Take Control with Business Budget Management Software

Managing budgets across departments, projects, and teams is complex. Smartsheet provides a centralized platform to plan, track, and control budgets in real time, so finance leaders and business teams can improve visibility, reduce risk, and make confident spending decisions.

Trusted by 85% of the Fortune 500, Smartsheet empowers 123K+ organizations to move faster, adapt confidently, and lead with intelligent work.

Why use Smartsheet to manage business budgets?

Smartsheet is business budget management software that helps teams plan budgets, track expenses, and monitor financial performance in real time. By centralizing budget data, automating updates, and providing visual dashboards, Smartsheet makes it easier to stay on budget and make data-driven decisions.

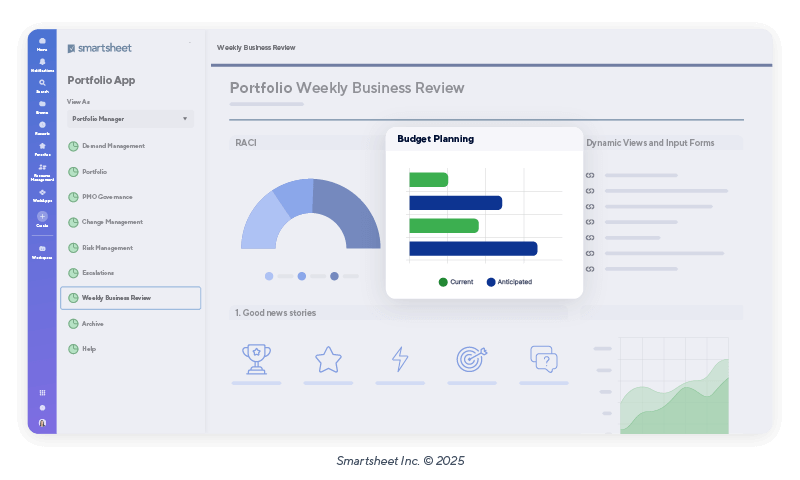

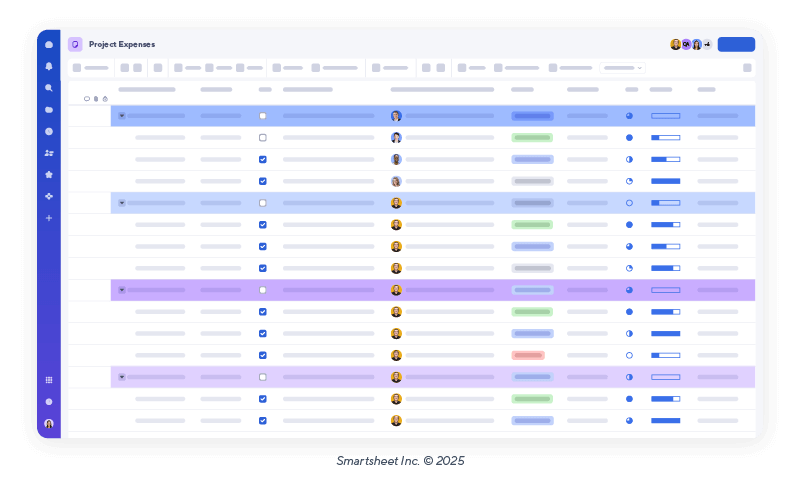

Stay on top of spending with real-time budget visibility

Get a single, shared view of spending across departments, projects, and teams.

- Track actuals vs. forecasts in real time to prevent overspend.

- Automate alerts and notifications when expenses approach budget limits.

- Connect data across systems and teams to eliminate manual consolidation.

Improve forecasting accuracy with live financial data

Make informed financial decisions faster with up-to-date numbers.

- Build rolling forecasts that adjust automatically as work changes.

- Model scenarios and what-if outcomes to plan for multiple possibilities.

- Spot trends and variances early using built-in reporting and dashboards.

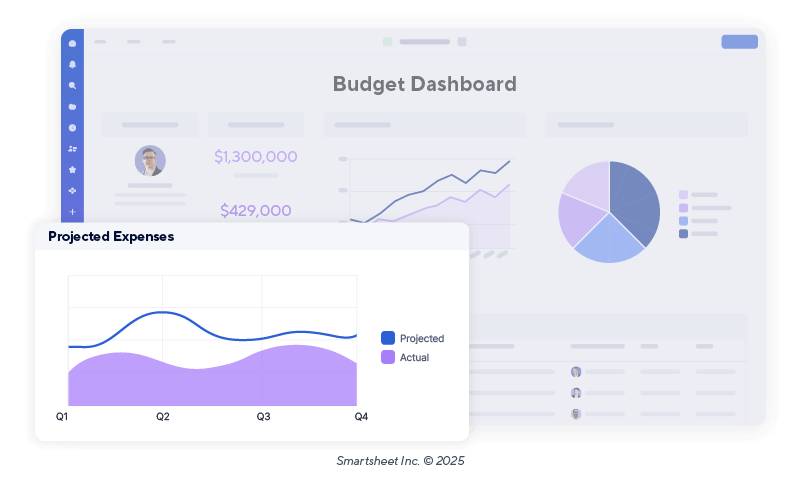

Increase accountability with shared budget visibility

Give teams, stakeholders, and leaders access to the same financial data.

- Create dashboards that highlight the metrics each audience needs to see.

- Share or export reports for leadership updates or board meetings in minutes.

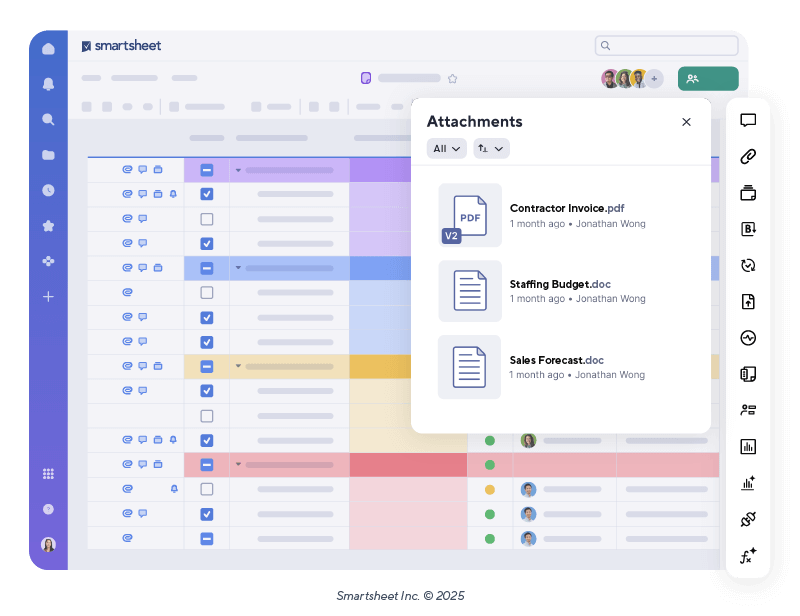

- Eliminate version control issues by managing budgets in one centralized platform.

Key features for managing business budgets in Smartsheet

Integrations

Smartsheet connects with the financial and budgeting tools and systems you already use.

Sync data with platforms like QuickBooks Online, Xero, or Workday. Streamline approvals with DocuSign, centralize file storage with Box or OneDrive, and keep teams aligned with Microsoft Teams and Slack integrations. Smartsheet bridges finance, operations, and leadership teams so budgets stay visible, accurate, and actionable.

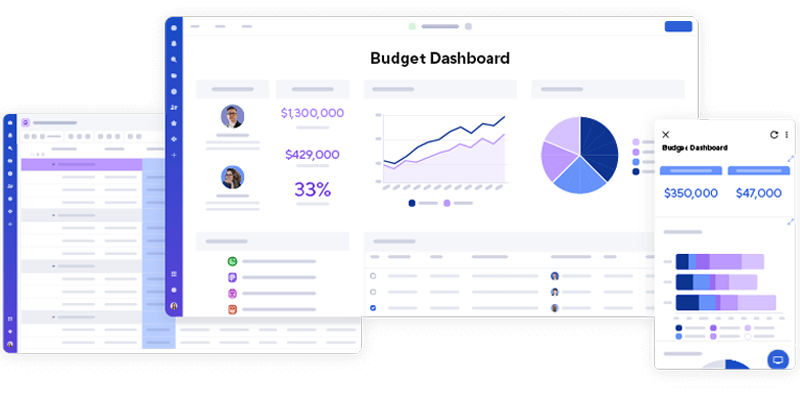

A platform built for smarter budget management

Discover how Smartsheet helps teams plan, track, and manage budgets with greater accuracy, visibility, and control.

Aruba uses Smartsheet to manage global budgets with precision and transparency

+/-1% Variance maintained across multiple budgets

Aruba, a Hewlett Packard Enterprise company, uses Smartsheet to manage complex global marketing budgets with precision and transparency. By centralizing budget data across 12 regional teams, Aruba gains real-time visibility into spend, strengthens collaboration, and confidently stays within a +/-1% variance goal. Smartsheet empowers Aruba to make data-driven decisions, improve forecasting accuracy, and maintain control over financial performance at scale.

Management for all types of business budgets

Smartsheet is business budget management software that helps teams plan, track, and report on budgets in one centralized workspace. Whether you manage operating costs, project budgets, or staffing plans, Smartsheet provides real-time visibility to support better forecasting and decision-making.

Pre-built template solutions

These multi-asset templates are designed to provide a complete workflow solution for managing tasks out of the box.

Budget management software FAQs

Business budgeting is important because it helps organizations control spending, allocate resources effectively, and plan for future growth. A clear budget provides visibility into cash flow and presents overspending. Without structured budgeting, companies risk financial inefficiency and missed opportunities.

Budget management in business is the process of planning, tracking, and controlling financial resources. It involves monitoring actual expenses against forecasts, adjusting allocations as needed, and ensuring accountability at every level. Modern business budget management software uses real-time data and automated reporting to streamline this process.

The best budgeting software depends on your organization’s size and needs. Tools like Smartsheet provide flexible, collaborative budgeting solutions that scale from small businesses to enterprises. Other options like QuickBooks Online may focus more narrowly on accounting. Look for software that offers real-time visibility, forecasting tools, and integrations with your existing systems.

The most effective budgeting method depends on your organization’s goals, cost structure, and operating model. Common approaches include zero-based budgeting, where every expense is justified from scratch each cycle; incremental budgeting, where budgets build on the previous period with adjustments; and rolling forecasts, where budgets are updated continuously to reflect real-time changes. Many companies gain both accountability and agility by combining zero-based budgeting for cost discipline with rolling forecasts for ongoing visibility and adjustment.

To create a budget spreadsheet, list income sources and expenses by category. Then track actuals against your planned budget. Excel or Google Sheets can work for basic budgeting, but they require manual updates and complex formulas. Budgeting software like Smartsheet automates this process, reducing errors and saving time.

Companies often use a mix of tools for budgeting, from spreadsheets to specialized platforms. Popular choices include Smartsheet, QuickBooks Online, Xero, Anaplan, and Workday. Collaborative platforms like Smartsheet are particularly effective because they combine familiar spreadsheet-style functionality with automation, dashboards, and real-time reporting.

Excel can be used for budgeting, but it is not purpose-built budgeting software. Excel works well for static spreadsheets and simple calculations, but it lacks automation, real-time collaboration, and integrations with financial systems. Smartsheet offers a similar, familiar spreadsheet-like interface, but adds real-time updates, automated alerts, shared dashboards, and connected data.