What Is Operating Cash Flow?

Operating cash flow represents the amount of cash that a company generates from its regular operating activities during a defined period. A company’s operating cash flow shows whether it can regularly generate enough cash to continue and grow its operations.

Here are more details on operating cash flow:

- Public companies must include operating cash flow in their quarterly financial reports.

- The operating cash flow serves as the first section of your company’s cash flow statement.

- Your operating cash flow offers a clear picture of the current state of your business.

- Operating cash flow provides an assessment of the capital your company will have for future growth.

- A cash flow statement often labels operating cash flow as “cash flow from operating activities.”

How to Calculate Operating Cash Flow

You calculate operating cash flow by using either the direct or indirect method. With the direct method, you track all inflows and outflows of cash. With the indirect method, you use numbers from other financial statements to determine cash flow.

The calculation shows the amount of cash your business has on hand at a specific point as a result of normal business operations.

“It’s not complicated. Your grandmother used to do budgeting and a cash flow statement,” says Ivanka Menken, Founder and CEO of The Art of Service, an Australia-based management consulting firm. “It’s not difficult. Don’t overcomplicate it.”

You can find a collection of easy-to-use Excel cash flow templates at “Free Cash Flow Statement Templates.” You can customize and download them for free.

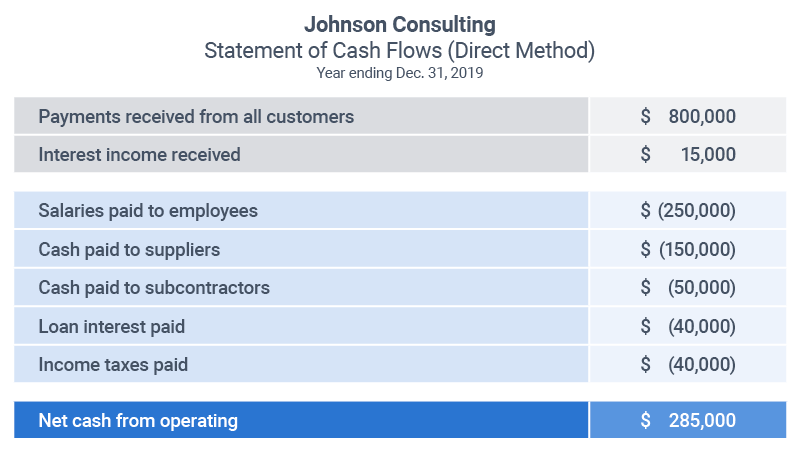

Direct Method of Determining Operating Cash Flow

Using the direct method of determining operating cash flow, a company tracks all cash inflows and outflows during a specified period. Here is the formula for that method:

Cash Inflows – Cash Outflows = Operating Cash Flow

Some experts believe that using the direct method to determine operating cash flow presents a clearer picture of a company’s operations. However, companies use the direct method less often than they use the indirect method, in part due to the difficulty of tracking all cash inflows and outflows.

Also, accounting standards require companies that use the direct method to prepare a reconciliation report. This report shows how a company’s reported net income aligns with its reported operating cash flow. Preparing the report is similar to using the indirect method to determine operating cash flow.

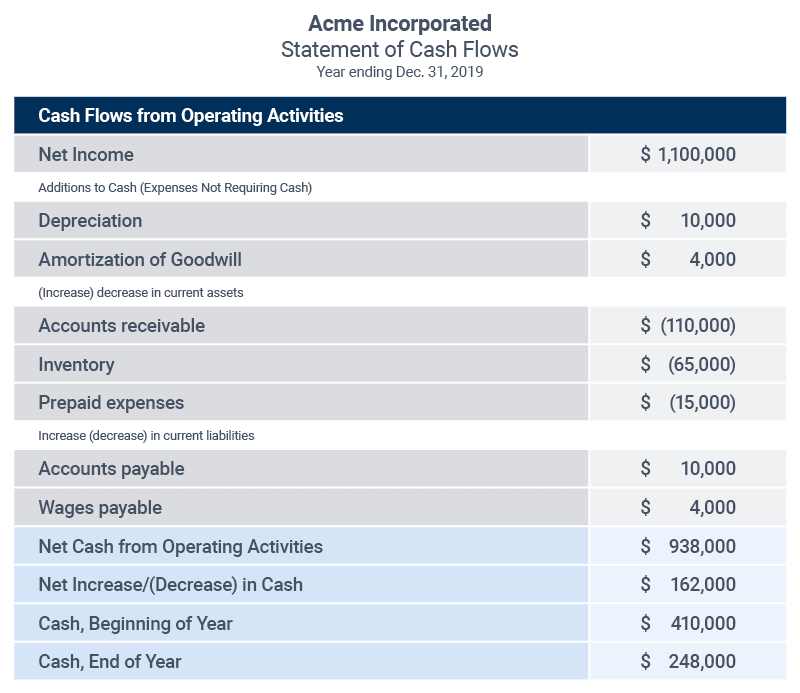

Indirect Method of Determining Operating Cash Flow

With the indirect method of determining operating cash flow, your company begins with net income from your income statement. You then add or subtract other numbers from your financial statements to determine your cash flow.

For example, a company adds back the depreciation included in its income statements because that depreciation doesn’t represent cash that the company has actually spent. The company subtracts any increase in accounts receivable because that increase represents cash the company hasn’t received yet. The company adds any increase in accounts payable because that increase represents cash the company hasn’t spent yet. The company makes additional adjustments based on other financial figures.

To determine operating cash flow, companies use the indirect method far more frequently than they use the direct method. They do so because they can easily determine operating cash flow from existing financial statements.

“[Numbers] just automatically feed over from the balance sheet and the income statement,” says T.J. Liles-Tims, Partner and Co-Founder of BVFF Partners, a business valuation and financial forensics firm in Oklahoma City.

Operating Activities Section of a Cash Flow Statement

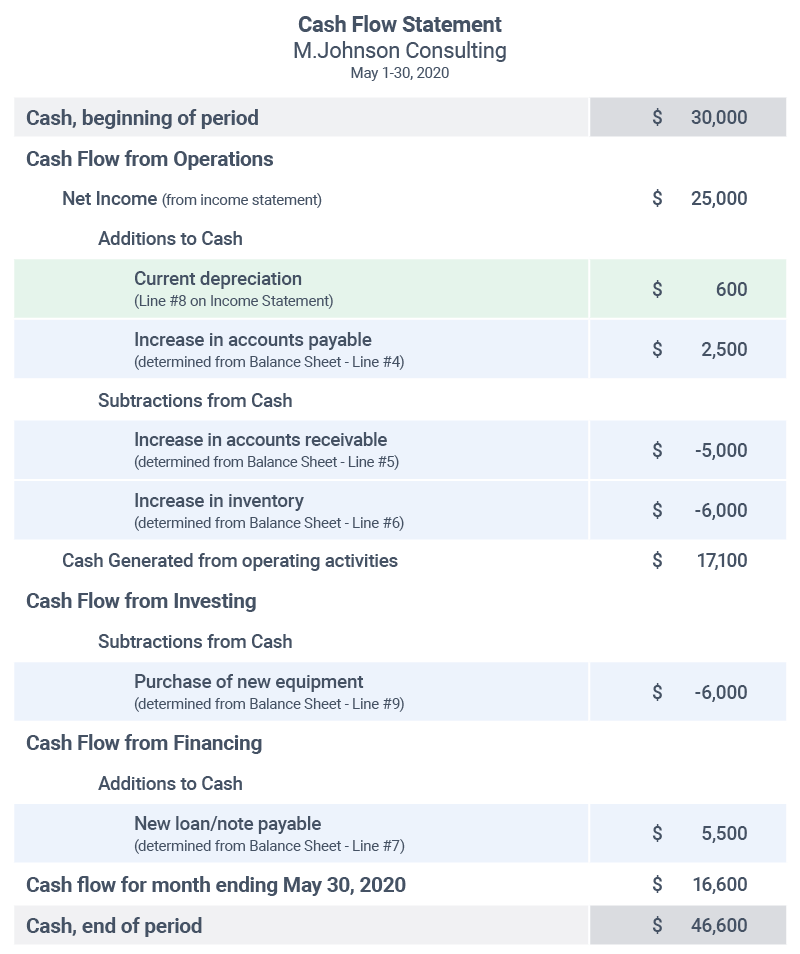

A cash flow statement is divided into three sections. A company’s owner as well as its investors are often most interested in the cash flow from operating activities section. This segment shows the cash that a company is generating from its regular operations.

The two other sections in a cash flow statement are the cash flow from investing activities and the cash flow from financing activities. These sections demonstrate how a company invests and borrows money. Items that might appear in one of these two sections include equipment purchases or longer-term acquisitions on behalf of the company.

Operating cash flow centers more on the core of a business. It focuses on the regular inflows and outflows that are central to a business’s work.

Operating Cash Flow Examples

Here’s an example of how you would use the direct method to determine operating cash flow, including a list of line items that might have:

Here’s an example of how you would use the indirect method to determine operating cash flow:

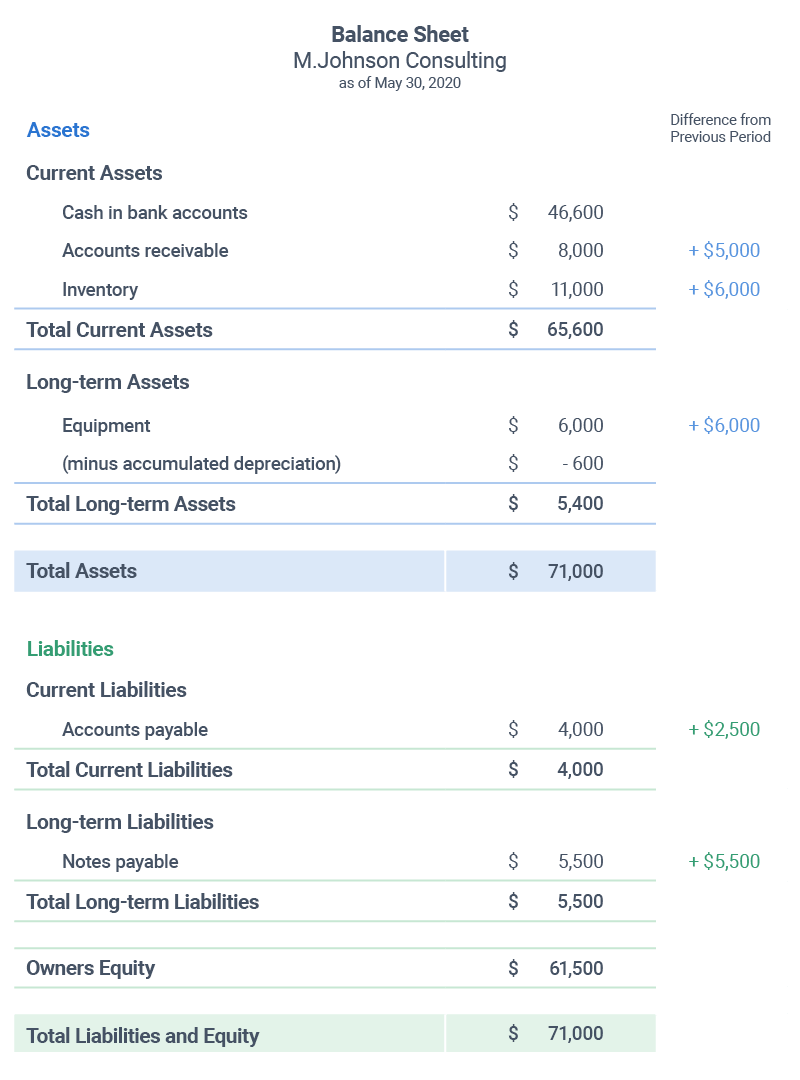

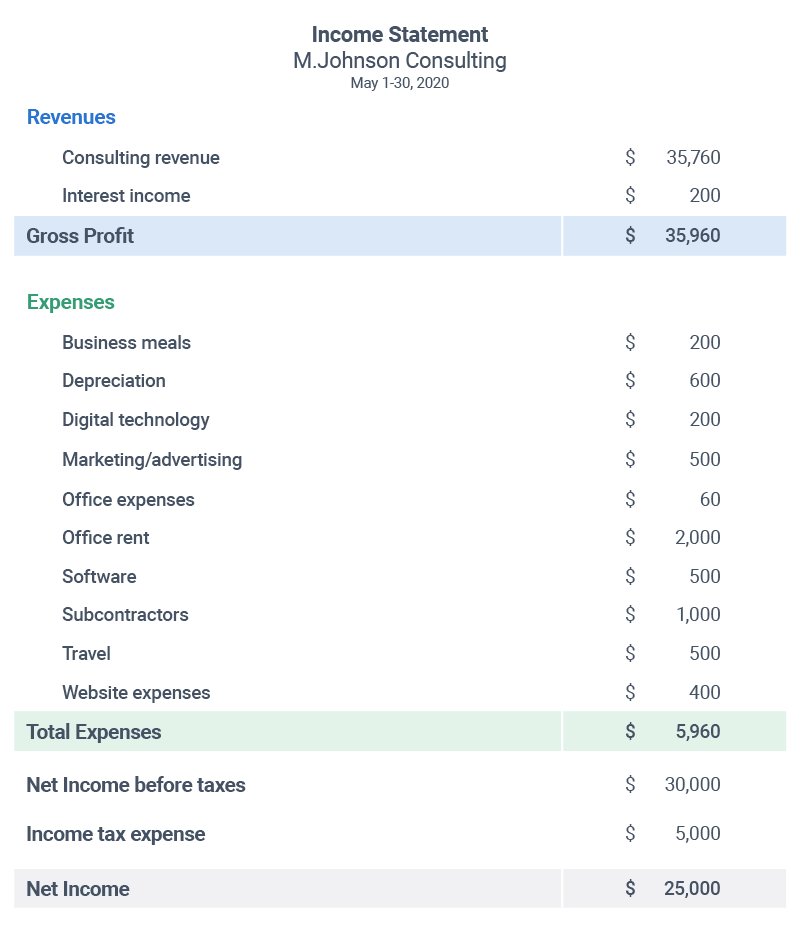

Here are examples of a hypothetical company’s three primary financial statements. The statements illustrate how a company can easily create an operating cash flow statement based on its two other primary financial statements: the income statement and the balance sheet.

Operating Cash Flow Formulas

Using the indirect method, experts apply different but related formulas to determine operating cash flow. In general, the formulas help companies decide how to determine actual cash inflows and outflows, as well as how to use those figures to arrive at operating cash flow.

Here is the most basic formula for determining operating cash flow:

Operating Cash Flow = Net Income + Non-Cash Expenses (on the income statement) – Increase in Working Capital

Here is another version of the formula for determining operating cash flow:

Operating Cash Flow = Operating Income (Sales Receipts – Cost of Sales) + Depreciation – Taxes +/– Any Changes in Working Capital

Here is a more detailed version of the formula:

Operating Cash Flow = Net Income + Depreciation + Stock-Based Compensation + Deferred Tax + Other Non-Cash Expenses – Increase in Accounts Receivable – Increase in Inventory + Increase in Accounts Payable + Increase in Accrued Expenses + Increase in Deferred Revenue

Operating Cash Flow vs. Net Income

A company’s operating cash flow amount can be very different from its net income amount. One reason for this variance is that a company determines its net income after subtracting a number of expenses that aren’t necessarily cash outflows. When calculating operating cash flow, a company doesn’t subtract those same expenses.

For example, after subtracting $15,000 in depreciation and $20,000 in accounts payable, a company might determine that its net income in a specific period is $100,000. But depreciation does not mean that less cash is available to that company. Nor does accounts payable mean less cash, as accounts payable represents those bills that haven’t been paid yet. Instead, assume that all net income is immediate cash receipts and there are no other figures to consider. In this case, operating cash flow for this same period would be $135,000.

However, operating cash flow does not always exceed net income. Depending on circumstances, operating cash flow can also trail net income.

Operating Cash Flow vs. EBITDA

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a metric that experts use to help judge how a company generates revenue from its working capital. In that way, it is similar to operating cash flow.

But there are major differences between the two metrics. For example, EBITDA excludes interest and taxes, while companies consider both interest and taxes when determining operating cash flow. The numbers for each metric can be very different.

Operating Cash Flow vs. Free Cash Flow

Operating cash flow shows the cash that a company’s normal operations generate. Free cash flow shows the same, while also subtracting the company’s capital expenditures from that operating cash flow figure.

Thus, operating cash flow demonstrates whether a company’s business operations generate enough cash to pay for regular expenses. Free cash flow shows whether the company can pay for not only its regular expenses, but also for its capital investments, such as buildings and equipment that might serve as a foundation for the business.

How to Determine Operating Free Cash Flow

The simplest way to determine free cash flow is to subtract a company’s investments in operating capital, or capital expenditures, from its cash flow from operations. Experts sometimes call this levered free cash flow.

Here is the formula to determine free cash flow:

Free Cash Flow = Cash Flow from Operations – Capital Expenditures

Another way to determine free cash flow is through other figures on a company’s income statement and balance sheet. Here is that formula:

Free Cash Flow = EBIT (Earnings Before Interest, Taxes) x (1 – Company’s Tax Rate) + Depreciation and Amortization – Changes in Working Capital – Capital Expenditures

Reasons to Determine Operating Cash Flow

There are a number of reasons that company leaders, along with investors or potential investors, would want to assess a company’s operating cash flow. The primary reasons center on understanding and assessing the health of a company.

Following are some of the main reasons for determining a company’s operating cash flow:

- Helps Company Leaders Understand Their Company’s Health and Financial Position: Experts point out that while a company has regular income statements to assess its progress, those statements don’t reveal everything a business must know to understand its health. Income statements, for example, show income that hasn’t yet turned into cash. And some of that income may never turn into cash. Cash flow statements show the actual cash your business is generating.

“Profit doesn’t show how much cash you generate, just as profit projections don’t takeinto consideration your accounts receivable, tax payable, and loan repayments,” says Menken of The Art of Service. “You can’t use all parts of the profit as cash in your business.” People always want to say that sales equals [cash], and it just doesn’t,” says Sherif Hassan, CEO of Capiform, which provides smaller banks with an online platform that helps them analyze credit and provide loans. “The difference between your income statement and your cash flow statement … it’s really your survival.” - Prevents Unexpected and Immediate Needs for Cash to Continue Operations: Experts say that if you don’t do cash flow analysis or don’t do it often enough, you can be subject to an immediate need for cash. “Now, you’re scrambling to try to generate cash,” says Liles-Tims of BVFF Partners. “That’s where so many business owners get into trouble. They do that, and they slip a credit card in the ATM to help out. Then they’re paying a 20 percent interest rate on the money. They need to be ahead of that curve.”

“If you’re a wholesaler or manufacturer or distributor, you may be providing your customers with net 30, net 60, or net 90 [days to pay their bills],” says Capiform’s Hassan. “In that scenario, your cash flow becomes critical to your survival. You might have $1 million in sales, but only $200,000 in cash.”

“You record the sale in July, but won’t get the cash until September,” says Menken. “And a lot of consulting businesses deal with this problem. You won’t be paid until September. But all of the expenses have to be paid right now.

“Cash is king. You need to have enough cash resources to be able to weather the storm, i.e., when the client doesn't want to pay or when there’s an unexpected expense or when an unexpected pandemic hits.” - Helps Potential Investors and Creditors Understand a Business’s Health: A cash flow statement separates financing and investment activities from operating cash flow because people, including investors, want to see the health of the normal operations of a company.

“An investor wants to know, ‘Am I going to be able to get my investment back?’ They want to know where the cash is being used,” says Liles-Tims.

Companies can also increase their understanding of their cash flow position by creating cash flow forecasts. To learn more about cash flow forecasts, visit the article How to Create a Cash Flow Forecast, with Templates and Examples.

In some cases, companies may also want to understand the likely cash flow from one specific project. To learn more about project cash flow, visit the article How to Master Project Cash Flow Analysis.

Operating Cash Flow vs. Income Statement vs. Balance Sheet

A cash flow statement, which includes operating cash flow, is one of the three primary financial statements that show the financial position of a company.

The other two widely used financial statements are the balance sheet and the income statement. The balance sheet shows a company’s overall worth based on assets and liabilities and shareholders’ or owner’s equity. An income statement shows a company’s overall revenue, expenses, and income.

Benefits of Cash Flow Statement vs. Balance Sheet or Income Statement

For many company owners, or potential investors, a cash flow statement is a better indication of a company’s ongoing health than its balance sheet or income statement. That’s because a cash flow statement shows the money you’ve actually spent and received due to your company’s main operations.

“I think it’s very important and probably the most underutilized statement of the three business statements,” Liles-Tims says of the cash flow statement.

A balance sheet shows total assets, but may reveal little about what those assets are producing. An income statement shows revenue and “income,” but communicates nothing about the cash that a business is actually putting in its bank accounts.

Hassan, from Capiform, says his team will look at accounts receivable figures on a balance sheet that includes customers who have still not paid as of 120 days after receiving an invoice. “I usually x those out — this money is not coming,” he says. Those figures don’t truly represent assets or cash.

Liles-Tims says, “If you compare a cash flow statement to an income statement … you’ll find that with a cash flow statement, you’re focusing more on the uses of the cash, whereas with an income statement, you have non-cash items (like depreciation). All the income statement serves to do is lower your bottom line (for tax purposes). It doesn’t give you a true picture of ‘cash is king.’”

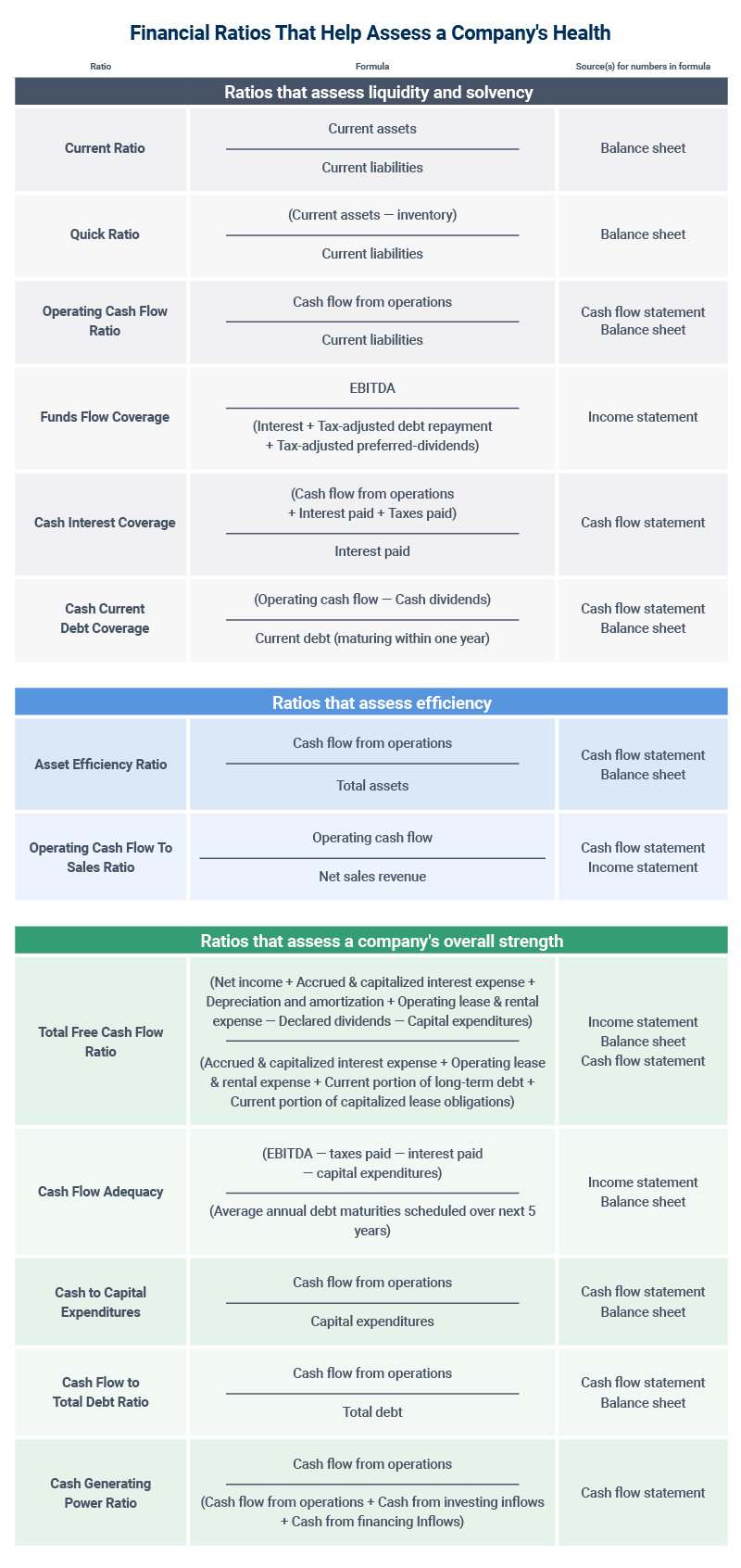

Important Ratios Derived from Cash Flow Statements and Analysis

Experts often use a company’s operating cash flow to perform financial modeling on the company. To do this, they use the cash flow statement, along with the balance sheet and income statement in some cases. They use those financial statements to calculate certain financial ratios. The ratios provide a picture of the company’s overall health.

Those ratios include the following: the current ratio, operating cash flow ratio, asset efficiency ratio, total free cash flow ratio, and cash flow to total debt ratio. See below to learn more details about those ratios, including how to calculate them and how to analyze them in order to locate a company’s strengths.

Menken says there are two simple ratios that are central to assessing a company’s health. One is the operating cash flow ratio. That’s cash flow from operations (from the cash flow statement) divided by current liabilities (from the balance sheet). “The primary reason to use the operating cash flow ratio is to determine whether you would have enough cash to pay off all of your current liabilities today if you had to,” she explains.

The other ratio is the current ratio, which is a solvency check. The ratio represents total assets divided by total liabilities. “You use this ratio to determine whether your assets would be worth enough to pay off all of your debts and liabilities if you had to,” Menken says.

How Often a Business Should Assess Operating Cash Flow

According to experts, every company should assess its operating cash flow at least once every six months, if not once every quarter. In fact, many companies should assess cash flow every month or even more often.

“We actually do it on a daily basis,” Menken says of her consulting firm. “Every day, we enter money coming into and going out of the bank account. We started doing this to understand the cadence and rhythm of the business.”

Challenges and Mistakes in Determining Operating Cash Flow

A common mistake when assessing operating cash flow is assigning inflow or outflow items to the wrong categories. Sometimes, this error occurs because companies want to limit operating outflows and enhance operating inflows. Organizations do this to make their operations appear more profitable. For example, a company might categorize the proceeds from the sale of property or equipment as an inflow item rather than an outflow item in operating activities.

Other common mistakes when determining operating cash flow include the following:

- A company may consider the purchase of equipment to be an operating activity. Liles-Tims says he sees many business owners make this mistake. You should consider the purchase of equipment to be an investing activity.

- When you make changes on the balance sheet or the income statement, you may fail to make the necessary corresponding corrections on the cash flow statement.

An Aid in Assessing Cash Flow

Menken’s The Art of Service offers detailed self-assessments that organizations can use to determine how well they understand and implement various business processes. The company offers clients and customers a self-assessment concerning how well they understand and perform cash flow management. With the assessment, the user answers a series of questions about cash flow within their organization; in the evaluation, the user is then prompted to analyze their knowledge and performance of various parts of cash flow management.

“With cash flow management in particular, you don’t know what you don’t know,” Menken says. “What this self-assessment does is force you to think beyond your own biases. It makes you step outside your comfort zone, so you can target exactly what you need to learn in order to really tackle cash flow.”

Discover a Better Way to Manage Operating Cash Flow with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

These templates are provided as samples only. These templates are in no way meant as legal or compliance advice. Users of these templates must determine what information is necessary and needed to accomplish their objectives.