Free M&A Planning and Strategy Templates

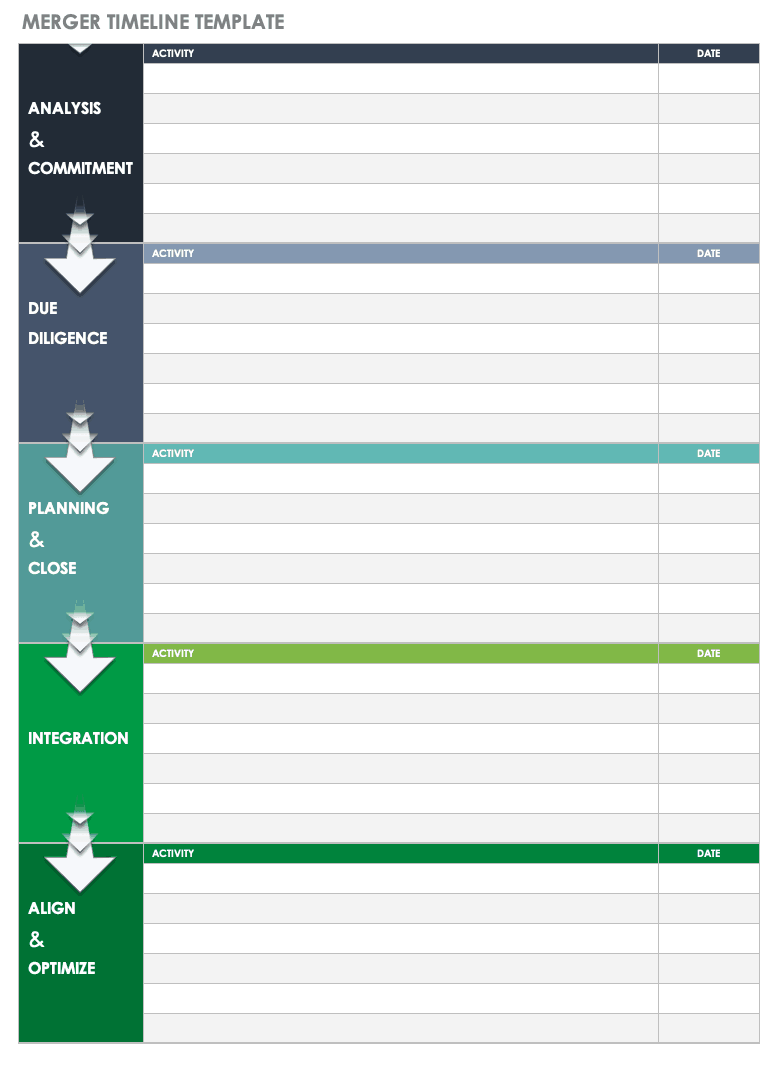

Merger Timeline Template

This simple template provides a visual outline for your merger schedule. The timeline separates the phases of a typical merger, with space to list key activities and due dates. You can use this initial schedule throughout the process as a blueprint for your efforts.

Download Merger Timeline Template

Excel | Word | PDF | Smartsheet

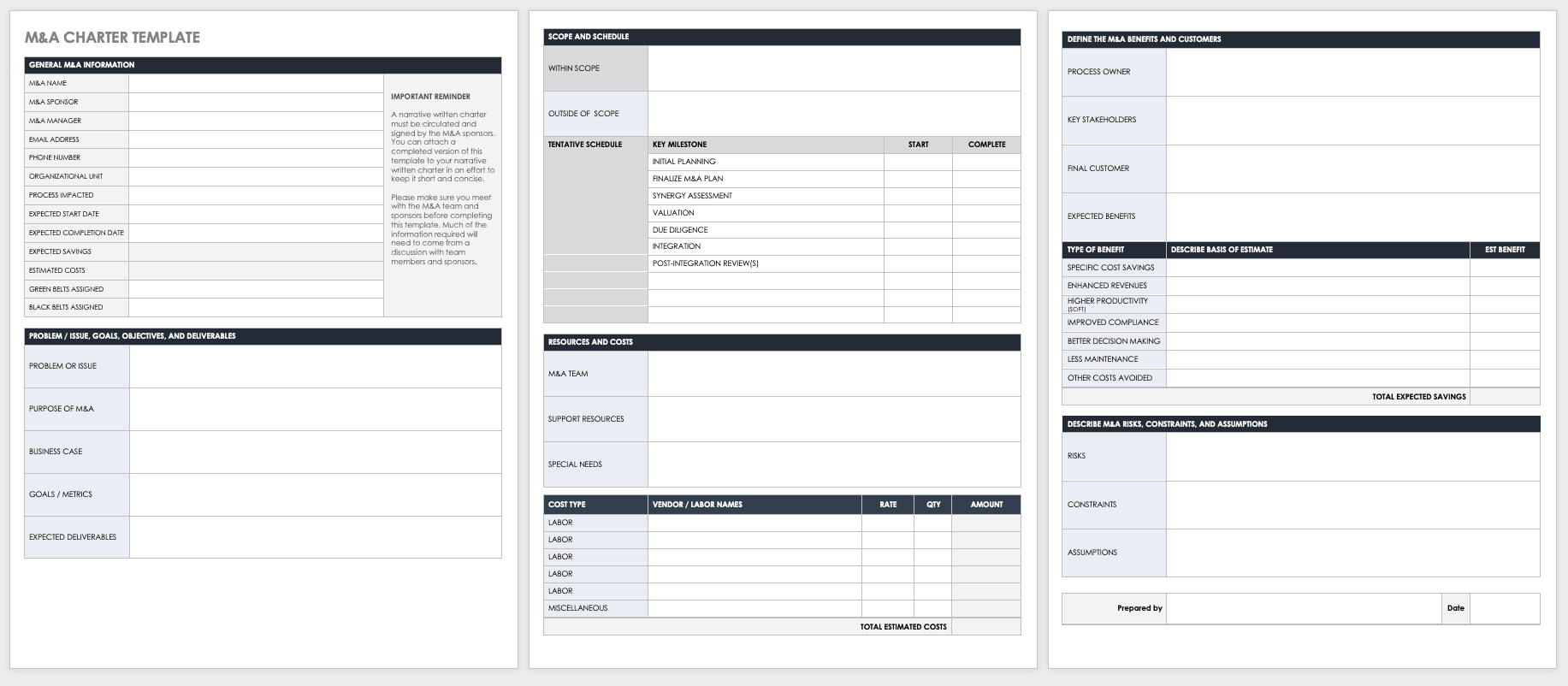

M&A Project Charter Template

A project charter is a formal narrative document in which you detail your goals, proposed budget, schedule, and responsibilities, as well as the problems you hope to solve with your venture — in this case, a merger or an acquisition. Use the Excel template to outline the planned aspects of the M&A; it will be the blueprint for the final narrative document in Word or PDF.

Download M&A Project Charter Template

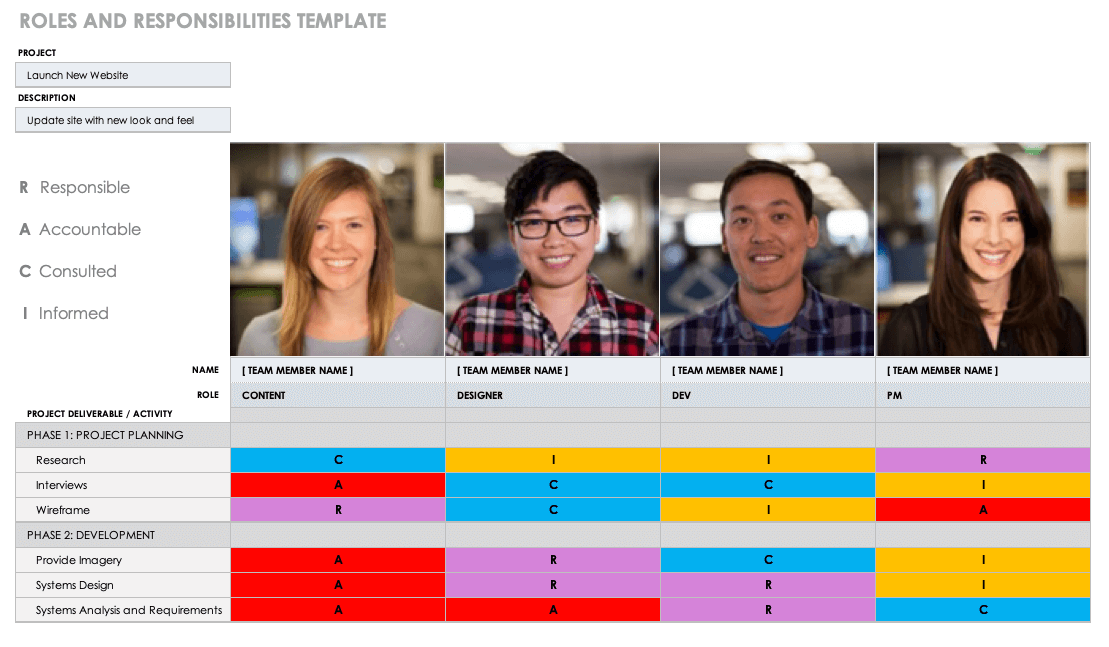

Roles and Responsibilities Template

A merger or acquisition will succeed only when everyone understands their roles and responsibilities from the outset. Use this standard roles and responsibilities template to organize team members by project and list their duties at each phase of the merger. Additionally, you can use this template for staffing and retention when you integrate organizations.

Download Roles and Responsibilities Template

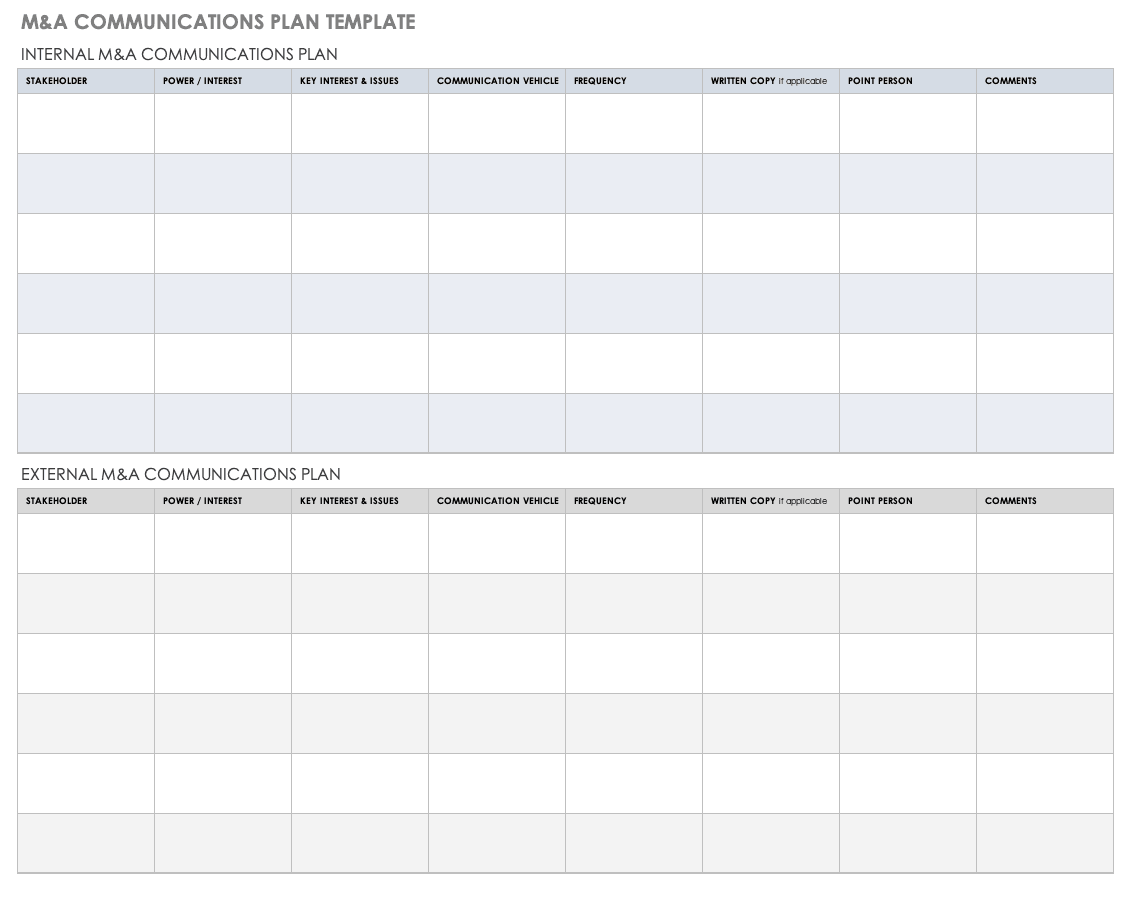

M&A Communication Plan Template

Use this template to plan communication for all stakeholders throughout the M&A process. This template includes separate charts for internal and external communications. It has space to list each stakeholder’s power or interest, their key issues, their communication vehicle and point person, their written copy, their frequency of communication, and any additional comments. Planning your communication at the outset — and updating your strategy along the way — can help ensure that both outside stakeholders and current employees stay up to date throughout the implementation process.

Download M&A Communication Plan Template

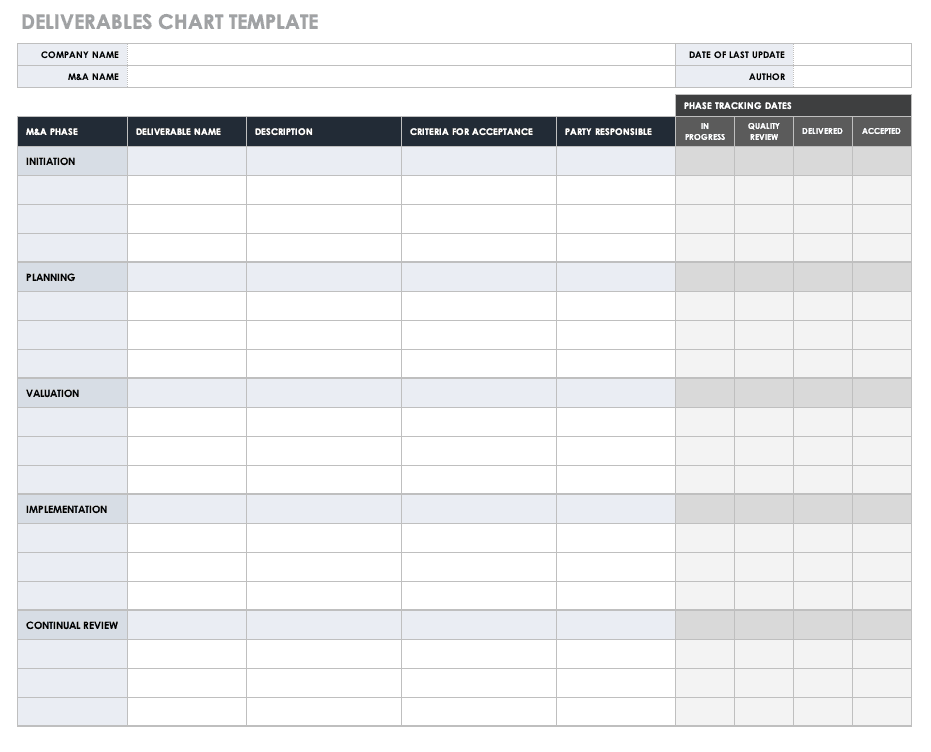

Deliverables Chart Template

This template provides a chart to list each deliverable at every stage of the M&A process, from initiation and valuation through implementation and review. List each deliverable, description, criterion for acceptance, and party responsible, and easily track the status of each item. Built-in child rows allow you to add project phases if your merger or acquisition requires more steps. Refer to this deliverables chart throughout integration to ensure you haven’t missed any details.

Download Deliverables Chart Template

M&A Press Release Template

Available as Word and PDF files, this template provides an outline for formally announcing news of a merger or acquisition. The template includes space for company logo(s), the deal agreement, contact and background information, quotes from executives, and the company boilerplate. But you can add or delete sections to fit the needs of your press release. You can find additional press release templates for business use here.

Download M&A Press Release Template

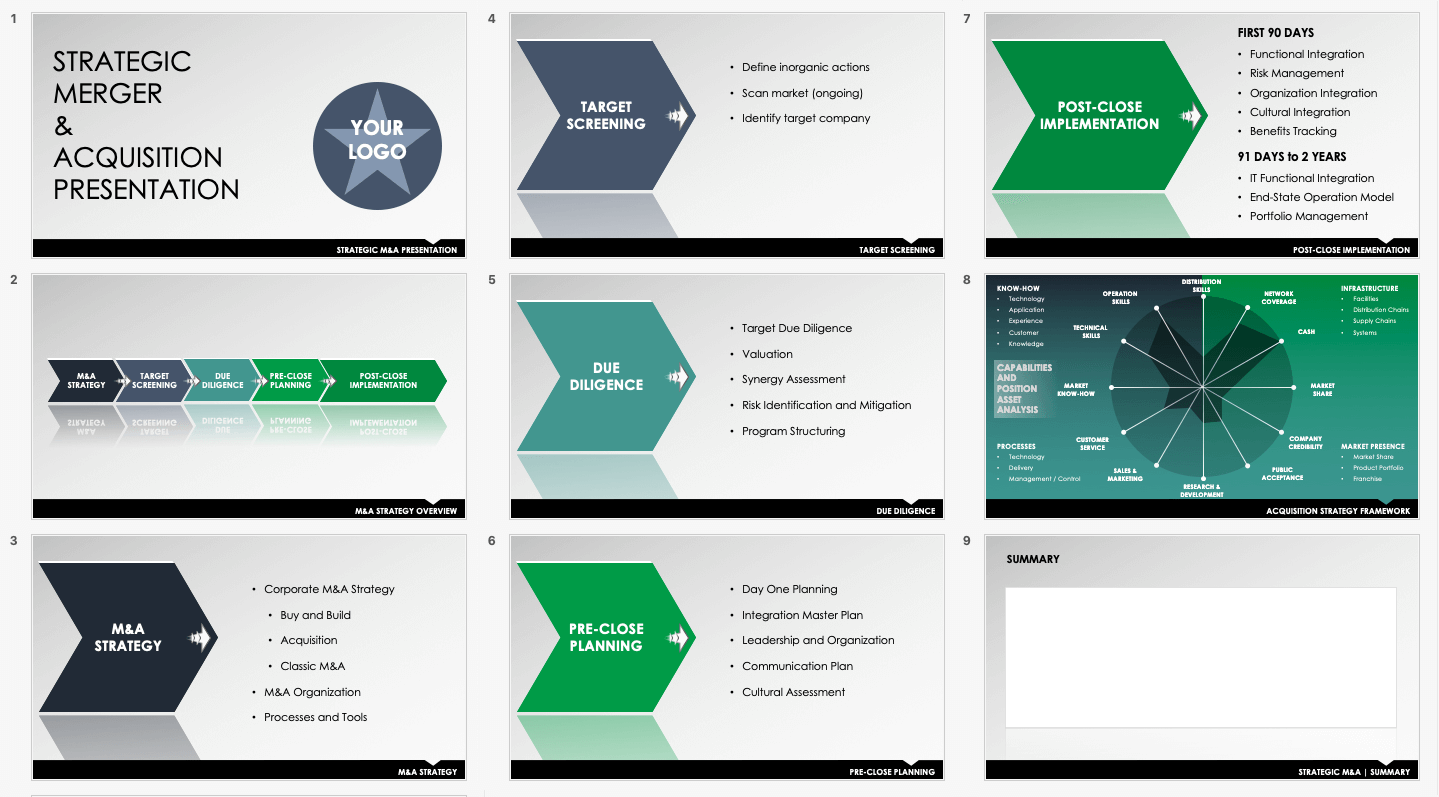

Strategic M&A Presentation Template

Use this PowerPoint deck to present the business case for your M&A strategy. The template includes a slide for each phase of the merger or acquisition, with space to detail your intended approach and processes. The final slide enables you to list list strengths, weaknesses, and resources for different aspects of the target company in a pre-built infographic and functions as a high-level capabilities and asset analysis. Showcase your well-researched strategy and plan with this professional M&A proposal template.

Download Strategic M&A Presentation Template - PowerPoint

Free M&A Valuation and Process Templates

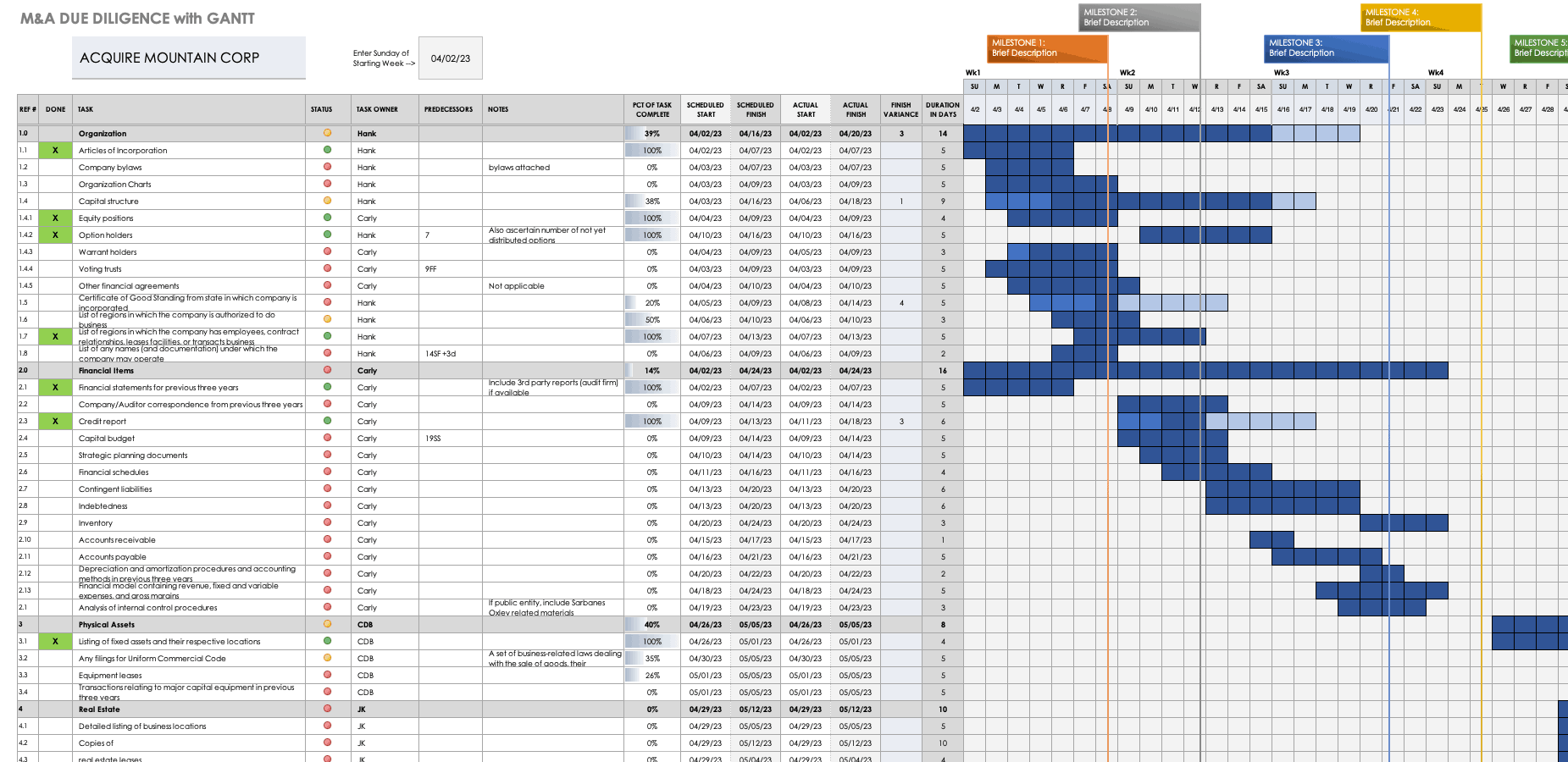

Due Diligence Template

Use this template to track and store information about each due diligence item. List all reference information about the item, along with the start and end dates, the party responsible, and the status. Additionally, the built-in Gantt chart allows you to simultaneously track multiple items against your project schedule, so that you can stay on top of every detail and adapt the timeline as needed.

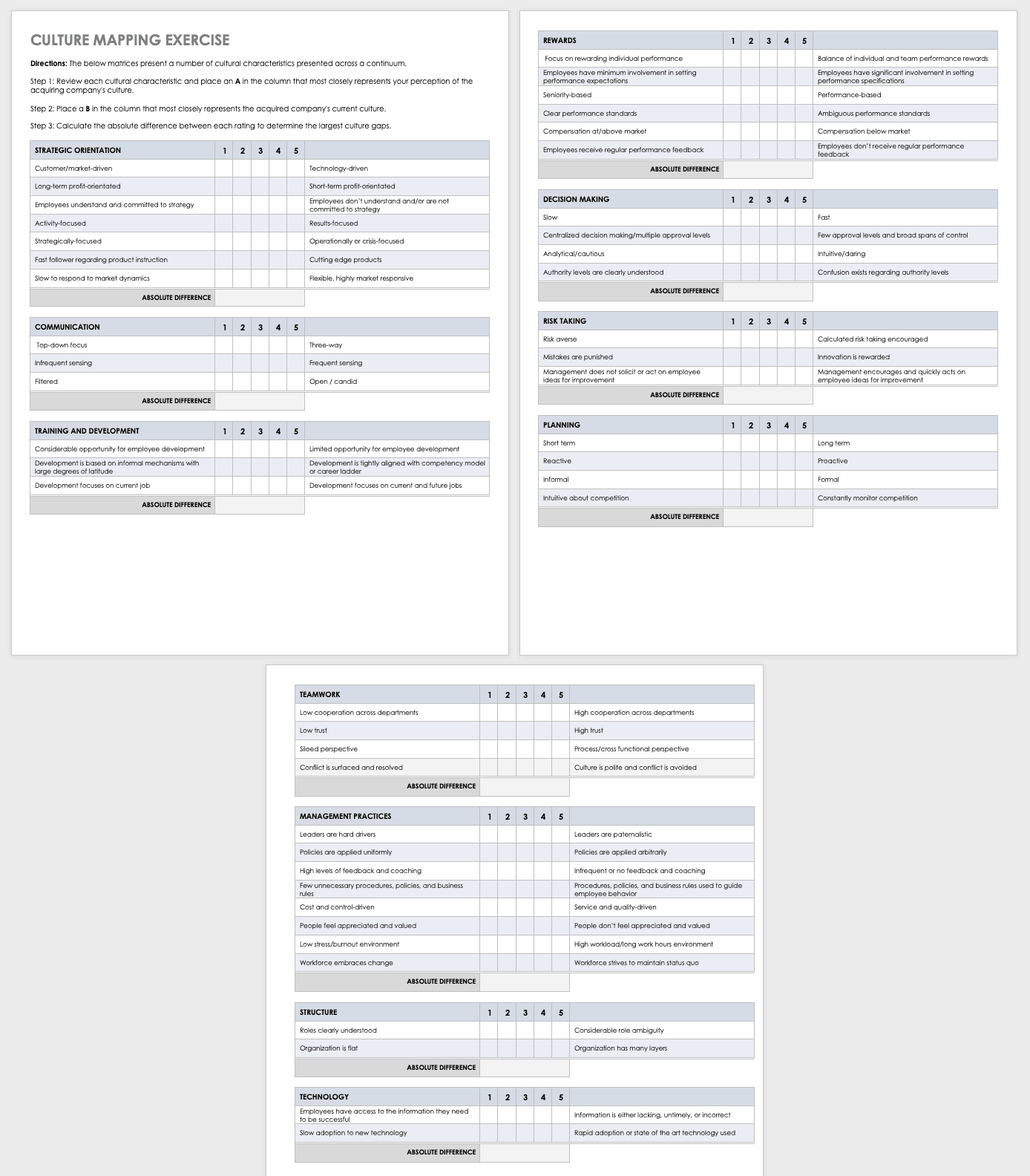

Synergy and Culture Mapping Exercise

Evaluating company synergy is not only about financials, but also about culture. This template walks you through a culture analysis: Using a scale from 1 to 5, evaluate multiple aspects of a company’s strategic orientation, communication, training and development, planning, teamwork, and other operations categories. This exercise will help you identify differences in the two companies, so you can address them during implementation.

Download Synergy and Culture Mapping Exercise

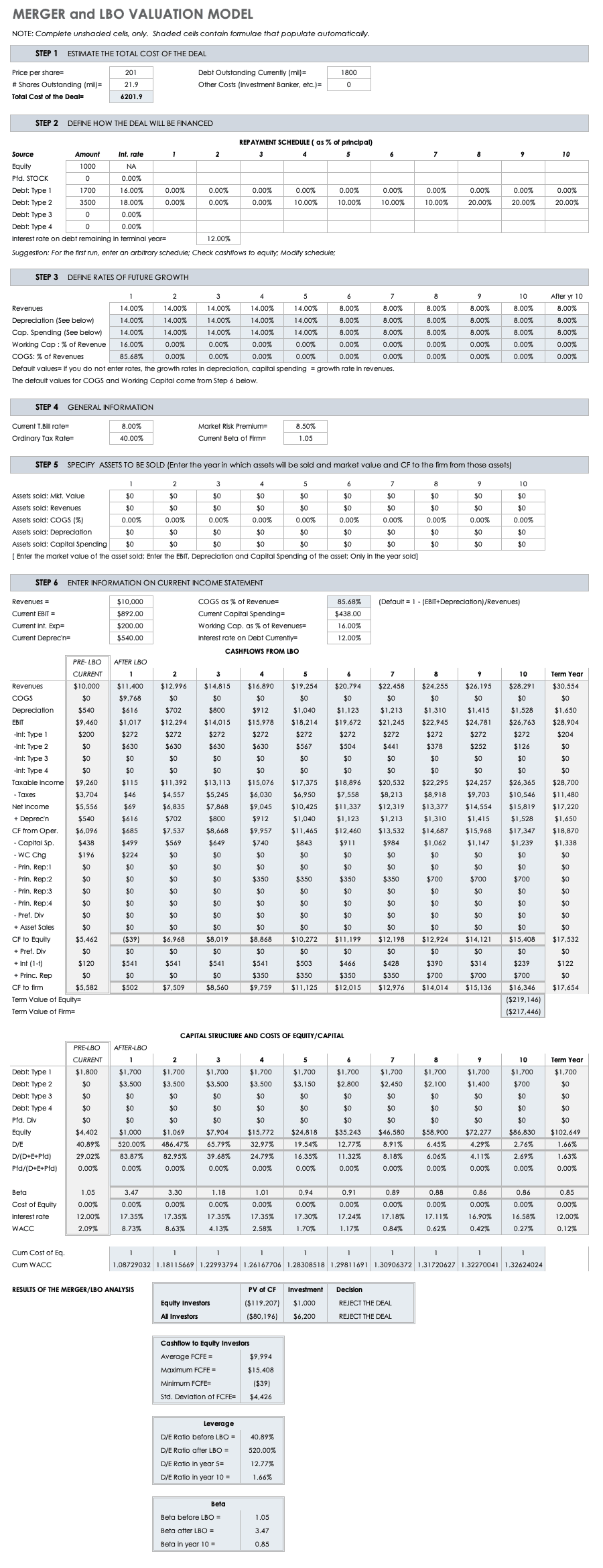

Merger and LBO Model Valuation

A leveraged buyout (LBO) is a type of transaction in which the acquiring company uses borrowed money — including its own and the target company’s assets and equity — to cover the cost of acquisition. This template provides a step-by-step valuation for an LBO, with sample data to guide your own calculations.

Download Merger and LBO Model Valuation

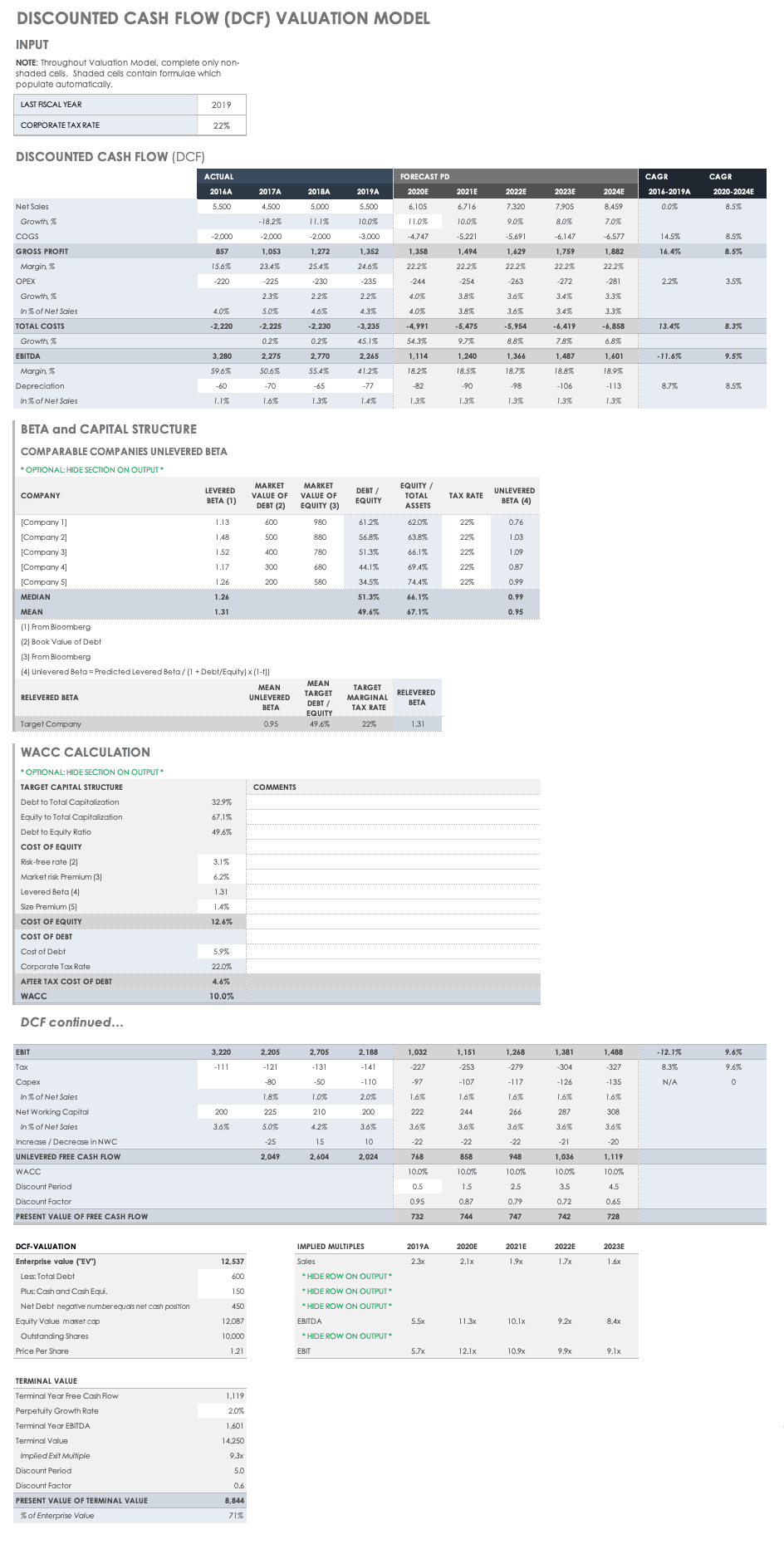

Discounted Cash Flow Valuation Model

Discounted cash flow (DCF) is a valuation method that you can use to evaluate an investment (in this case, merging with or acquiring a company) based on estimates of its future cash flow. Use this template to find the present value of expected future cash flow by inputting net sales, profit, and other financial information, and follow the calculations to determine the value of the investment.

Download Discounted Cash Flow Valuation Model

Free M&A Integration Templates

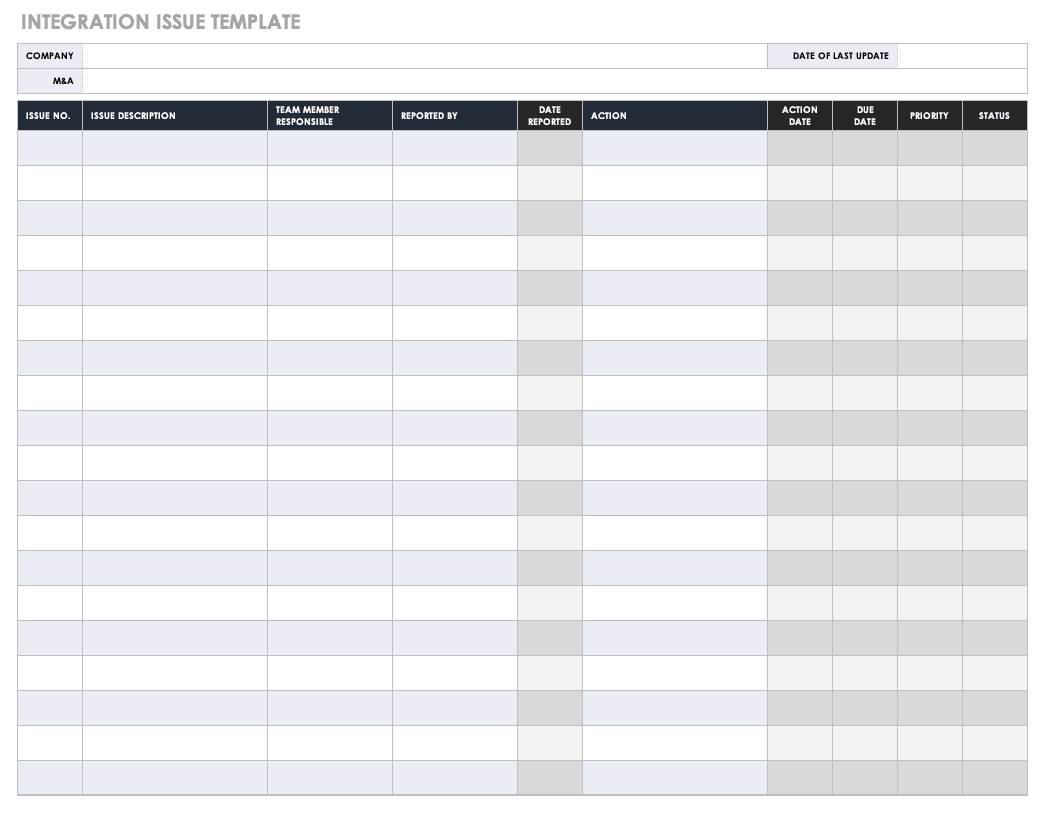

Integration Issue Form

Issues are bound to come up during integration, and this simple issue form allows you to track these challenges. The chart includes sections for listing a number and a description for the issue, as well as the team member responsible, the date it was reported, the action taken, the priority, and the status. Thus, you can monitor both the issues that arise and the responsiveness of your team throughout the integration process.

Download Integration Issue Form

Excel | Word | PDF | Smartsheet

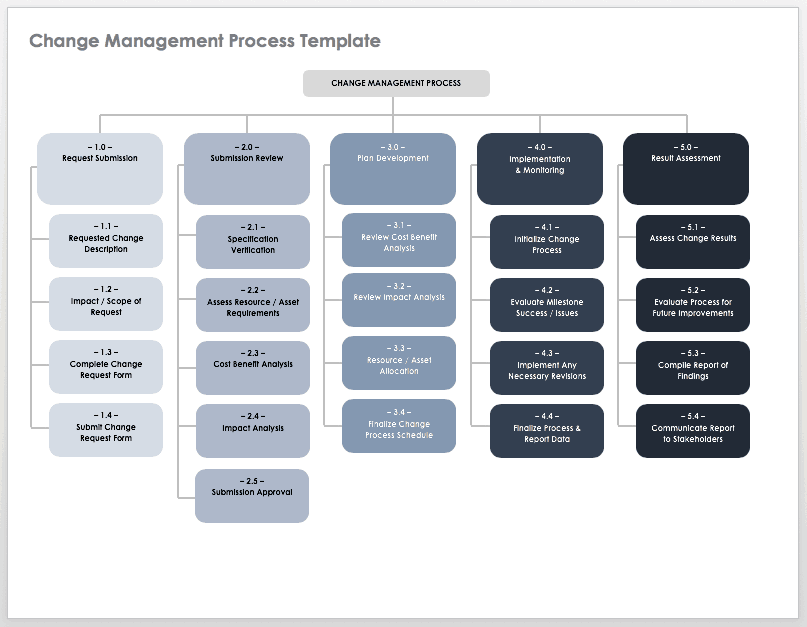

Change Management Process Template

Just like any organizational change, integration requires planning. Use this change management template to outline the processes that will help you integrate the companies’ cultures, finances, roles and responsibilities, and more. This template is formatted like a flow chart, so you can view the entirety of the process schedule.

Download Change Management Process Template

Word | PDF | Smartsheet

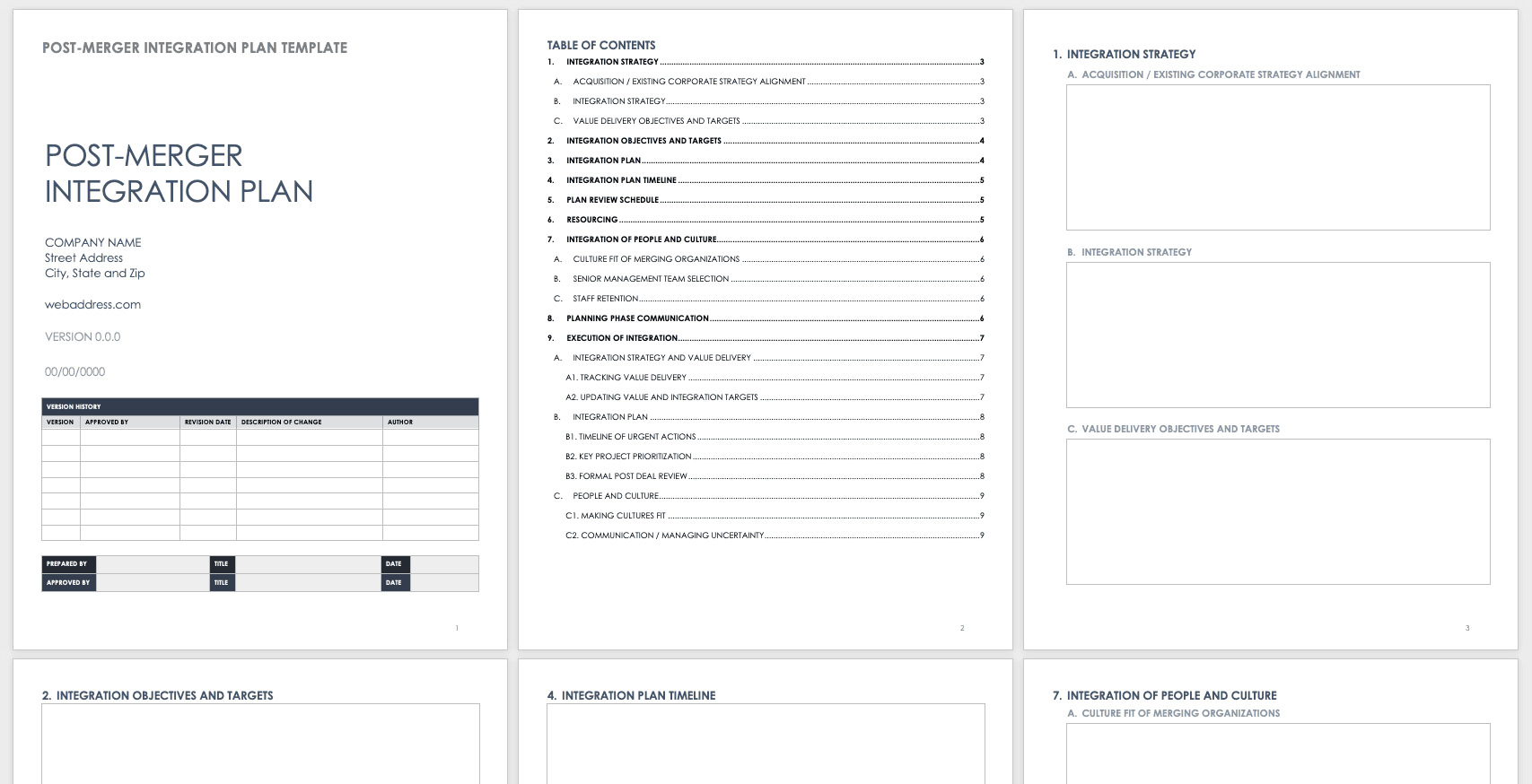

Post-Merger Integration Plan

Once you’ve closed the deal, you need to create an integration plan — typically, a lengthy document that outlines the changes facing each department in terms of structure, communication, and culture. Use this template to detail your integration strategy, objectives, resourcing, and execution plan. This template outlines the categories you can include, but you can adapt it to fit your needs.

Download Post-Merger Integration Plan

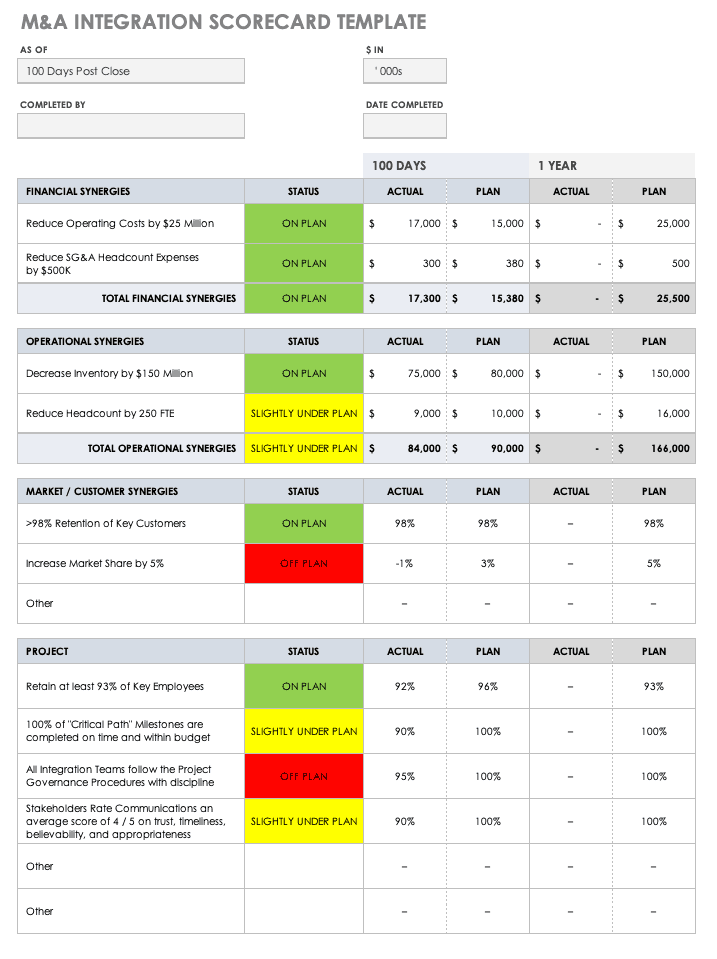

M&A Integration Scorecard Template

Use this template to evaluate integration 100 days and one year after you close the merger or acquisition. The template includes sections for detailing financial and operational synergies, total cost savings, market and customer synergies, and goals and projections for the coming year. By using a scorecard, you can hold yourself accountable to your initial objectives and take lessons for the future. Download the template in Excel or Word for internal data-gathering or as a PowerPoint slide to present to stakeholders and executives.

Download M&A Integration Scorecard Template

Excel | Word | PDF | PowerPoint

Additional M&A Templates

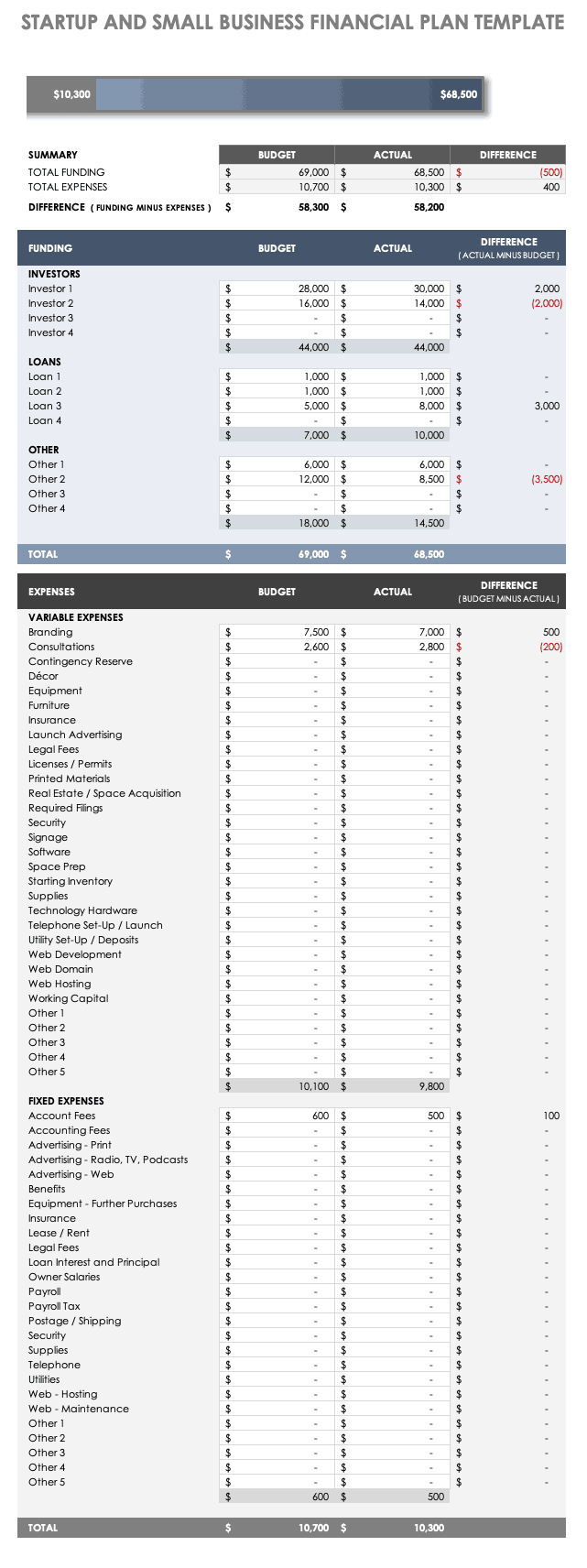

Startup and Small-Business Financial Plan

The templates in this section are not specific to M&A transactions, but they help in the planning and due diligence phases of the process.

Startups and small businesses face different considerations and constraints than do large corporations. Use this simple Excel template to list costs, loans, and expenses, as well as to identify funding sources. This template functions similarly to a budget plan in that it allows you to track estimated and actual costs, as well as make adjustments along the way.

Download Startup and Small Business Financial Plan

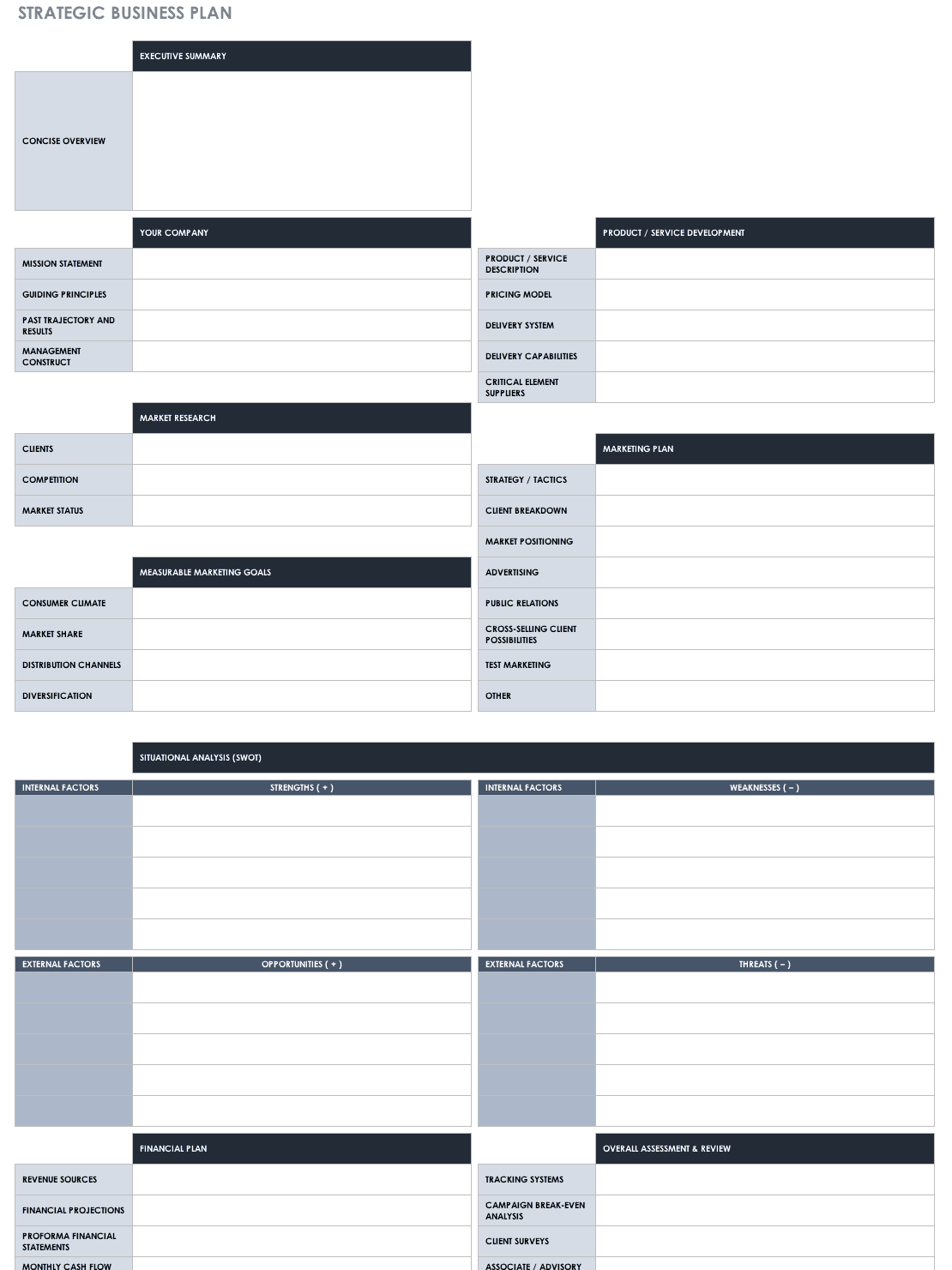

Strategic Business Plan

This comprehensive business plan template aids in planning and can function as a communication tool. With space to include company information, research, goals, and risks, this template provides a one-stop shop for managing all of the moving pieces of your business plan.

Download Strategic Business Plan

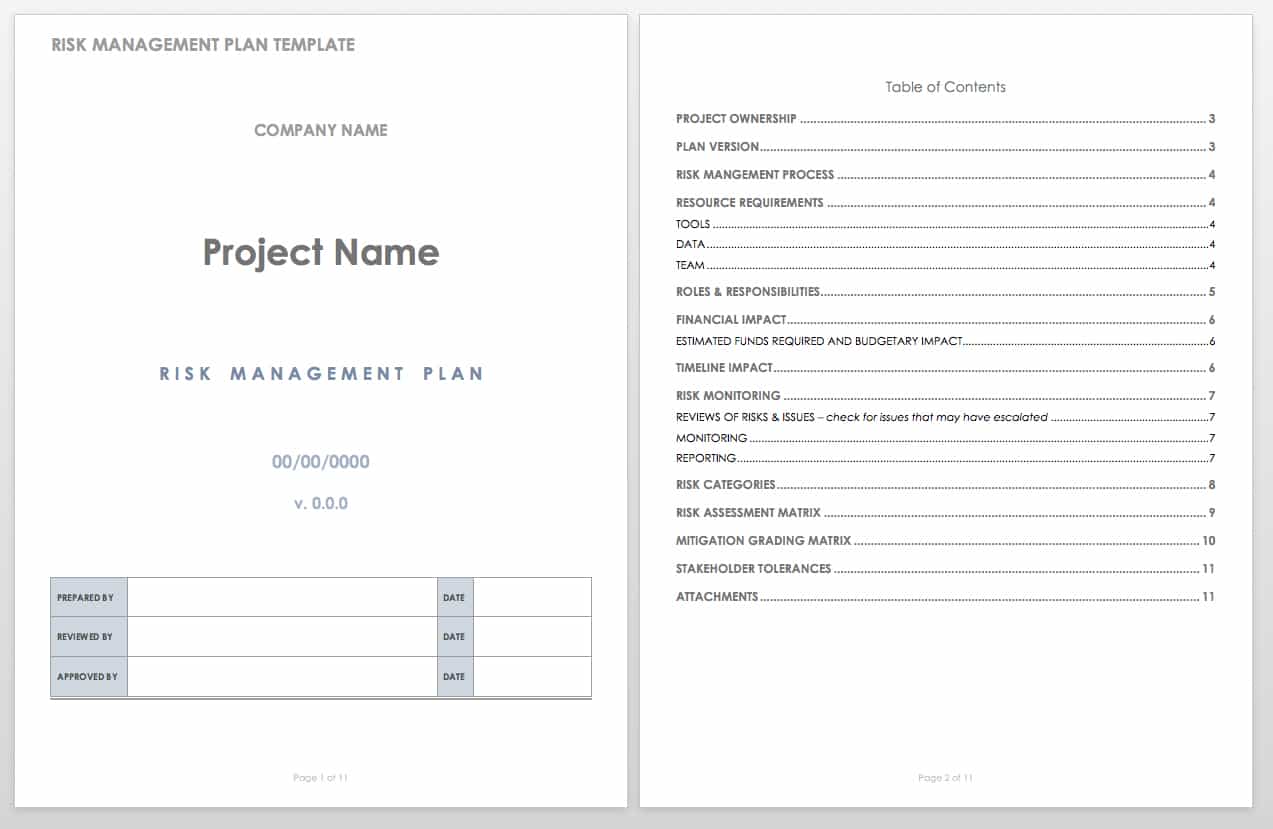

Risk Management Plan Template

During the M&A planning phase, you need to identify the risks associated with acquiring or merging with another company. This risk management template includes space for analysis and monitoring, numerical calculations, a risk register, and a list of potential risks. Use this template to identify and monitor risks for the duration of your merger or acquisition.

Download Risk Management Plan Template

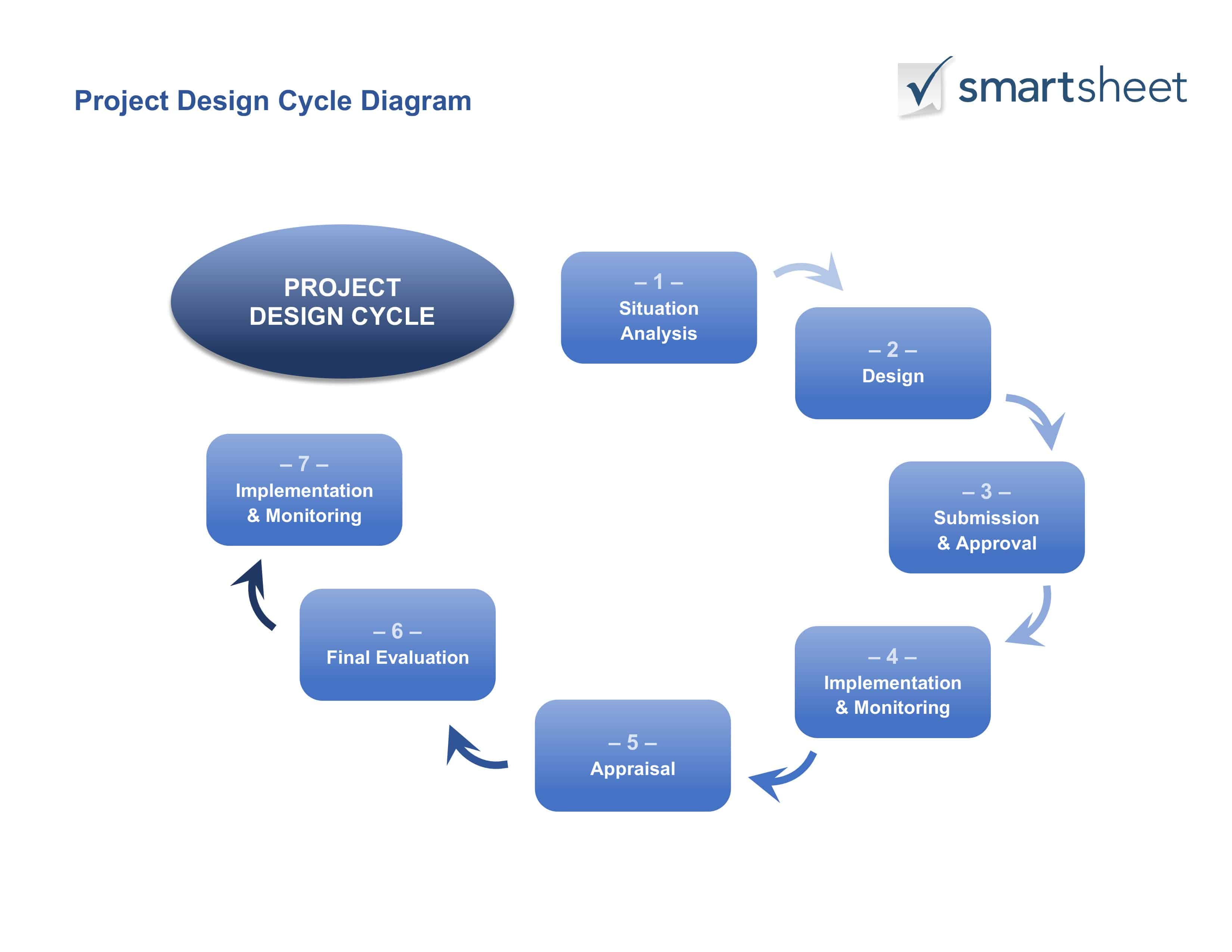

Project Lifecycle Plan

Understanding the lifecycle of your project — including the phases of your merger or acquisition — is crucial to planning the scope, resources, roles and responsibilities, and deliverables. This graphic template allows you to visualize your project lifecycle, from analysis and design all the way through implementation and monitoring. Add or delete phases to fit the needs of your endeavor.

Download Project Lifecycle Plan

What Is M&A?

M&A stands for merger and acquisition, a phrase that describes two companies or organizations that combine into one entity. The driving idea behind a merger or acquisition is that the companies together will be stronger, more competitive, or more profitable than they are by themselves.

Though the term M&A is common, mergers and acquisitions are actually two distinct concepts. A merger occurs when two companies of equal size or profitability come together, renounce their individual titles and stock, and continue as one unit. An acquisition occurs when one company (called the acquiring company) buys another, smaller company (called the acquired or target company). However, both terms generally refer to the consolidation of assets and liabilities that occurs when two entities combine into one.

Organizations have many reasons to choose M&A, but they essentially boil down to increasing synergy, the idea that when combined, two entities will be more powerful or competitive than they would each be on their own. On the buy side, the acquiring company might want access to certain technologies, resources, position in the market, or talent; on the sell side, the target company may want greater financial or market security.

There is a legal component to any merger or acquisition, but that is outside the scope of this article. Note that the templates provided here are intended for business use, not for lawyers.

Key Terms in M&A

The following is a list of key terms in M&A:

- Asset vs. Stock Sale: In an asset sale, the acquiring company purchases the target company’s assets and liabilities; a stock sale is the purchase of the owner’s shares in a company. There are financial and liability concerns with both options, so be sure to consult legal counsel when deciding which route to pursue.

- Consolidation: In M&A, this refers to the amalgamation of multiple organizations’ financials. Consolidation occurs in both mergers and acquisitions.

- Joint Venture: This term refers to a business entity that is owned and governed by two or more parties.

- Management Acquisition: Also called a management buyout, this is a type of acquisition in which a company’s existing management buys the company from the existing private owners or the parent company.

- Tender Offer: This is a public, open invitation by a prospective acquirer to all shareholders of a publicly traded company. This potential acquirer interfaces directly with the stockholders to facilitate the exchange.

Tips for Executing M&A Strategy

A successful M&A begins with — and relies on — a well-thought-out, well-researched strategy. Planning is vital for both the acquiring and acquired company, as the process is extremely difficult, with substantial data, staff, and money on the line. Plan early and continuously throughout the merger or acquisition, and set expectations for roles and responsibilities early on in the process. Most M&As involve several people, and you need a strategy for who will own each aspect of the transition.

Once you’ve set your strategic plan for merging with or acquiring a company, you must perform due diligence. As outlined above, due diligence includes numerous assessments, from valuation to the analysis of synergy and culture. Think of due diligence as an in-depth, multifaceted way of contextualizing multiple companies. With proper due diligence, you ensure that the merger or acquisition is a good fit. It also confirms that you have the correct tools and adequate resources in place to integrate with minimal disruption to all involved parties.

For an in-depth look at M&A strategies, read this article. Here is a list of quick tips that will help you get started.

- Be patient. Mergers and acquisitions are long-term investments, so treat them as such. Delays will inevitably arise, so stay patient and build in time for unexpected events.

- Build accountability with your team. Train your team to understand that actions have consequences.

- Continually make reviews. Perform ongoing due diligence.

- Perform an independent integration assessment. Any deal can benefit from external help, especially the kind concerning particularly large or complex organizations.

- Understand regulatory and other legal compliance issues before beginning the process. No merger or acquisition will succeed if it doesn’t meet legal standards. Consult legal counsel early in the process, so you can be sure you’re doing everything properly from the outset.

- Don’t take the first offer. Sell-side parties should get multiple bids to discover their worth, and they shouldn’t be afraid to bargain if necessary.

- Perform valuation systematically. The more you plan strategically, the less likely you are to suffer from information overload as you move through valuation and due diligence. Understand what information you need to obtain (and how you’ll obtain it) before jumping into analysis.

- Create a transition plan. Even after you close the deal, you still have work to do. Create a transition plan to manage the organizational changes that both parties will undergo, clarify staff retention and responsibilities, and monitor integration over time.

Phases of M&A

Typically, mergers and acquisitions follow a similar process that includes the following general phases:

- Planning: Planning includes elements ranging from strategy, initial research, and investor pitching to communication plans and timelines. Thorough planning is crucial to any successful M&A.

- Valuation: This phase entails several specific and highly detailed steps, including financial valuation, culture and synergy mapping, and due diligence. Acquiring companies can use several different techniques to evaluate an organization’s profitability or holdings; many opt to hire outside counsel to perform these analyses.

- Integration: Once you’ve signed the deal, it’s time to integrate the two business entities. Successful integration requires planning for organizational structure, finances, roles and responsibilities, culture, and much more. Be sure to monitor integration over time and strive to continually improve.

For a step-by-step walkthrough of M&A processes, read this article.

Improve Mergers and Acquisitions with Smartsheet for Project Management

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.