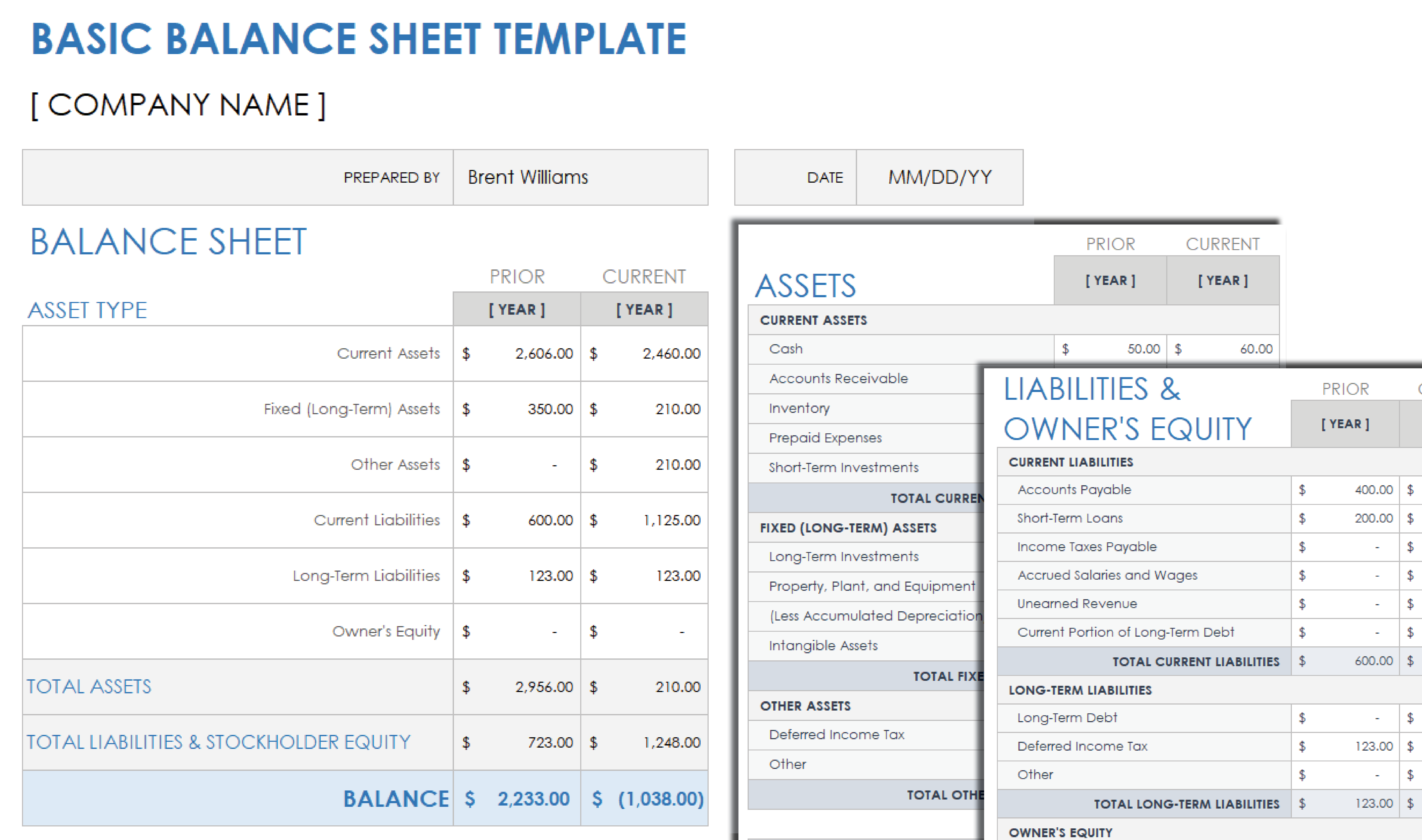

Basic Balance Sheet Template

Download a Basic Balance Sheet Template for

Excel

| Google Sheets | Smartsheet

Use this simple, easy-to-complete balance sheet template to determine your overall financial outlook. Enter the details of your current fixed and long-term assets and your current and long-term liabilities. The template will then calculate your resulting balance or net worth. Save this printable template as a year-by-year balance sheet, or easily customize it to be a day-by-day or month-by-month balance sheet. Enter projected figures to see your financial position compared to your financial goals.

For an easy-to-use online balance sheet template, see this basic balance sheet template.

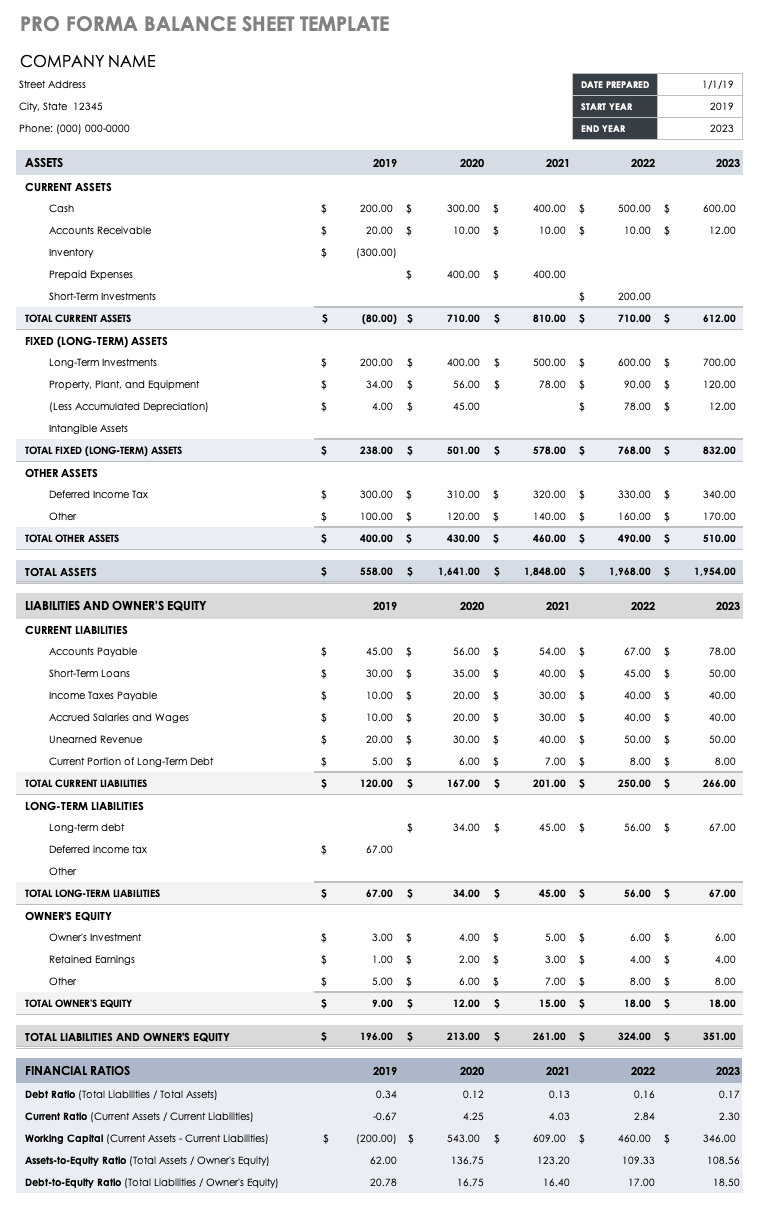

Pro Forma Balance Sheet Template

Download a Sample Pro Forma Balance Sheet Template for

Excel

|

Adobe PDF

| Google Sheets | Smartsheet

Download a Blank Pro Forma Balance Sheet Template for

Excel

|

Adobe PDF

| Google Sheets

Use this balance sheet for your existing businesses, or enter projected data for your business plan. Annual columns provide year-by-year comparisons of current and fixed assets, as well as current short-term and long-term liabilities. By reviewing this information, you can easily determine your company’s equity. This balance sheet template includes tallies of your net assets — or net worth — and your working capital. Download the sample template for additional guidance, or fill out the blank version to provide a financial statement to investors or executives.

Download one of these free small business balance sheet templates to help ensure that your small business is on track financially.

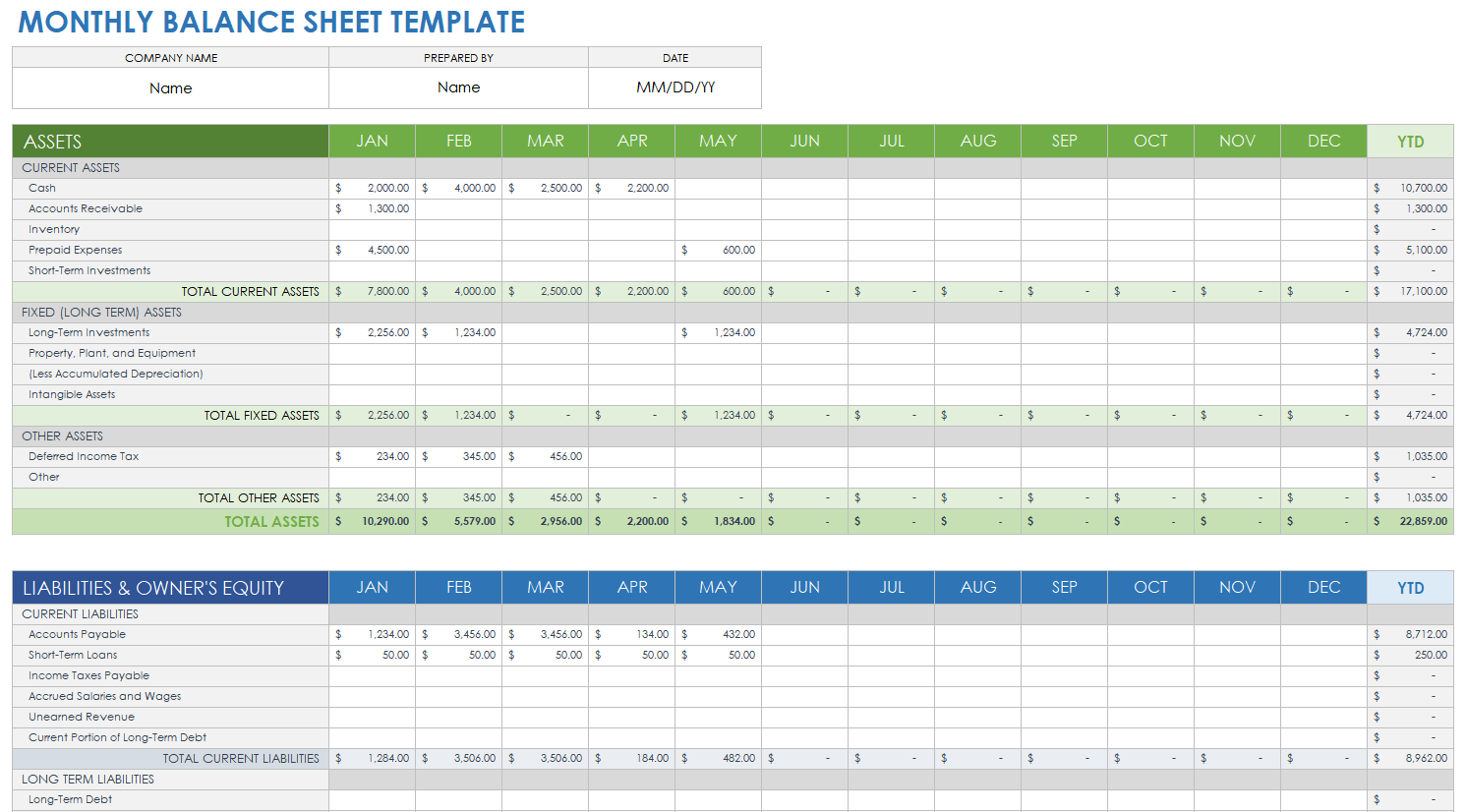

Monthly Balance Sheet Template

Download a Monthly Balance Sheet Template for

Excel

| Google Sheets

Ensure that you meet your financial obligations and solvency goals with this easy-to-use monthly balance sheet template. Enter your assets — including cash, value of inventory, and short-term and long-term investments — as well as liabilities and owner’s equity. Completing the form will provide you with an accurate picture of your finances. This template also includes a Common Financial Ratio section, which calculates month-by-month debt ratio, working capital assets-to-equity ratio, and debt-to-equity ratio so that you can accurately evaluate your company’s financial health.

For additional tips and resources for your organization’s financial planning, see our comprehensive collection of free financial templates for business plans.

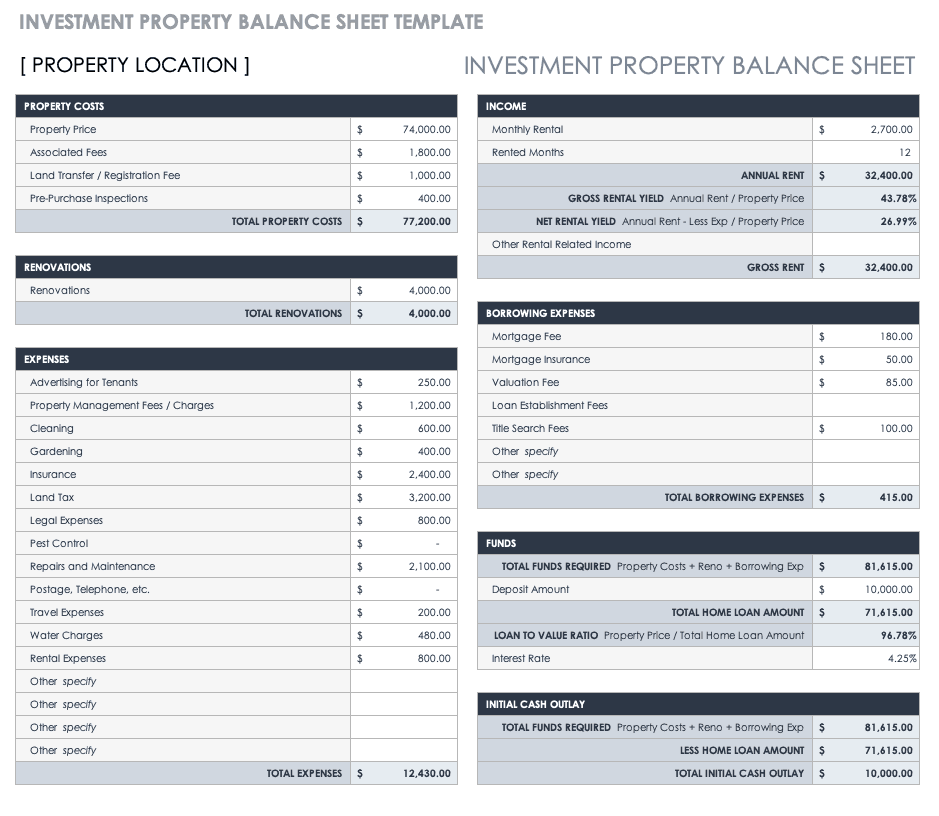

Investment Property Balance Sheet Template

Download an Investment Property Balance Sheet Template for

Excel

| Google Sheets

Designed with secondary or investment properties in mind, this comprehensive balance sheet template allows you to factor in all details relating to your investment property’s growth in value. You can easily factor in property costs, expenses, rental and taxable income, selling costs, and capital gains. Also factor in assumptions, such as years you plan to stay invested in the property, and actual or projected value increase. You can also edit the template to include whatever details you need to provide for renting, refinancing, home-equity lines, and possible eventual sale of your investment property.

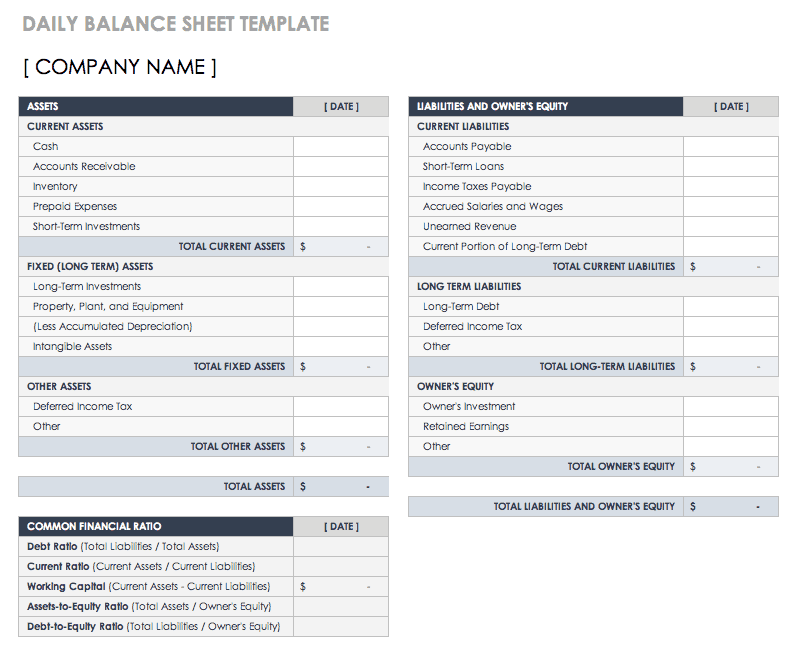

Daily Balance Sheet Template

Download a Daily Balance Sheet Template for

Excel

| Google Sheets

Keep day-to-day tabs on your assets, liabilities, equity, and balance with this easy-to-use, daily balance sheet template. Enter your total current, fixed, and other assets, total current and long-term liabilities, and total owner’s equity, and the template will automatically calculate your up-to-the-minute balance. You can save this daily balance sheet template as individual files — with customized entries — for each day requiring balance insights for any 24-hour period.

Find more balance sheets and accounting templates in this collection of the top Excel templates for accounting.

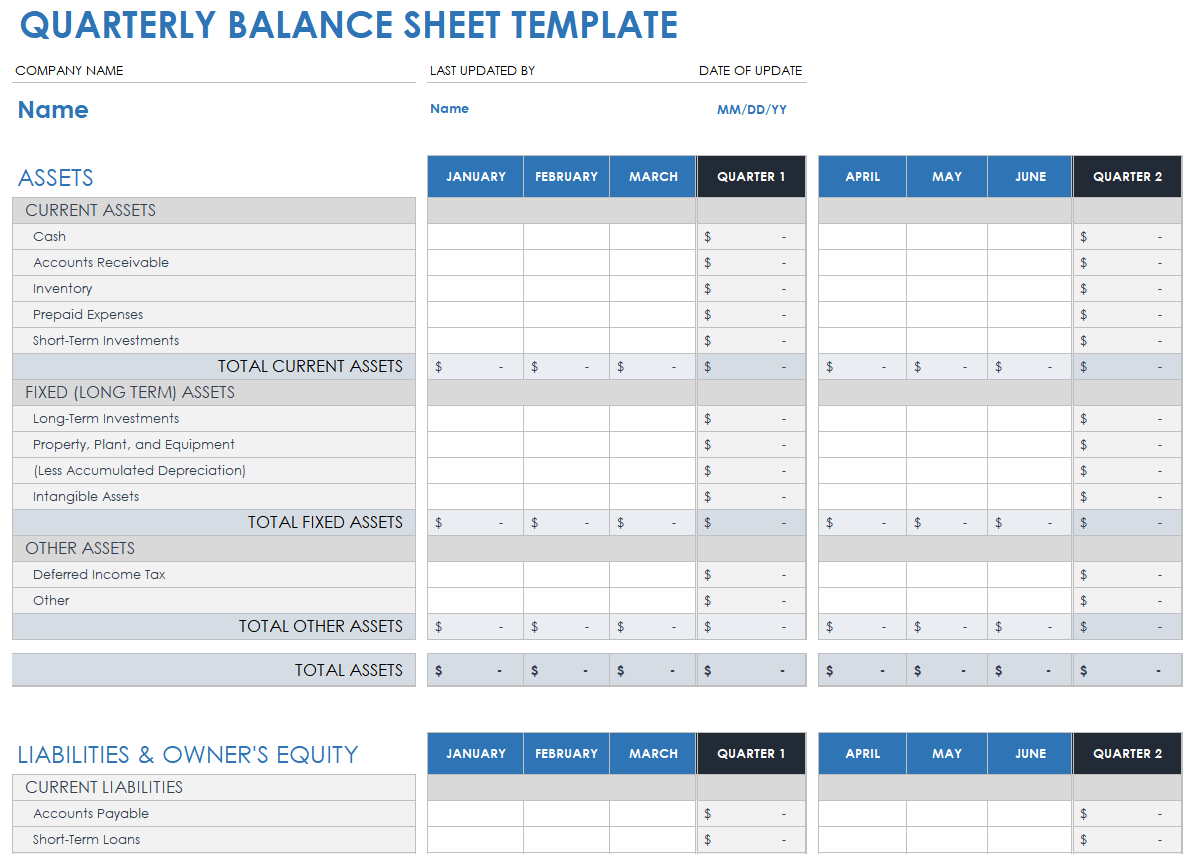

Quarterly Balance Sheet Template

Download a Quarterly Balance Sheet Template for

Excel

| Google Sheets

Track your quarterly financial position by entering each month’s assets and liabilities and reviewing the monthly and quarterly perspectives of your owner’s equity. Monthly columns provide you with assets, liabilities, and equity tallies, and also reflect three-month figures for each quarter. This is the perfect template for short-term analysis of fiscal health but can be used for year-over-year monthly and quarterly comparisons.

What Is a Balance Sheet Template?

A balance sheet template is a tool for tallying your assets and liabilities so that you can calculate your equity. Use a balance sheet template to ensure you have sufficient funds to meet and exceed your financial obligations.

Companies, organizations, and individuals use balance sheets to easily calculate their equity, profits, or net worth by subtracting their liabilities from their assets. By doing so, they can get an overall picture of their financial health. A balance sheet also serves as a company or organization’s financial position over specified time, such as daily, monthly, quarterly, or yearly.

Regardless of the type of balance sheet (simple, business-related, or calendar-specific), they all use the same simple formula:

Whereas a simple balance sheet template allows you to easily fill in the basic assets and liabilities information for a quick glimpse at your financial outlook, a more robust template, such as a pro forma business balance sheet, is useful for entering current assets details, such as accounts receivable and inventory details.

Regardless of your line of business, all balance sheet templates have standard, pre-set formulas that factor in the following details to keep your financial details balanced and accurate:

Assets:

- Current Assets: Current assets can be converted to cash within a short period of time and include checking and savings account balances, accounts receivable, inventory, prepaid expenses, short-term investments, and other liquid assets.

- Fixed Assets: Fixed assets, such as property, cars, equipment, stocks and bonds, and intangible assets, take time and effort to convert into liquid cash.

- Total Assets: Your total assets include all of your current and fixed assets.

Liabilities:

- Current Liabilities: Current liabilities, such as accounts payable, short-term loans, income taxes, salaries and wages, and unearned revenue, are debts or obligations that are usually due within a year.

- Long-Term Liabilities: Long-term liabilities, such as loans, debt, and deferred income tax, are financial obligations you pay over time.

- Total Liabilities: Your total liabilities include all of your current and long-term liabilities.

- Owner’s Equity: Owner’s equity is the value of your company once your liabilities are subtracted from your assets. This is also called net worth.

Additionally, balance sheet templates allow you to enter projected figures so that you can compare your current financial standing with your projected or target finances. For example, you can use a balance sheet to determine what your quarterly figures must be in order to beat your previous year’s profits. Balance sheet templates, such as this Investment Property Balance Sheet, allow you to factor in details such as property costs, expenses, rental and taxable income, selling costs, and capital gains.

Gain Insight into Your Company’s Financial Position with Balance Sheets in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.