What Is a Project Budget?

A project budget is a detailed plan that outlines where and how much money will be spent on a project. It includes all estimated costs — such as labor, materials, equipment, and overhead — and helps teams allocate resources and track spending.

Creating a project budget is a lot like creating a personal budget: You’re tracking what you need and how much it will cost, as well as making sure you don’t overspend. Project budgets, however, involve more moving parts and can be harder to manage.

Another difference between personal budgeting and project budgeting is that project managers have to be careful to avoid underspending as well as overspending. While overspending risks project failure, underbudgeting can reduce future allocations, raise red flags with stakeholders (especially in the public sector), and signal poor forecasting or missed opportunities for higher-quality output.

How to Create a Project Budget

To create a project budget, start by listing all project tasks and identifying the resources needed for each. Estimate your labor, materials, equipment, and overhead costs, and add a contingency buffer to cover unexpected expenses. Use past data, team input, and planning tools to improve accuracy.

Here is a step-by-step guide to creating a project budget:

- Learn Your Organization’s Budgeting Standards

Before building a project budget, make sure you know your organization’s expectations. Larger companies often have established formats and categories that your budget needs to follow. You’ll want to know these upfront.

If you’re budgeting for a small business, you might not have formal corporate standards, but your budget still needs to be clear and align with how you actually track money. That might mean using a simple spreadsheet, such as one of these project budget templates.

- Define the Scope of Work

Clearly outline what is and isn’t in scope. This will help you identify the resources, tools, and services you’ll need to

deliver the project.

“Have some knowledge about what the project is all about — what it must have, what it must not, and what the project results are to be,” advises Olivier Wagner, Founder and CEO at 1040 Abroad.

Try one of these scope of work templates, and remember to get formal approval on your statement before you begin budgeting.

- Choose Your Budgeting Approach

Project managers use a mix of budgeting methods and cost-estimating techniques. Choose the one that makes the most sense for your project:

- Top-Down Budgeting: With top-down budgeting, leadership sets the overall budget, then distributes funds across teams or tasks based on organizational goals. Use this method when leadership has a fixed spending limit and wants to align the project with strategic priorities.

- Bottom-Up Budgeting: With bottom-up budgeting, project leaders estimate costs at the task level and add them up to determine a budget. Use this when accuracy is important, such as for large construction projects where material, labor, and equipment costs need to be estimated line by line.

- Zero-Based Budgeting: In zero-based budgeting, every new project budget starts at $0. Project leaders must justify all expenses and secure approval for them. Use this when controlling costs tightly. You can try this free zero-based project budget template for Excel to better understand how it works.

- Analogous Estimating: With this method, managers base their budget on historical data from similar projects. Use this when you have relevant past project data and need a quick estimate to get started.

- Parametric Estimating: Parametric estimating involves leaders using cost formulas to calculate budget estimates based on known cost rates. Use this when you have reliable unit costs. For example, if you know it costs $500 to produce one unit, and you plan to produce 100 units, then your estimated cost is $500 × 100 = $50,000.

- Three-Point Estimating: Three-point estimating involves creating a budget based on the average of the most optimistic, most pessimistic, and most likely cost scenarios. Use this for projects with a high degree of uncertainty, such as developing a new product.

Combine an estimating and budgeting method to improve accuracy. For example, use top-down budgeting to set overall limits, then apply bottom-up or parametric estimating within each phase to build detailed budgets.

Here’s what Chris Arndt, Founder and CEO of expandCFO, recommends: “Use zero-based budgeting for each new project so that you always start with a $0 budget and build it with only necessary project costs.” This way, each expense is evaluated and approved before being added to the budget.

The opposite, more common approach, Arndt says, is where “a certain percentage of overall revenue is just budgeted as the total cost, which is easier to do, but can lead to expense bloat for the project.”

- Break the Project Into Milestones and Tasks

Start by identifying key milestones, then list the tasks required to reach each one. Be as detailed as possible.

“I always use the ‘aim small, miss small’ phrase with my clients,” says Arndt. “This is meant to help them budget at a more detailed level for their projects. Sure, this takes more time to do upfront, but it usually results in a much more accurate budget at the end. Additionally, a more detailed budget results in more communication and planning at the beginning of a project, which can lead to a better overall project plan.”

Try one of these work breakdown structure (WBS) templates for help with this stage.

Estimate Resources Needed

Identify and categorize all potential expenses. This can be overwhelming, but accuracy is the ultimate goal of project budgeting, and identifying as many expenses as possible will help you stay on target.

“There are more hidden costs than you imagine,” says Abdur Rehman Arshad, a finance professional and CEO of Capidel Consulting. For example, he says, “if you're budgeting based on the required output, or service-related projects, know that productivity lags for new hires has to be a part of budgeting.”

Generally, project costs fall into three categories: direct, indirect, and miscellaneous costs. Here are examples of each type:Three Cost Types of Project Budgeting with Examples

Type of Cost Examples Direct:

One-time expenses tied to specific deliverables

- Hardware or equipment purchases

- One-time consultant or freelancer fees

- Printing and production costs

- Materials or supplies used for a single deliverable

- Travel costs tied to a client project

Indirect:

Ongoing or shared expenses that support the project

- Software subscriptions

- Office rent and utilities

- Salaries for full-time staff (not tied to one project)

- Office supplies (folders, printer paper, highlighters)

- IT support and maintenance

- Professional memberships or association fees

Miscellaneous:

Any other expenses

- Currency exchange fees on international payments

- Bank or transaction fees

- Client gifts or hospitality expenses

- Professional development courses that might benefit multiple projects

Remember to also factor in the cost of quality (CoQ), or the total cost of ensuring that a product or service meets quality standards. These costs can be direct, indirect, or miscellaneous and include any expenses related to prevention, appraisal, internal failure, or external failure.

Here is a list of examples:The Four Costs of Quality (CoQs) with Examples

Type Examples Prevention:

Costs to avoid defects before they happen- Employee training programs for quality awareness or safety

- Preventive maintenance of equipment

- Supplier quality audits

- Quality planning and process improvement initiatives (Lean, Six Sigma)

Appraisal:

Costs to verify quality- Employee training programs for quality awareness or safety

- Preventive maintenance of equipment

- Supplier quality audits

- Quality planning and process improvement initiatives (Lean, Six Sigma)

Internal Failure:

Costs of defects caught before reaching the customer- Scrap and wasted raw materials

- Rework labor to fix defective products

- Machine downtime due to process errors

- Re-inspection and retesting after rework

- Inventory write-offs for defective goods

External Failure:

Costs of defects that reach the customer- Customer returns and refunds

- Warranty claims and replacements

- Field service repairs or recalls

- Complaint handling and customer support

- Lost sales due to reputational damage

- Determine Resource Cost Rates

Once you’ve quantified the total resources required for the project, it’s time to assign a dollar value to each resource, making sure to use the same time unit across all rates. For example, are you calculating rates per hour, per day, or per month?

For employee labor, you’ll also have to adjust for overhead and benefits, such as health insurance, retirement contributions, and shared costs such as office space and equipment use. For equipment, you’ll calculate costs based on purchase price, rental fees, or depreciation.

Make sure to document all assumptions or issue requests for quotes (RFQs) or requests for proposals (RFP) where possible. “Some inputs require more validation than just assumptions,” warns Arshad. “Costs like rent and equipment vary a lot based on factors such as location and quality. A budget built on industry averages is risky; get vendor quotes for the exact item or service you plan to procure.”

- Calculate Total Costs

Multiply resource quantities by cost rates to get subtotals across categories. This is your informed estimate of what the total project cost will be.

- Add a Contingency Buffer

“Scope creep and unforeseen expenses can easily turn an excellent budget into a nightmare,” warns Wagner. “To tackle it, you should prepare a contingency budget that will enable you to cover any unexpected expenses.”

A typical contingency buffer is 5–15 percent of the total project budget. Add this to your total budget estimate.

Remember, you’re not padding the budget arbitrarily — you’re making a thoughtful allowance for things that are likely enough to happen but unpredictable in timing or scale. Be sure to conduct a thorough risk assessment as part of your contingency planning.

- Set a Budget Baseline

You track actual spending against the official budget baseline as the project moves forward. To create your baseline, start by verifying your budget estimate with historical data from similar past projects and consulting with experts. Gather as much feedback as possible to fill in gaps. “Make sure you are covering all costs by considering all departments,” suggests Arshad. Otherwise, he says, “licensing and approval may come as a surprise and may cause delays.”

Once your cost estimates are solid, secure the necessary approvals from leadership and stakeholders and lock in the numbers.

Now, you have a completed budget. It will likely change as the project progresses, so you’ll have to manage the budget actively throughout the project lifecycle.

Example of How to Make a Project Budget With a Template

To build a project budget using a template, open the simple project budget template in Smartsheet. Share it with team members, assign permissions, and add your project title, phases, and tasks. Enter budgeted and actual costs for each task to track variance.

Here is an example of how to make a project budget with a template:

- Open the Simple Project Budget Template in Smartsheet

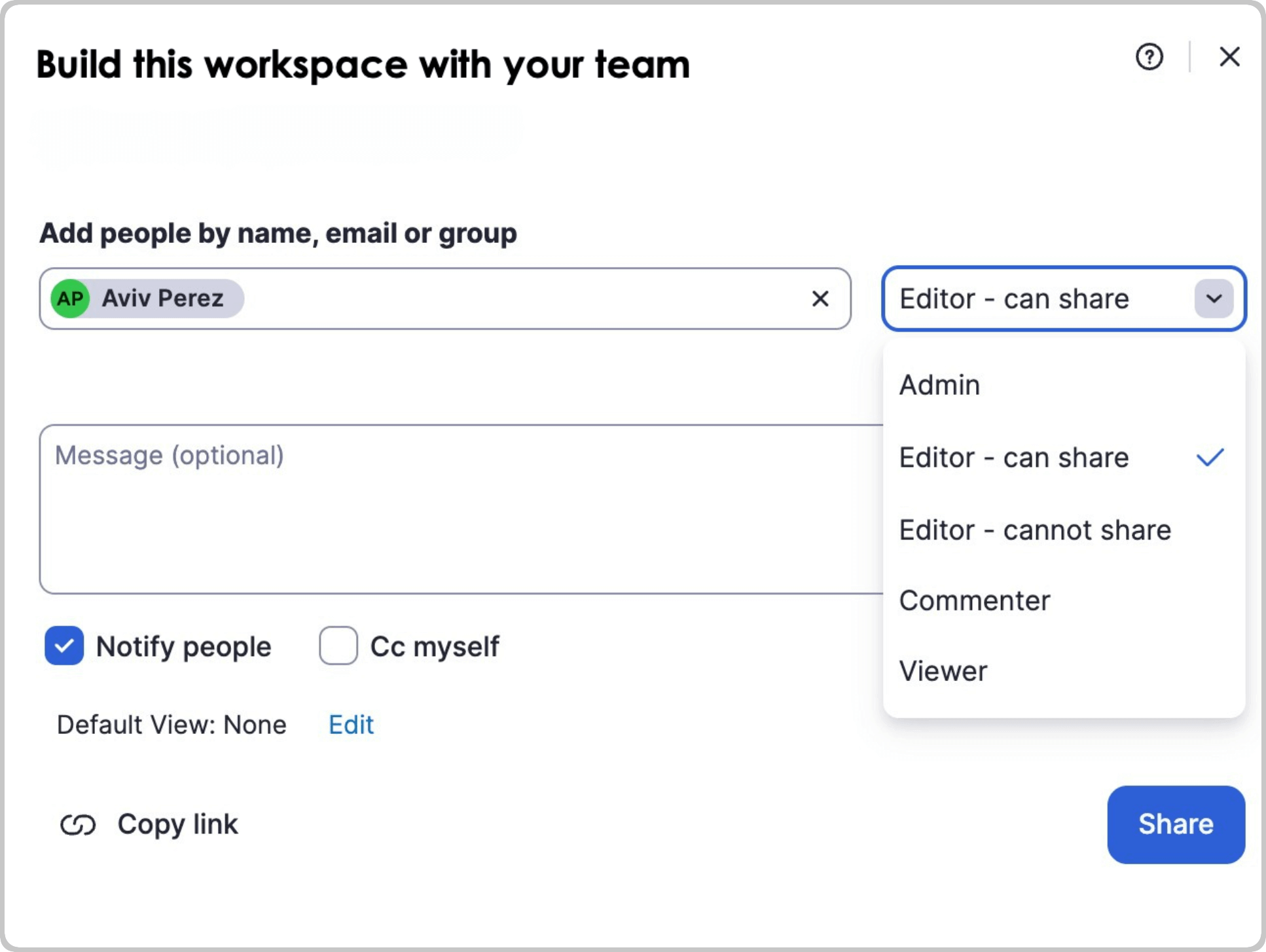

- Share With Team Members

A pop-up will appear and enable you to invite people and groups, customize an invitation message, and assign permissions.

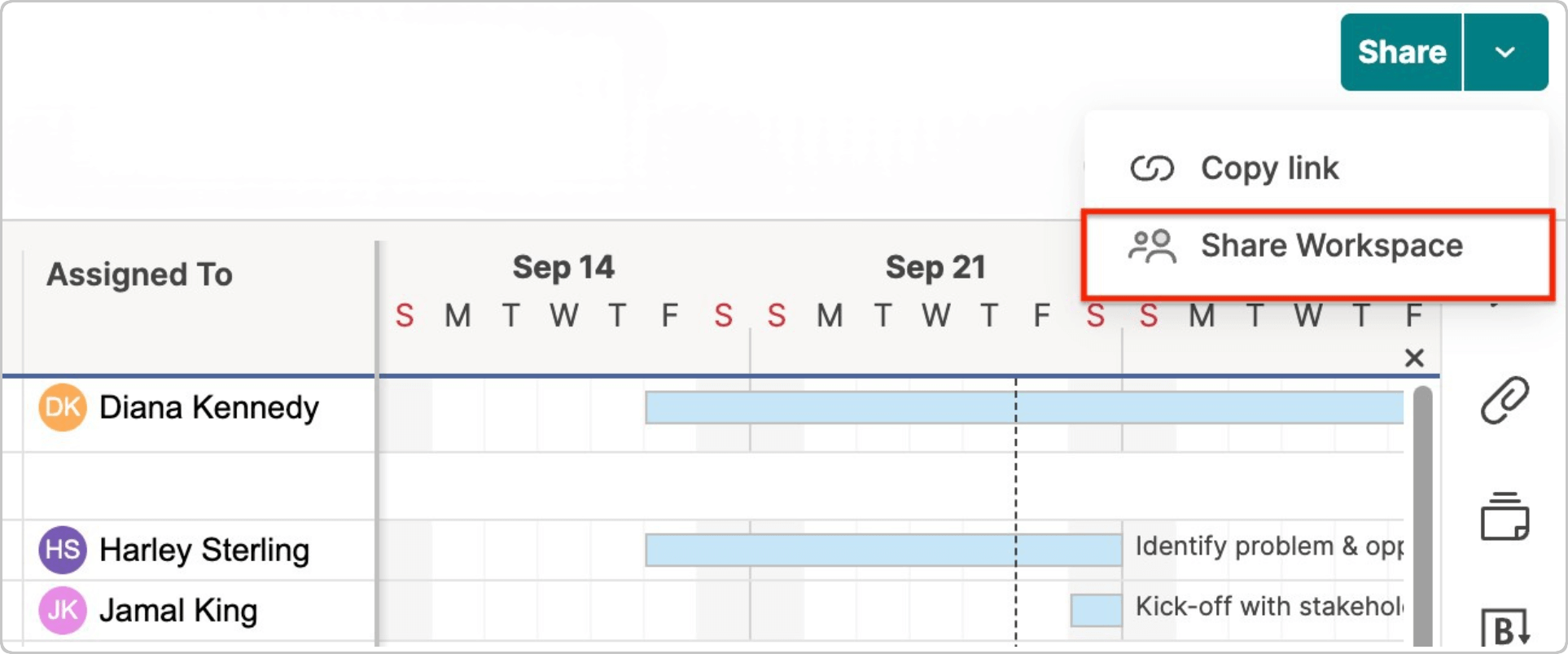

If you’re not ready to share yet, simply close the pop-up. You can always click Share later and choose whether to share the entire workspace or a single sheet.

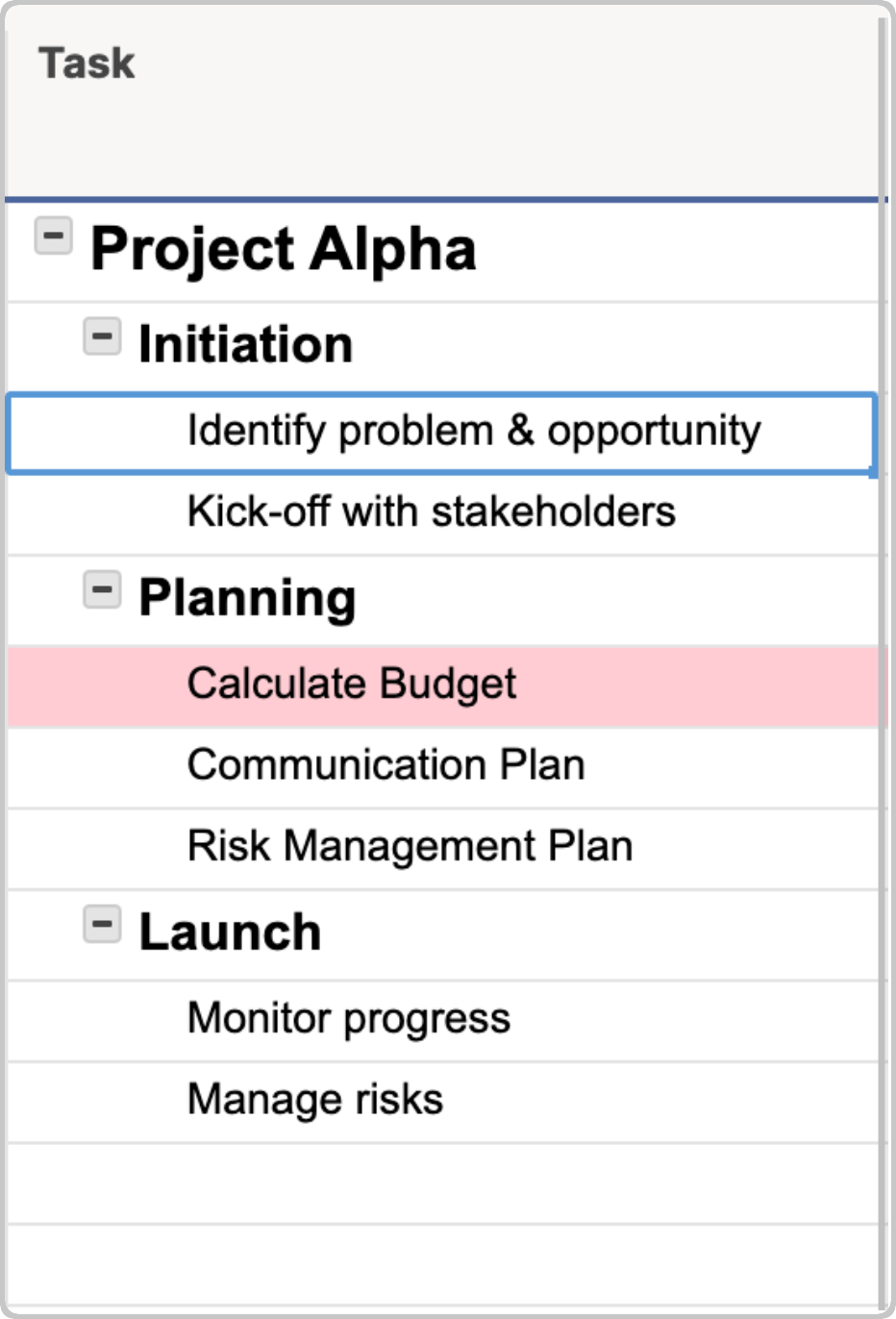

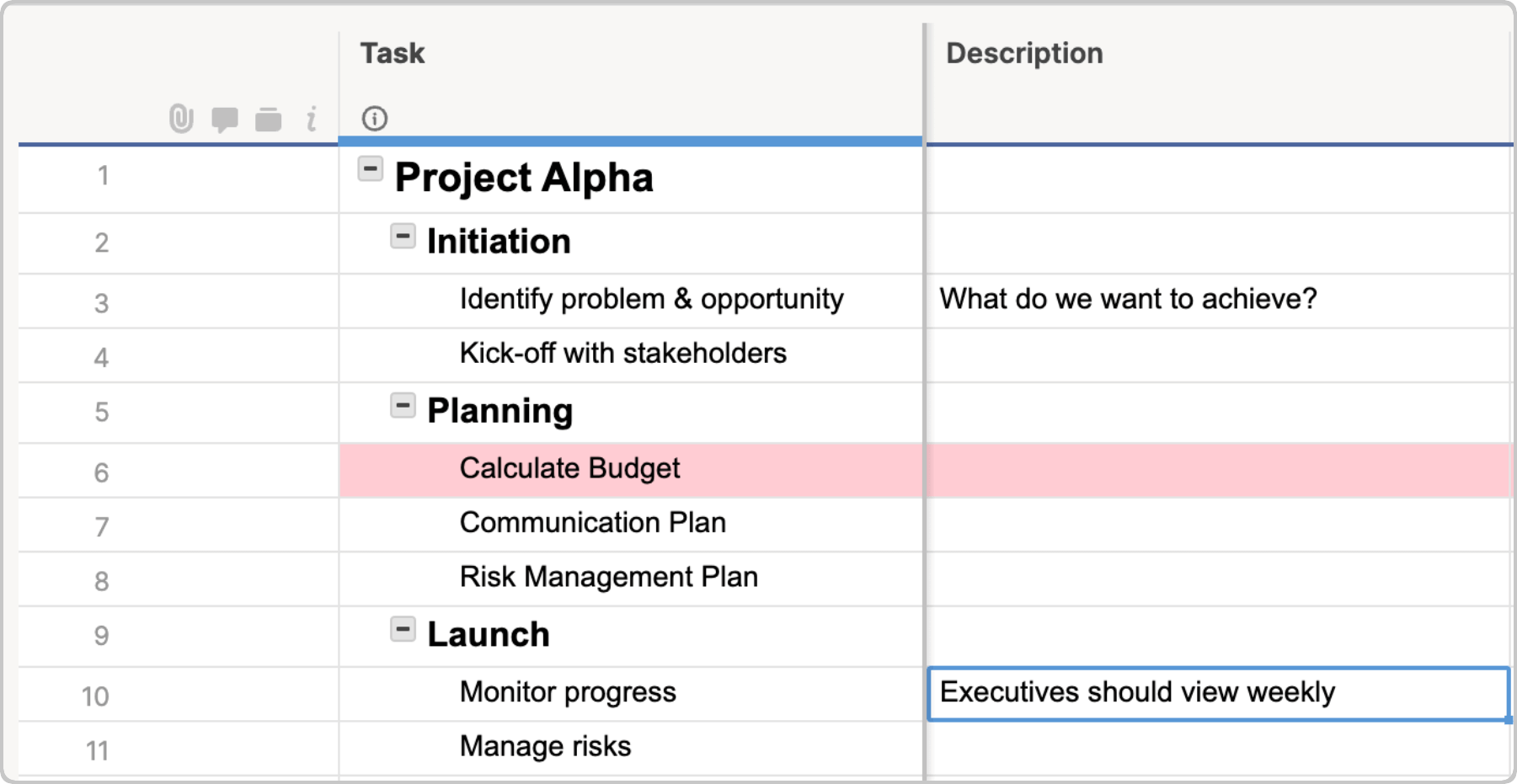

- Add Project Title, Phases, and Tasks

In the Tasks column, replace the example project title, phases, and tasks with your own. Simply click on the cell you want to update and enter your own project data.

Use the Description column for any clarifying notes or instructions.

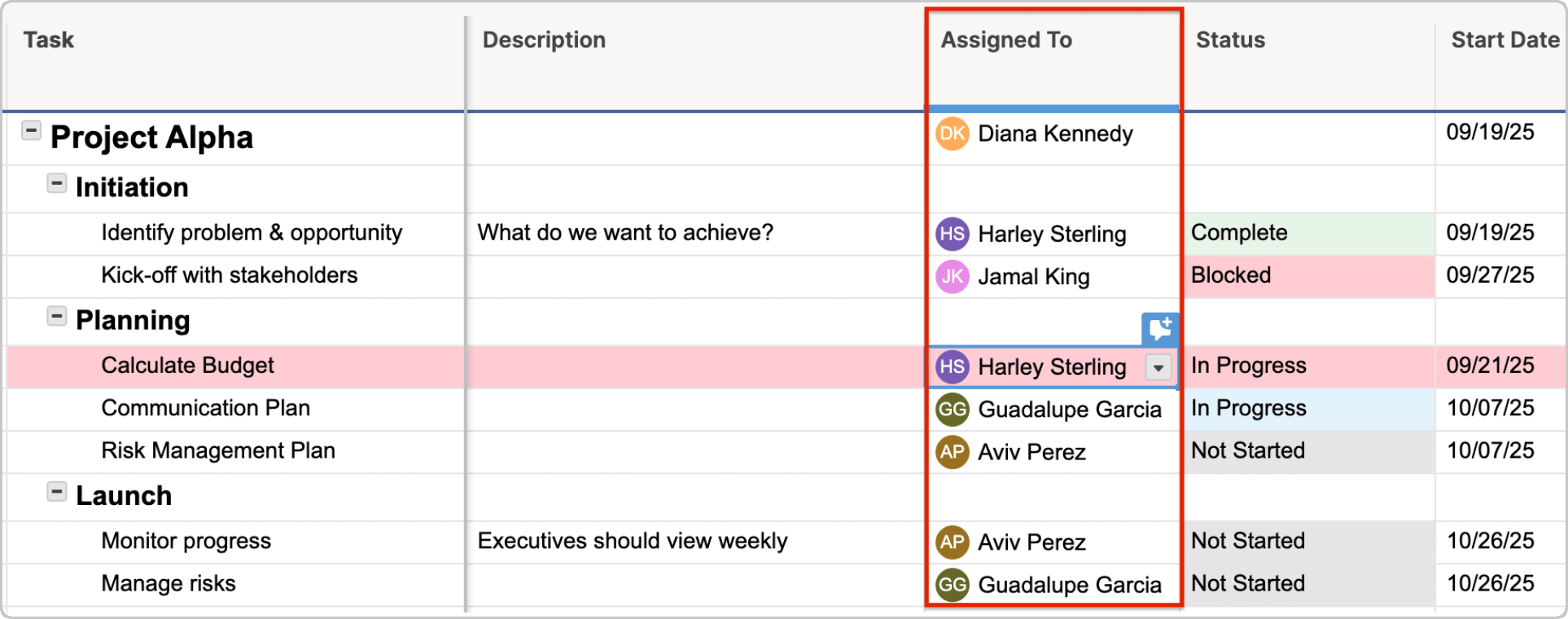

- Assign Tasks

In the Assigned To column, click the drop-down carrot to select from your contact list, or begin typing in a team member’s name to search through your contacts.

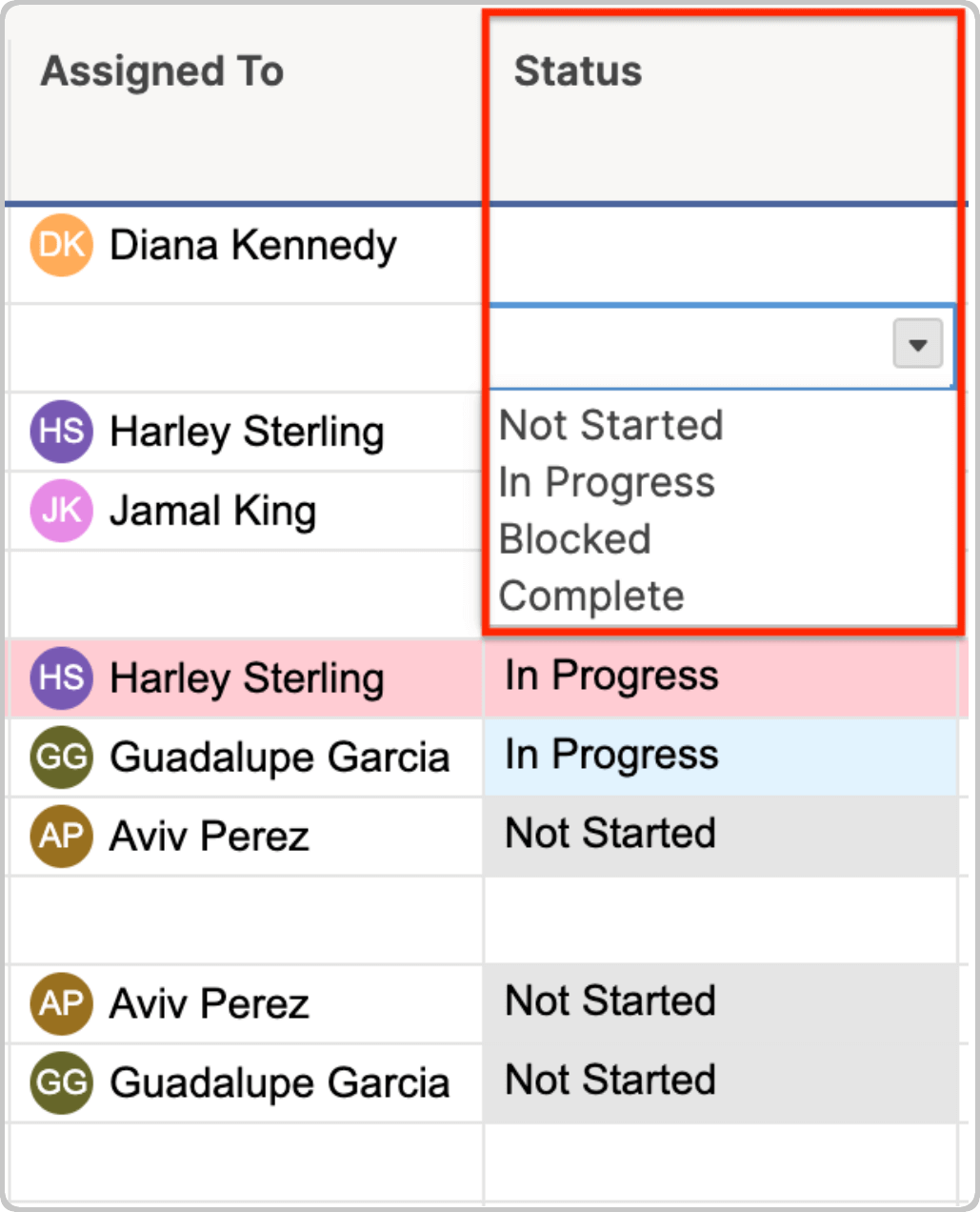

- Assign Task Statuses

In the Status column, select a status from the drop-down menu: Not Started, In Progress, Blocked, or Complete.

The template automatically applies color coding based on your selection so that you can spot problems quickly.

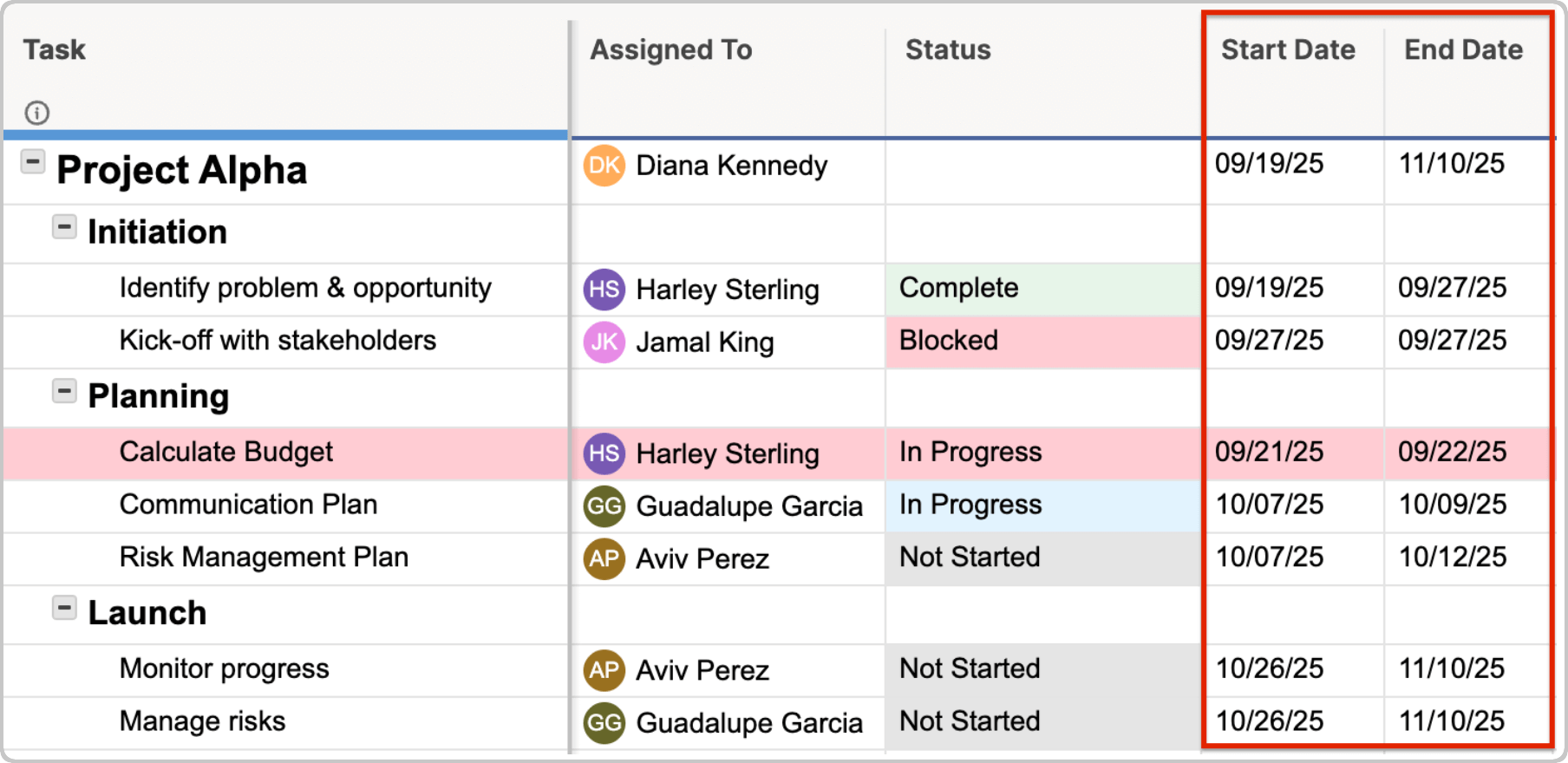

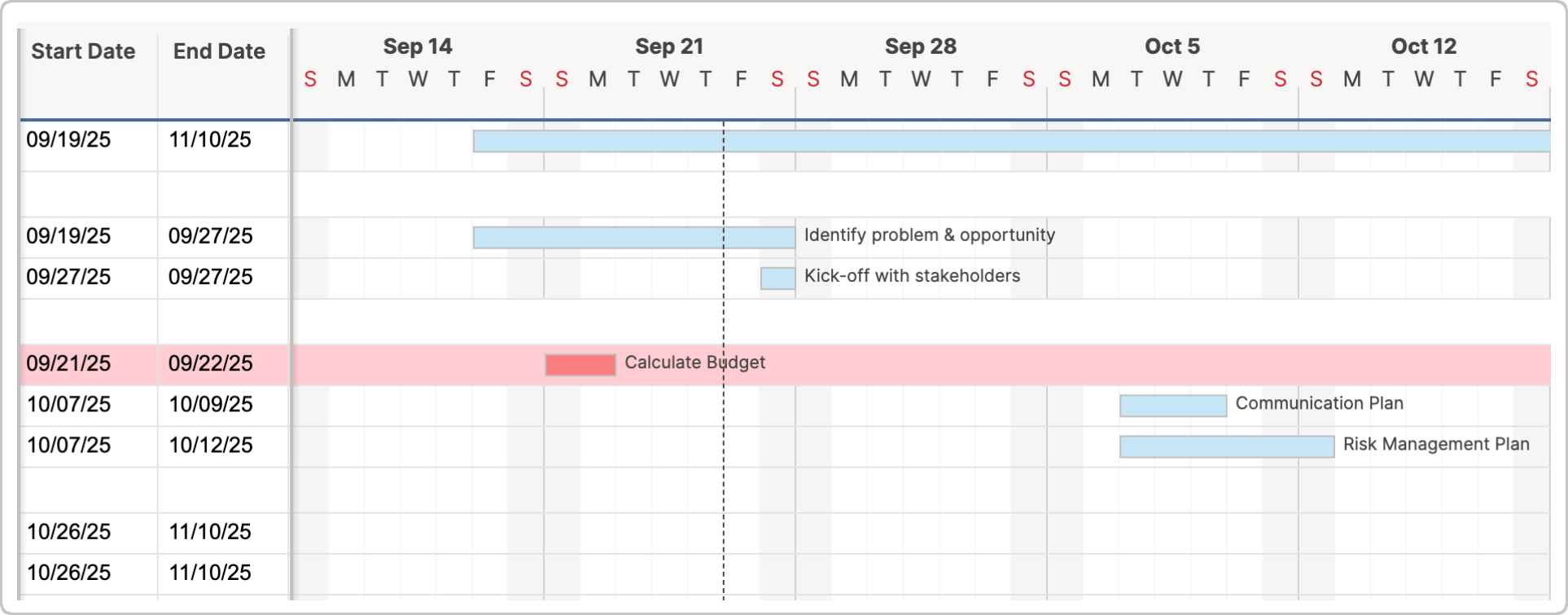

- Assign Start and End Dates

For each task, add start and end dates.

The Gantt chart view updates automatically on the right, giving you a visual timeline of the project.

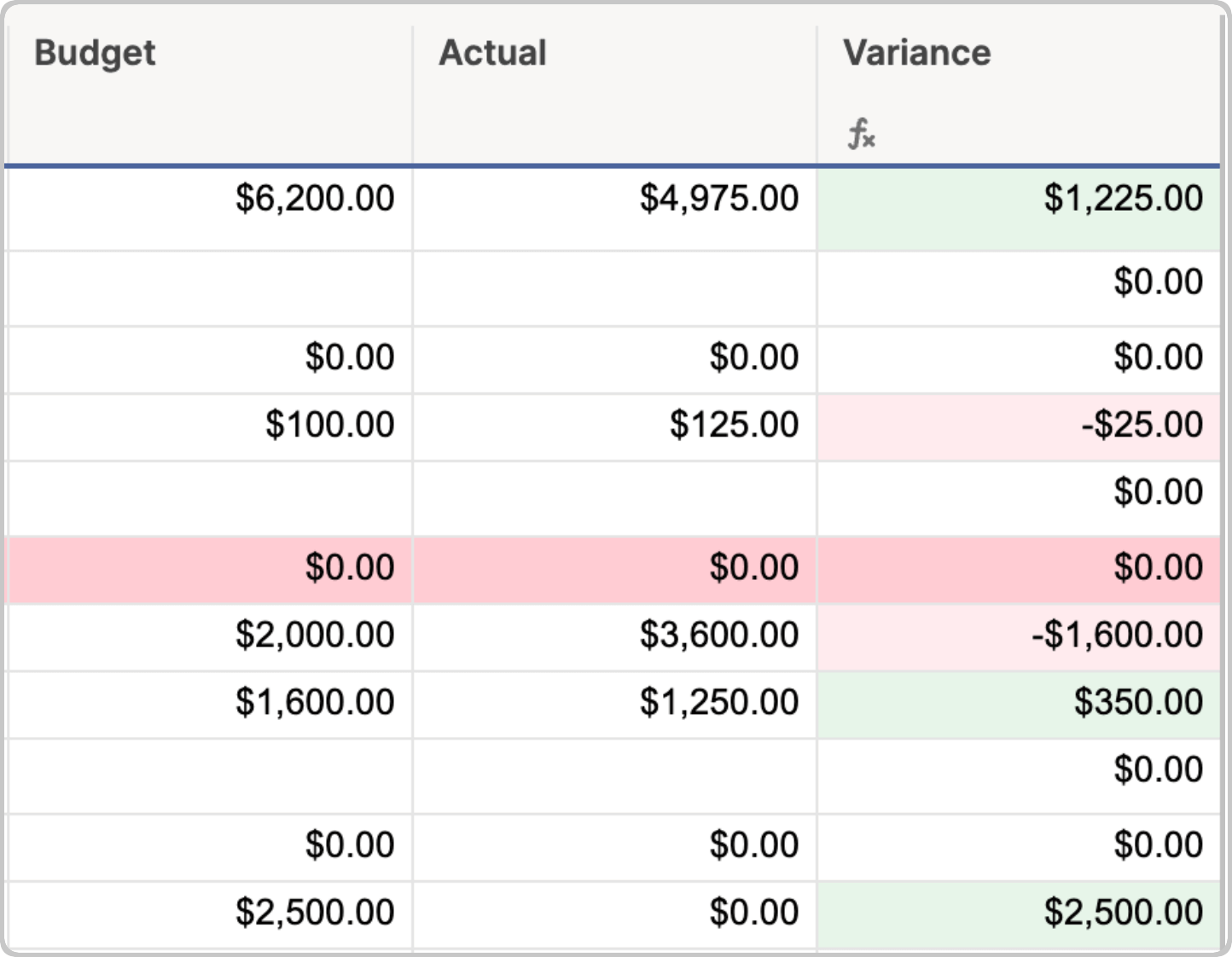

- Track Variance for Each Task

Enter the budgeted cost for each task. As you incur costs, log the actual amount in the next column. The template auto-calculates variance and highlights negative variances in red.

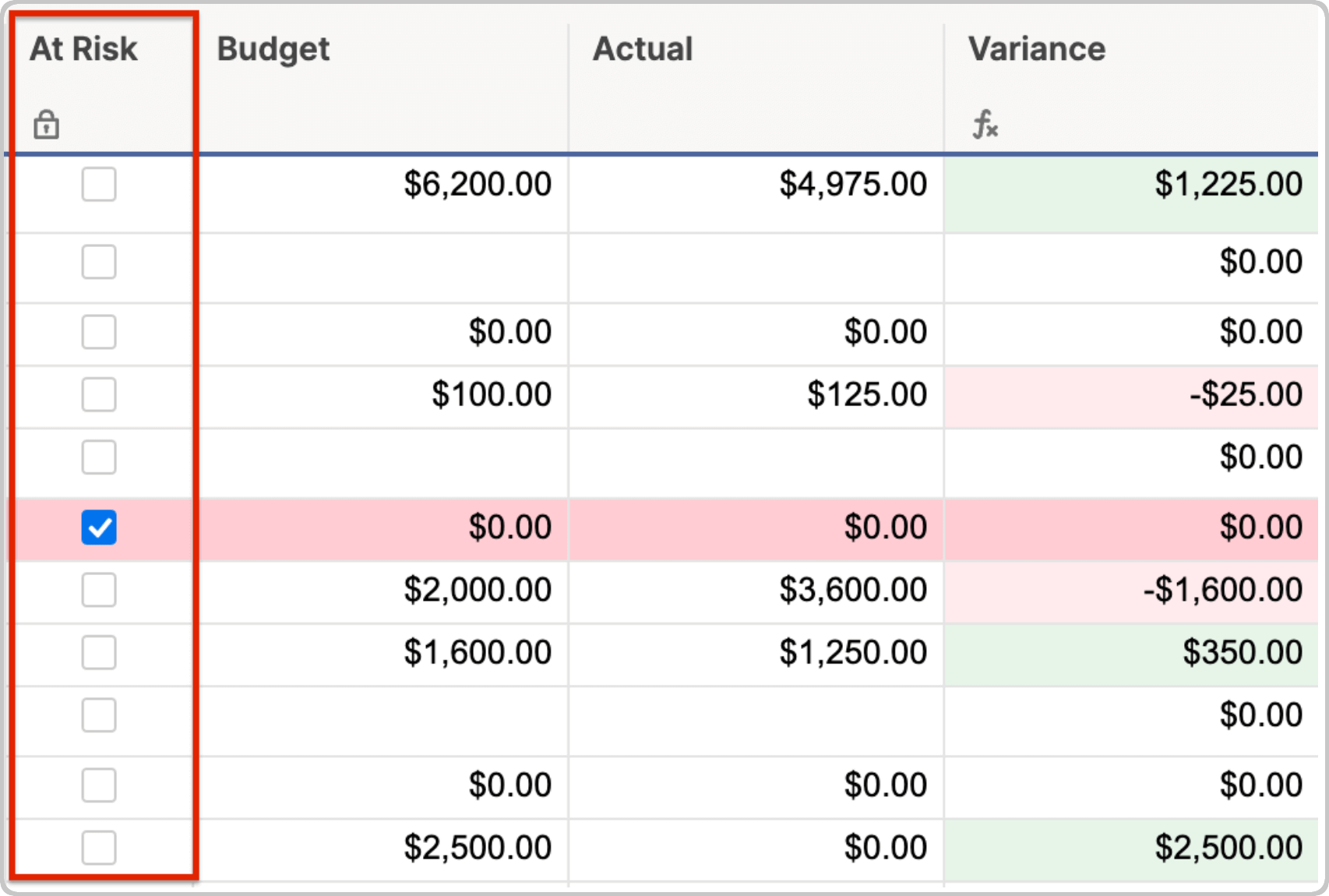

- Update as You Go

Keep the sheet current by updating statuses, dates, and actual costs regularly. If you notice a task is at risk, you can flag it in the At Risk column, which will highlight the entire row in red.

How to Manage a Project Budget

To manage a project budget, track all expenses against your budget baseline. Monitor variances regularly to spot when costs are trending above or below plan. Communicate updates to stakeholders at agreed intervals, and adjust forecasts if conditions change. If major shifts occur, seek approval before revising the baseline.

The ultimate goal of project budget management is to be proactive, not reactive. Try to catch issues early so you can course-correct before they escalate.

You may not have to manage the budget from start to finish — responsibilities depend on your organization’s structure. If you are managing the budget for the whole project lifecycle, here are all the steps that you’ll need to complete or oversee:

- Define Spending Authority and Approval Practices

Clear communication and accountability are essential to effective budget management — especially in large organizations or for complex projects. Start by identifying who has the authority to spend money on behalf of the company, and what they can spend it on. Establish transparent reporting and approval processes so that everyone understands how to document, review, and authorize spending.

Make it clear that you will not approve expenses that fall outside the scope of the project without necessary approvals.

- Initiate Procurement

If your project requires materials, vendors, or subcontractors, you’ll need to complete the following steps to procure those resources:

- Research and Select Vendors: Depending on the project, you may have already gathered vendor quotes or estimates during budgeting. If not, this step begins once the budget is approved. Send out RFPs or RFQs, compare proposals, and select vendors based on cost and capability. Once selected, you’ll move forward with contract negotiations and approvals.

- Create SOWs (Statements of Work): A statement of work outlines the scope, deliverables, timeline, and responsibilities for each vendor or contractor.

- Establish Clear Communication: After signing contracts, stay in close contact with vendors to align on expectations. Be clear on when and how they should invoice, and monitor their deliverables and deadlines. Any changes to scope or cost need to be formally approved.Vendor and contractor management is an integral part of managing a project budget. Find out everything you need to know in this guide to vendor management.

- Track and Compare Costs

Log expenses as they occur, and regularly compare actual spending against baseline estimates. Use milestones and deliverable submissions as natural checkpoints to review the budget, while conducting additional reviews whenever possible. “The more frequently these numbers are compared, the sooner the project manager can spot a potential problem and course-correct to avoid future expense overages,” says Arndt.

Arndt also recommends using a cloud-based tool for this step, rather than a static spreadsheet. “Having multiple versions of a spreadsheet being emailed to different departments can be very difficult to manage as nobody knows which version is the most up to date,” he says. “Having a cloud-based tool like Smartsheet with version tracking can be a great way to centralize the budget file and always have one source of truth.”In addition to tracking individual expenses, you’ll need to monitor the following:

- Change Requests: One of the biggest threats to a project’s finances is scope creep. If someone submits a request to change the scope of the project, you’ll need to evaluate the budget impact of that request before approving. Learn more prevention methods in this guide to managing scope creep.

- Committed Costs: Track items that have been approved but not yet invoiced, such as purchase orders and long-term service agreements. Ignoring these can make your budget appear healthier than it really is and lead to surprise overruns when invoices finally arrive.

- Labor Usage: Monitor actual labor hours against estimates. Overruns in staffing can quickly become one of the largest sources of budget variance. Reallocate or adjust workloads before costs start to spiral.

- Watch for Risk Impacts: Monitor cost-related risks from your risk register and activate contingency plans as needed.

- Update Forecasts and Adjust as Needed

If actual spending starts to deviate significantly from estimates, revise your forecasts to reflect the new reality and update as you go. “The budget is not a static document and must not be treated as such,” explains Arshad. “Be prepared to revise based on new realities.”

Share concise updates with stakeholders, especially when approaching key thresholds or variances, so expectations remain aligned. “Everyone involved in the project should be aware of the situation with the budget so no one is surprised,” says Wagner. “In cases where costs are rising more rapidly than anticipated, it is important that decisive measures are undertaken before the situation becomes uncontrollable.”

Where needed, reallocate budget across tasks or phases to respond to shifting priorities, staying within approved limits. If you must request additional funding from stakeholders or sponsors, be prepared with a strong business case that justifies the need.

- Capture Lessons Learned

As with all project management processes, you’ll get the most value from budgeting by reviewing results after the project ends. Document what caused variances and evaluate vendor performance. This will help you improve accuracy in future budgets and make better procurement decisions.

Project Budget Creation Starter Kit

Download the Project Budget Creation Starter Kit

Use this free starter kit to help you create and manage a project budget. This kit includes templates for a project budget spreadsheet, project risk assessment, and more.

In this kit, you’ll find:

- A project budget template for Excel to track estimated and actual project costs

- A project management scope of work template for Microsoft Word to define the project scope for more accurate cost estimates

- A work breakdown structure (WBS) outline and diagram template for Excel so you can identify all project tasks, helping you assign cost estimates to each project phase

- A request for proposal (RFP) template for Microsoft Word to gather accurate vendor bids

- A contractor scope of work template for Microsoft Word to stay aligned with external resources on scope and payment terms, and to prevent scope-related cost overruns

- A project risk assessment and analysis template for Excel to identify cost-related risks and plan appropriate contingency funds

Use Smartsheet Project Management Tools to Create an Accurate Project Budget

From simple task management and project planning to complex resource and portfolio management, Smartsheet helps you improve collaboration and increase work velocity -- empowering you to get more done.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Project Budget FAQs

A project budget is structured into categories such as equipment, labor, materials, contingency, and overhead. It usually breaks down expected costs by phase, task, or department and includes both fixed and variable expenses. This structure helps leaders allocate resources and manage financial risks throughout the project lifecycle.

To calculate a project budget, identify all required tasks and resources, estimate the cost for each, and add them together. Include direct costs such as labor and materials and indirect costs such as overhead. Next, add a contingency buffer — typically 5–15 percent of the total budget — for unexpected expenses.

A project estimate is an early guess at a project’s total cost. A project budget is a detailed plan that shows how much will be spent on each part of the project. The estimate helps shape the budget, while the budget is used to track and control spending.

A budget proposal is a formal request for funding that outlines estimated costs and justifies expenses. A project budget is the approved, detailed plan that allocates funds to specific tasks and phases. The proposal leads to the finalized budget, while the budget helps manage spending.