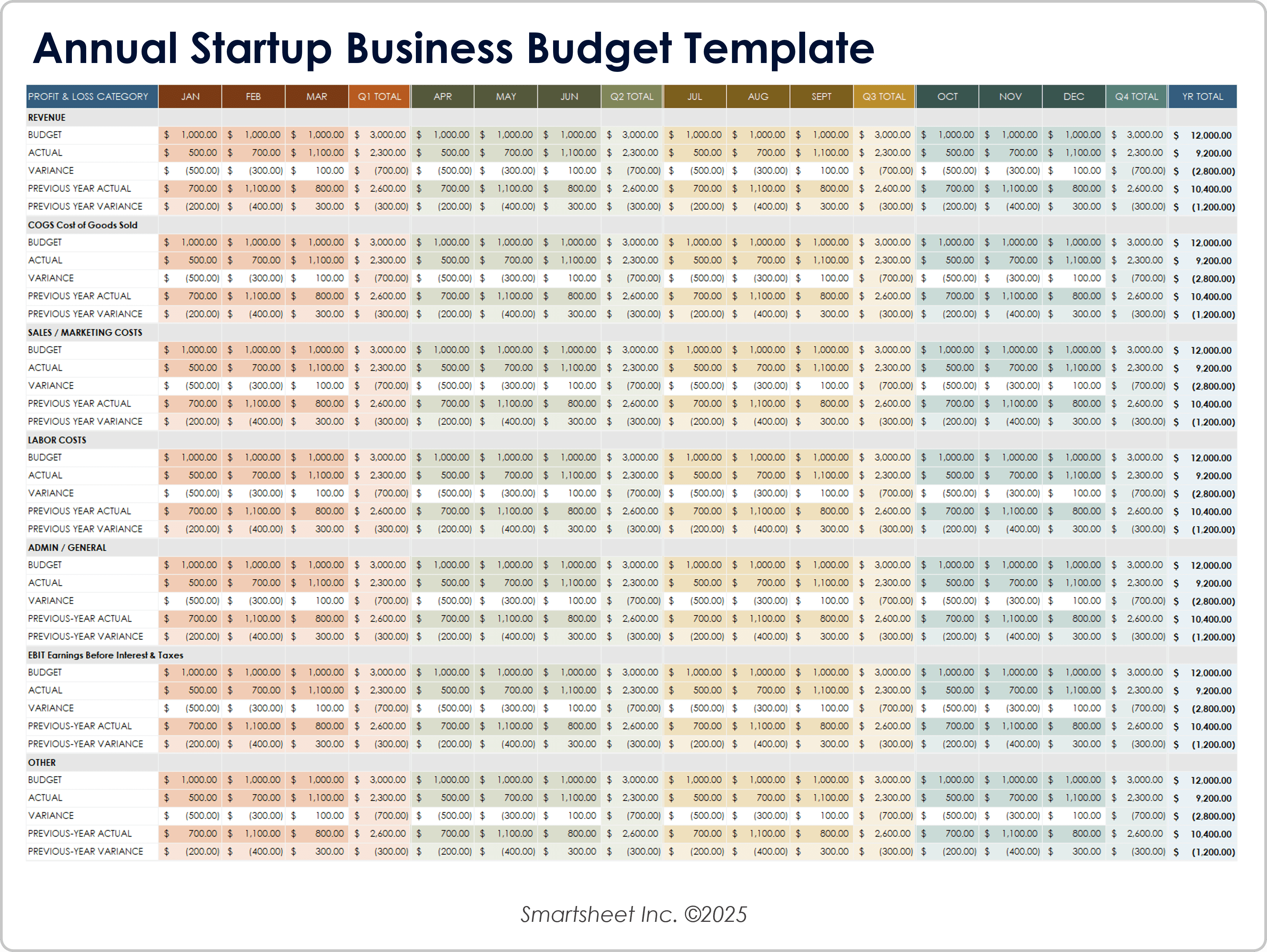

Annual Startup Business Budget Template

Download an Annual Startup Business Budget Template for

When to Use This Template: Entrepreneurs can use this template to monitor revenue, expenses, and profitability across all four quarters. It’s a great tool for tracking actual performance against projections throughout the year.

Notable Template Features: Monthly and quarterly breakdowns for income, cost of goods sold (COGS), labor, and admin expenses allow you to track variances in real time. Built-in fields for previous-year actuals and variances support year-over-year performance analysis, while calculated EBIT and cash flow figures offer a complete financial snapshot.

Check out this collection of small business budget templates for managing expenses and income as your company needs evolve.

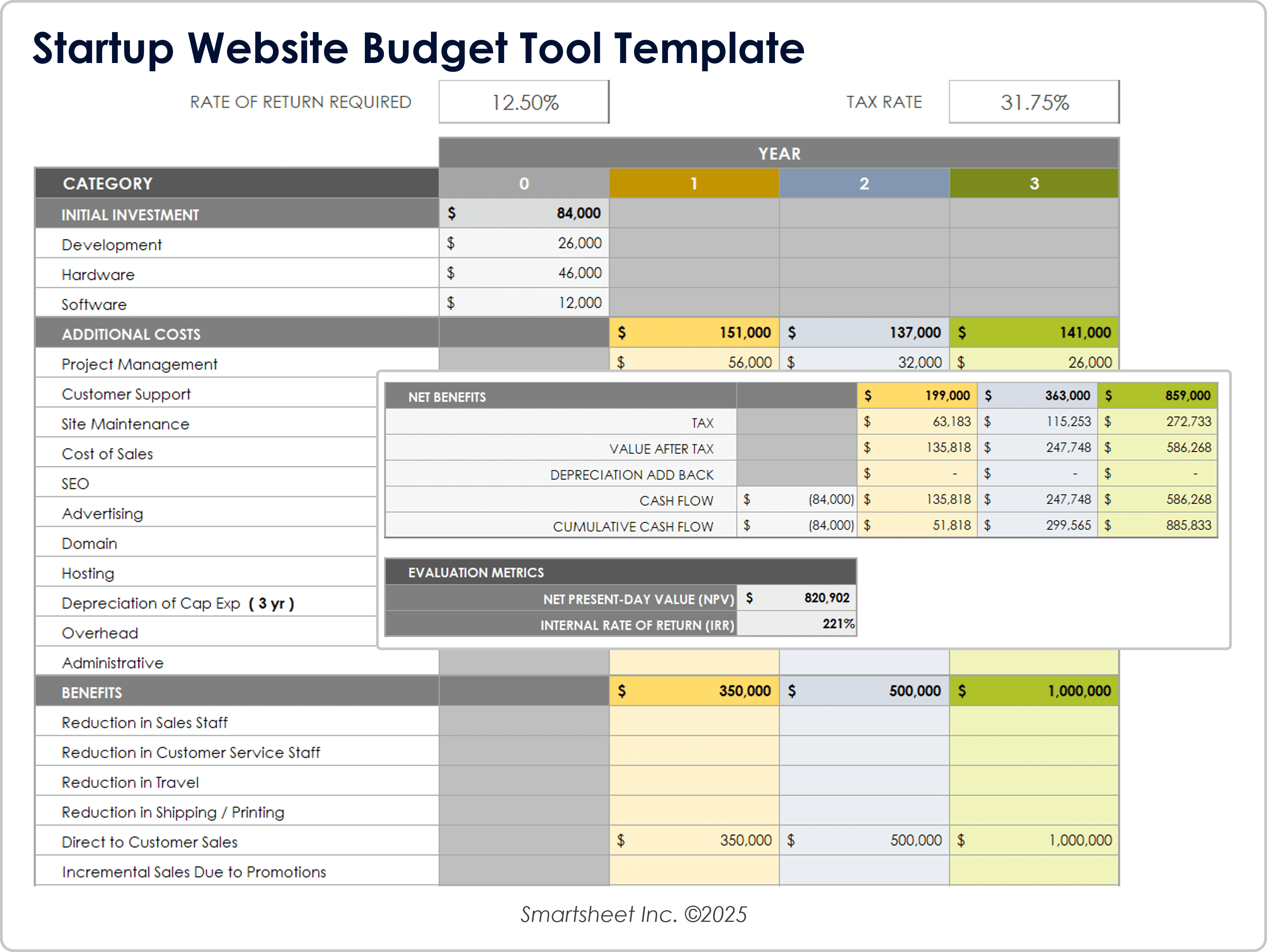

Startup Website Budget Tool Template

Download a Startup Website Budget Tool Template for

When to Use This Template: Use this tool to forecast investment returns, operational costs, and long-term financial benefits of launching a new web-based business. Startups that are building or scaling online platforms can use this tool to visualize a clear ROI view over a three-year period.

Notable Template Features: The template includes columns for initial investment, ongoing costs, and projected benefits, with built-in calculations for net cash flow, net present value (NPV), and internal rate of return (IRR). Pre-filled fields for development, hosting, advertising, customer support, and direct sales help model tax-adjusted profitability and cumulative cash flow.

Tips for Creating a Startup Budget Template

A strong startup budget template provides a framework to plan your business operations by comparing expenses with projected and actual revenue sources.

To account for your startup’s operational costs, compared to potential and actual revenue, you should include the following sections in a startup budget template:

- Budgeted and Actual Expenses: Enter budgeted and actual expenses to see if any line items are over or under budget.

- Budgeted and Actual Funding: Enter projected funding (revenue, investors, loans, etc.) and compare it to the actual funding amount for any given time period (monthly, quarterly, or annually).

- Broad Expenses Categories: Create expenditure categories to house other, smaller items (e.g., broad cost categories such as administrative, location, hardware, licenses, and marketing).

- Itemized Expenses: Enter budgeted and actual line-by-line items for each and every expense. For example, instead of merely entering a figure for “location,” include line-items such as rental cost, internet set-up, furniture costs, and security.

- Variable Costs: Include fluctuating expenses that might vary monthly or annually.

- Fixed Costs: Include costs you can confidently forecast due to their lack of variation.

- Startup Budget Overview: Review the autocalculated broad strokes of your budgeted versus actual expenses, as well as your funding less expenses.

- Startup Funding: List the total amount of your budgeted versus actual startup funding (investors, loans, additional funding, etc.) to ensure you have adequate funding.

A startup budget template can help expose your company’s expenditures with revenue ( — and other income sources, such as investments) — to determine the cost of your operations compared to the resources you have to justify those operational expenses.

While annual startup budget templates provide you with annual insights into the fiscal health of your company’s budget, it’s also important to have shorter perspectives, such as monthly and quarterly, so that you aren’t surprised by unforeseen operational costs. Shorter-term startup budget templates enable you to accurately calculate your venture’s true budget and serve as a document for banks or other lenders to review, if you’re seeking a loan.

Better Manage Startup Budgets With Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.